What is Pendle?

Imagine trading the yield you get from crypto staking. This could provide a whole new set of investment strategies to optimize yield. Pendle, with its automated market maker system, makes yield trading possible. What exactly is Pendle? How does it work? Check out the full explanation in the following article.

Article Summary

- 🏦 Pendle is a DeFi protocol that tokenizes yield-bearing assets to enable the trading of yield futures. To do so, it uses a specialized automated market maker system.

- ♻️ With yield tokenization, Pendle divides yield-bearing assets into standardized yield (SY) tokens. Then, it can be further divided into principal tokens (PT) and yield tokens (YT) to monetize and trade yield.

- 🔆 Pendle has the main features of minting, swapping, earning, yield farming, and claiming. It also has advantages such as yield utilization strategies, no lock-up time limit, and cross-chain support.

- 🪙 Pendle has a native PENDLE token used for the Pendle ecosystem. It can also be converted into vePENDLE for governance purposes and additional benefits.

What is Pendle?

What is Pendle? Pendle is a DeFi permissionless protocol that facilitates the tokenization and future yield trading. It uses a specialized Automated Market Maker (AMM) system. By using Pendle, users can maximize their returns in various market conditions. This is done by implementing multiple advanced yield strategies.

Pendle’s primary goal is to provide a way for users who own yield-bearing assets to increase their profits further. In addition, users can purchase assets at a lower price than the market price. This is because Pendle divides yield-bearing assets into principal tokens and yield tokens, where the division makes the price of the principal tokens cheaper.

Pendle does this by tokenizing the yield. Thus, Pendle creates a new token that represents the future yield of an asset. Users can then trade or lock the yield token through Pendle’s DEX.

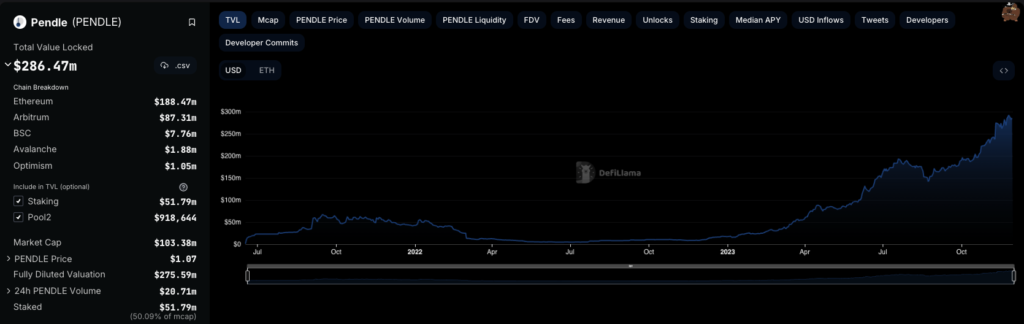

As seen from the DefiLlama data above, Pendle’s TVL reached US$ 286.47 million as of December 4, 2023. Notably, the largest Pendle TVL was on the Ethereum network, which amounted to US$ 188.47 million. The Arbitrum network followed this at US$ 87.31 million. So far, Pendle has had a positive trend, reflected in the consistent growth of its TVL throughout 2023.

To understand how Pendle works, you better learn more about how LSDFI works here.

How Does Pendle Work?

The way Pendle works is that it allows users to trade or earn yield through tokenized yield assets. Users can get it by depositing it into Pendle’s liquidity pool. As a liquidity provider, users will be rewarded with tokens. These tokens can then be traded or staked for greater returns.

Pendle uses a yield tokenization mechanism and an Automated Market Maker to make this possible. The following is an explanation of each:

Yield Tokenization

Pendle will wrap yield-bearing tokens (such as Lido’s stETH or GMX’s GLP) into standardized yield (SY) tokens. In a sense, it is a wrapped version of Pendle’s AMM-compatible yield-bearing token. After that, SY will be subdivided into principal tokens (PT) and yield tokens (YT). This process is called yield tokenization where the yield is tokenized into two different tokens.

A prominent example of a yield-bearing asset is property such as a house. A house as an asset can be divided into two components. First, the right to own the house, which is the principal. Second, the yield is the right to the income from the cost of the house being rented out to others.

While in crypto, stETH is an example of a yield-bearing asset. In this case, the principal is the right to own the stETH. The yield is the right to the interest earned on the stETH.

Pendle allows users to monetize their yield in a more advanced way. They can unlock the value of their assets in a more liquid and tradable form. This also provides additional liquidity that can be used for other purposes.

