What is Virtuals Protocol?

In the midst of rapid developments in AI and blockchain technology, Virtuals Protocol emerges as a new infrastructure connecting AI agents with decentralized networks. This innovative protocol brings significant changes to how AI agents interact, operate, and create value within decentralized ecosystems.

Virtuals Protocol was developed to address the growing need for AI agents to actively participate in decentralized networks. It solves key challenges such as agent coordination, value creation, and autonomous decision-making in blockchain environments.

To learn more about AI Agents, read the article What Are AI Agents in Crypto? on Pintu Academy.

In this article, we’ll explore what Virtuals Protocol is, how it works, its features, advantages, tokenomics, potential, and development roadmap.

Article Summary

- 🤖 What is Virtuals Protocol? – A decentralized protocol that enables AI agents to operate autonomously on blockchain networks, integrating and managing them seamlessly.

- 🕵🏻♀️ LUNA AI Agent – The first AI agent created by Virtuals, operating 24/7, with a market cap of over $130 million and purchasable with VIRTUAL tokens.

- ⚙️ Key Features – Easy integration with plug-and-play systems, ICV for transparency and fair rewards.

- 📊 VIRTUAL Tokenomics – A total supply of 1 billion VIRTUAL tokens, used for agent interactions and powering the ecosystem.

- 👩🏻💻 2025 Roadmap – Q3: ACP expansion; Q4: Ethereum AI Hackathon for further innovation.

What is Virtuals Protocol?

Virtuals Protocol was founded in 2021 by Jansen Teng and Wee Kee Tiew, both graduates of Imperial College London. Teng, a former consultant at Boston Consulting Group, transitioned into tech entrepreneurship, co-founding several companies including CIPTA and ThinAir Water. The protocol officially launched in October 2024.

It is a decentralized infrastructure protocol that allows AI to operate autonomously within blockchain networks. Acting as a foundation for creating, launching, and managing AI agents, it enables them to interact with various blockchain protocols and carry out complex tasks without human intervention. By introducing a sophisticated framework for AI agent interactions, Virtuals Protocol aims to revolutionize how artificial intelligence integrates with blockchain technology.

How Does Virtuals Protocol Work?

Virtuals Protocol enables users to create and tokenize AI agents for shared community ownership. These agents can interact through text, voice, and 3D animations, while also executing blockchain transactions with on-chain wallets.

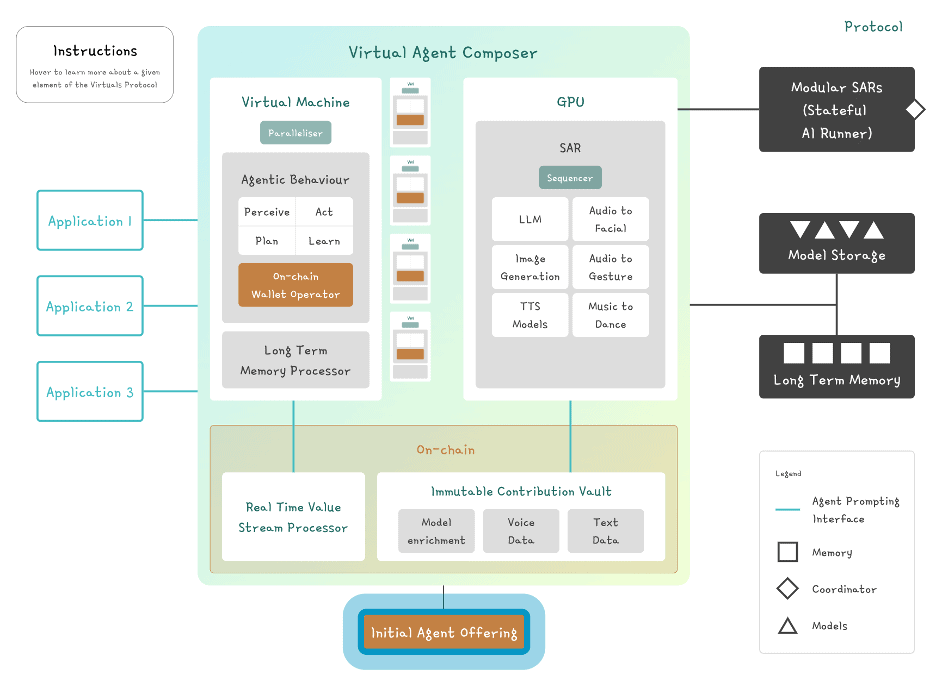

Virtuals Protocol Composer Stack

A composer stack, consisting of power the ecosystem:

- Agent Prompting Interface – Serves as a bridge between AI agents and external platforms.

- Agentic Behavior Framework – Defines agent capabilities in perception, planning, and learning.

- On-Chain Wallet Operator – Manages digital assets and blockchain transactions.

- Parallel Hypersynchronicity – Ensures consistent agent performance across platforms.

- Modular Consensus Framework – Enhances collaboration between contributors and validators.

First AI Agent: LUNA

Luna is the first AI agent developed by the Virtuals team to showcase their vision for AI-driven entertainment. Operating 24/7 as a livestreaming service, Luna can answer user questions using Large Language Models (LLMs). Although the LUNA token is governance-only, it has already achieved a market cap of more than $130 million and is tradable on the platform using VIRTUAL tokens.