On the one hand, yield tokenization can also reduce the capital requirements for users to do yield farming. They can monetize the yield that will be obtained to be used upfront.

Pendle AMM

After obtaining PT and YT, they can be traded on Pendle through its AMM mechanism. However, there is a difference between Pendle’s AMM and regular AMM. A regular AMM does not take time decay into account. This can lead to investor losses due to incorrect asset pricing.

Pendle’s AMM uses a time-decaying model to optimize capital while increasing exposure to future yields. Pendle’s AMM also makes more accurate adjustments in pricing assets. At the same time, it prevents depletion of the liquidity pool.

In addition to trading PT and YT tokens, Pendle’s AMM supports providing liquidity for yield farming products. It allows users to add liquidity to multi-collateral pools. From there, users can use it to facilitate other yield-farming strategies.

Keep in mind that yield tokenization is a very new concept. It is also an innovation that Pendle brings to the table. Therefore, before trying Pendle, you need to understand how yield tokenization and all its derivatives work.

Let’s learn more about AMM through this Pintu Academy article.

Pendle’s Features

Pendle can provide additional returns from their yield-bearing assets without having to lock up their collateral. This is done through minting, swapping, farming, earning, and claiming. Here is a further explanation of each feature:

1. Mint

Each user can mint their tokens by depositing their yield-bearing assets. By doing this, users will get PT and YT tokens based on their underlying assets. They can trade these assets or use other strategies to increase their profits.

2. Swap

After getting YT from minting, users can sell it or swap it. The swap can be lucrative depending on the value of the underlying movements. In addition, through swaps, users can swap their tokens with other YT assets that may generate higher yields in the future. As for existing PTs, they can also be swapped separately or held to maturity.

3. Farm

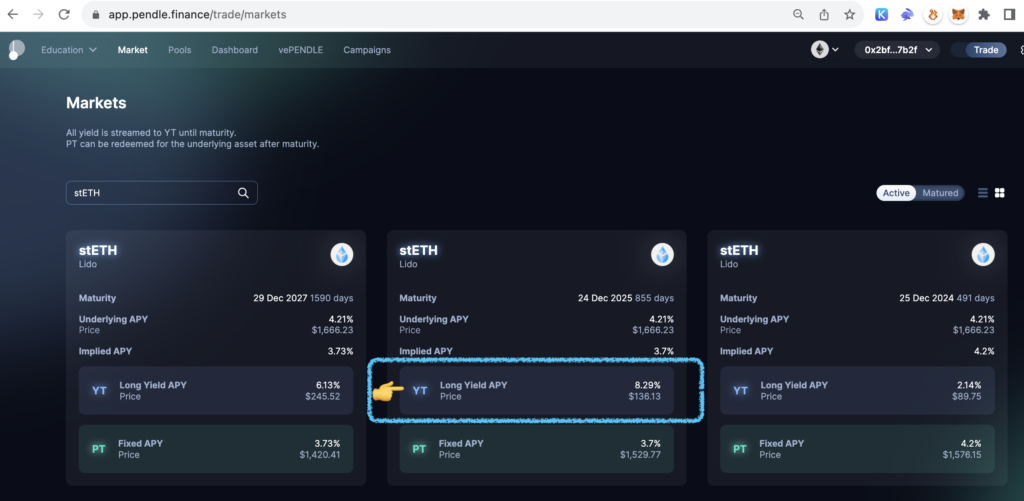

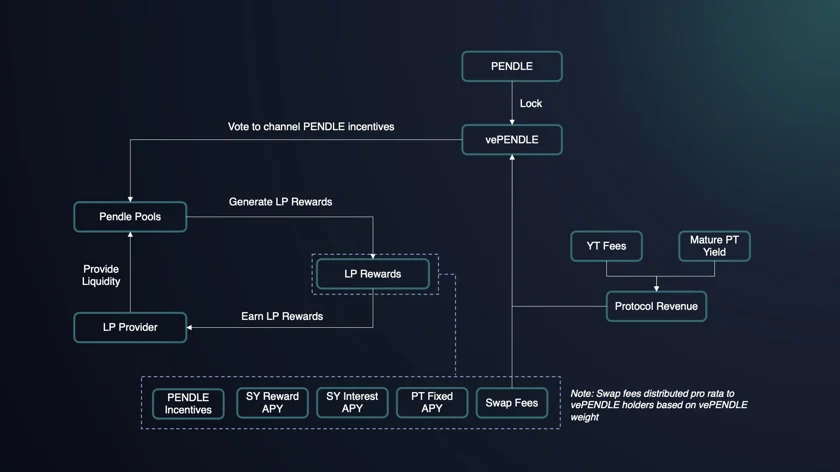

YT can also be added to Pendle’s liquidity pool if you don’t want to swap. Each liquidity pool has a different maturity period and APY. By becoming a liquidity provider, users will be incentivized until the end of the maturity period. The incentive or APY earned can be much greater if the user owns vePENDLE. For those interested in farming on Pendle, you can do so on the following pools page.

Want to know more about yield farming and how it works? Find out more here.

4. Earn

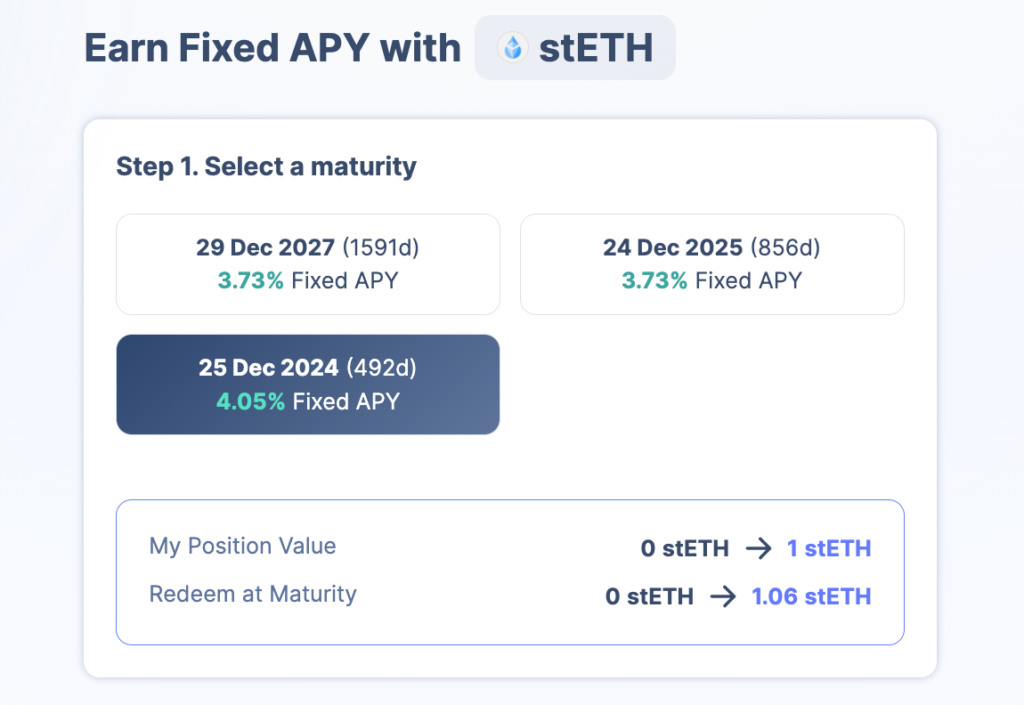

Another great feature of Pendle is earning. Unlike a typical earn, Pendle offers a fixed APY. In the example below, if you stake 1 stETH with a maturity date of December 25, 2024, you will earn a total return of 0.06 stETH or an APY of 4.05%.

With Earn Pendle, you can exit anytime by selling your PT stake at the market price on Pendle’s AMM. Seller and buyer activity will drive the sale price itself.

5. Claim

Once past the maturity date, YT tokens no longer have value. The user must decide whether to redeem before maturity or roll over the asset to set a new maturity date. If they want to redeem, users must still choose PT and YT. It depends on the situation, but users may have to draw from the liquidity pool or buy new tokens in the market.

As for claiming YT, as well as rewards or swap fees, users can do so through the market page in the Pendle app. Users can specify how the tokens will be claimed, whether in USDC or otherwise.

Pendle’s Advantages

The following are some of the advantages that Pendle has:

- 🤑 Various yield utilization strategies. Pendle allows users to trade yield by creating a yield market. Starting from fixed yield, long yield, getting additional yield, and so on. Learn about various yield utilization strategies in Pendle in the following handbook.

- ⏱️ No lock-up period. Pendle has no lock-up period other than the maturity date. Thus, users can withdraw their asset and its yield at any time. It provides flexibility and convenience for users.

- ⛓️ Cross-chain support. Pendle supports Ethereum, Arbitrum, Binance Smart Chain, Avalanche, and Optimism networks. This makes it easier for users to make cross-chain transactions.

- 🪙 vePendle. By locking the PENDLE token, users will get the vePENDLE token. It can provide users with additional benefits, such as rewards from transaction fees to the authority to vote in Pendle governance.

PENDLE Token

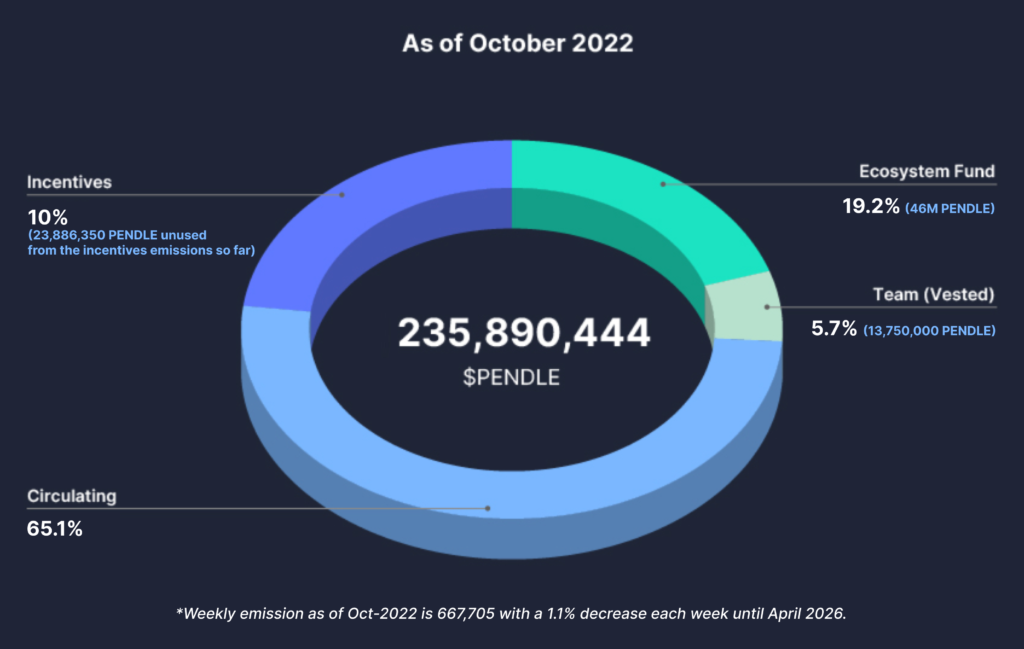

PENDLE is an ERC-20 token that acts as the native token of the Pendle ecosystem. It serves to maintain the operation and value of the Pendle system. PENDLE has a market capitalization of US$ 305 million at the time of writing, with a circulating supply of US$ 235.88 million. PENDLE is also an inflationary hybrid token with a perpetual inflation rate of 2%.

When users stake the PENDLE token, it turns into vePENDLE. Its primary function is governance. vePENDLE is the token that governs Pendle’s operations, which helps the system become more decentralized and stable.

The value and power of vePENDLE will depend on how much and how long PENDLE tokens are staked. However, the value of vePENDLE will continue to drop and eventually become worthless at the end of the lockup period. At that moment, users can unstake their PENDLE tokens.

Since its launch in May 2021, the PENDLE token has been on a downward trend. It even reached its lowest point at US$ 0.045 in mid-2022. However, the PENDLE price has slowly started to rise and is now at US$ 1.28.

Does PENDLE have a good tokenomic? To determine this, you can find out through the following article.

Conclusion

Pendle is a DeFi protocol enabling tokenization and trading future yield through the AMM system. Pendle monetizes yield through tokenization. It does this by dividing yield-bearing tokens into standardized yield (SY), which is further divided into principal tokens (PT) and yield tokens (YT).

Its main features include minting, swapping, earning, farming, and claiming. It has several advantages, such as diverse yield utilization strategies, no lock-up time limit, and cross-chain support.

How to Buy PENDLE on Pintu

You can start investing in PENDLE by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for PENDLE.

- Click buy and fill in the amount you want.

- Now you have PENDLE!

In addition to PENDLE, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

Reference

- Pendle Docs, Introduction to Pendle, accessed on 1 December 2023.

- Pendle Academy, Introduction to Optimizing Yield, accessed on 1 December 2023.

- Gabriel, What is Pendle? All You Need to Know About PENDLE, Gate Learn, accessed on 1 December 2023.

- Eli5 DeFi, Delve into pendle in redefining yield in DeFi, Twitter, accessed on 1 December 2023.

Share