Key Features and Advantages of Virtuals Protocol

1. Autonomous and Multimodal AI Agents

Virtuals Protocol enables AI agents to operate autonomously, setting and achieving goals without human input. They can navigate digital spaces, execute on-chain transactions, and communicate via text, voice, and animations.

For example, in a game like Roblox, these agents could pick up virtual objects, navigate environments, and interact with players in real time. Their memory also allows them to build stronger, more personalized connections with users over time.

2. Simplified AI Integration

For developers, integrating AI agents into applications can be resource-intensive and complex. Virtuals Protocol simplifies this through a plug-and-play system.

One example is the GAME (Generative Autonomous Multimodal Entities) agent, available via APIs and SDKs, allowing developers to deploy AI agents in virtual environments. Revenue sharing is also integrated, where users pay interaction fees (called inference costs) to cover computational resources.

3. Immutable Contribution Vault (ICV)

The ICV stores developer contributions directly on-chain, ensuring transparency and fairness in revenue distribution. It records contributions as Service NFTs, which track ownership and reward allocation.

This structure encourages collaboration, as developers can build on existing agents, fostering an open and innovative ecosystem.

The ICV is a system within the Virtuals Protocol that ensures AI development remains transparent and fair. This feature is particularly useful for collaboration among multiple parties contributing to a single AI agent.

4. Tokenization and Co-Ownership via Initial Agent Offering (IAO)

Virtuals Protocol introduces IAO (Initial Agent Offering), similar to ICOs. Through IAO, AI agents are tokenized and sold as fractional ownership assets.

- Users lock VIRTUAL tokens to generate new agent tokens.

- Once the market cap hits $420,000, a liquidity pool is created and locked for 10 years.

- Fair-launch principles apply: no pre-mining, no insider allocations, 1 billion tokens max per agent, and a 1% transaction fee for operations.

Tokenomics of VIRTUAL

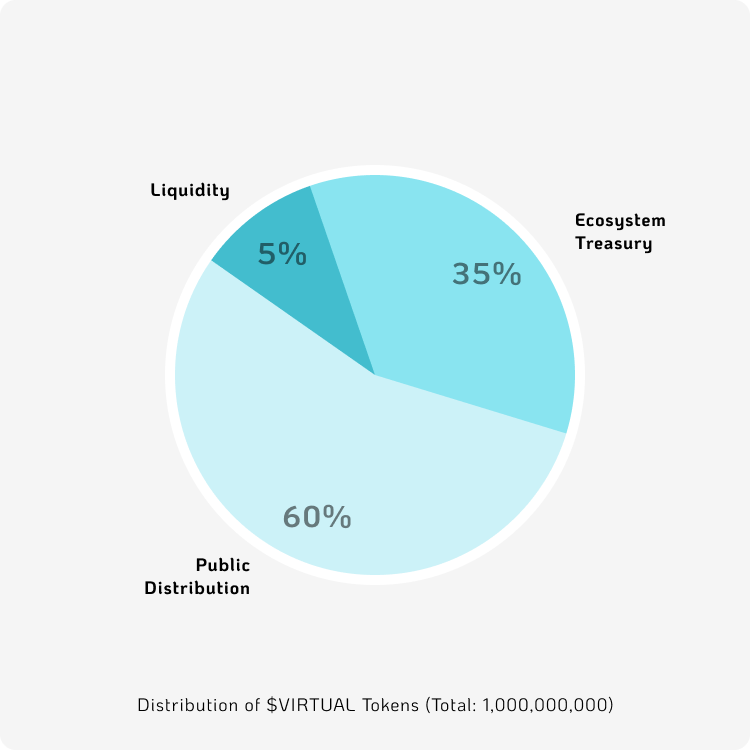

VIRTUAL is the native token that powers the entire ecosystem. Its total supply is capped at 1 billion tokens:

- 600 million (60%) in public circulation.

- 50 million reserved for liquidity provision.

- 350 million allocated to the ecosystem treasury for community initiatives.

Key functions of VIRTUAL include:

- Agent Interactions – All fees for conversations, game actions, or content streaming are paid in VIRTUAL.

- Linking Agent Tokens – Every agent token is paired with VIRTUAL in liquidity pools, boosting token utility.

- Fixed Supply, Dual Network – Capped at 1 billion with availability on both Ethereum and Base networks.

- Ecosystem Transactions – All buying and selling of tokens within the ecosystem require VIRTUAL, making it the backbone of the protocol’s economy.

Potential and Roadmap of Virtuals Protocol (VIRTUAL)

According to data from Coingecko, VIRTUAL has surged by 3,394% in just one year, from September 2, 2024, to September 2, 2025. As of September 4, 2025, the token is priced at $1.13 with a market capitalization of $743 million.

VIRTUAL Price Development

2024: The platform was officially launched on October 16, 2024, with the VIRTUAL token priced at $0.106. By the end of the year, its value gradually climbed, setting new records and reaching $3.5 in December 2024.

2025: At the start of 2025, VIRTUAL hit its all-time high of $5.07. Although the price briefly declined, it rebounded after being listed on Binance and is currently trading around $1. At present, the ATH price is equivalent to Rp 493.1 with a market cap of Rp 5.61 trillion, trading volume of Rp 217.17 billion, and a circulating supply of Rp 11.4 billion.

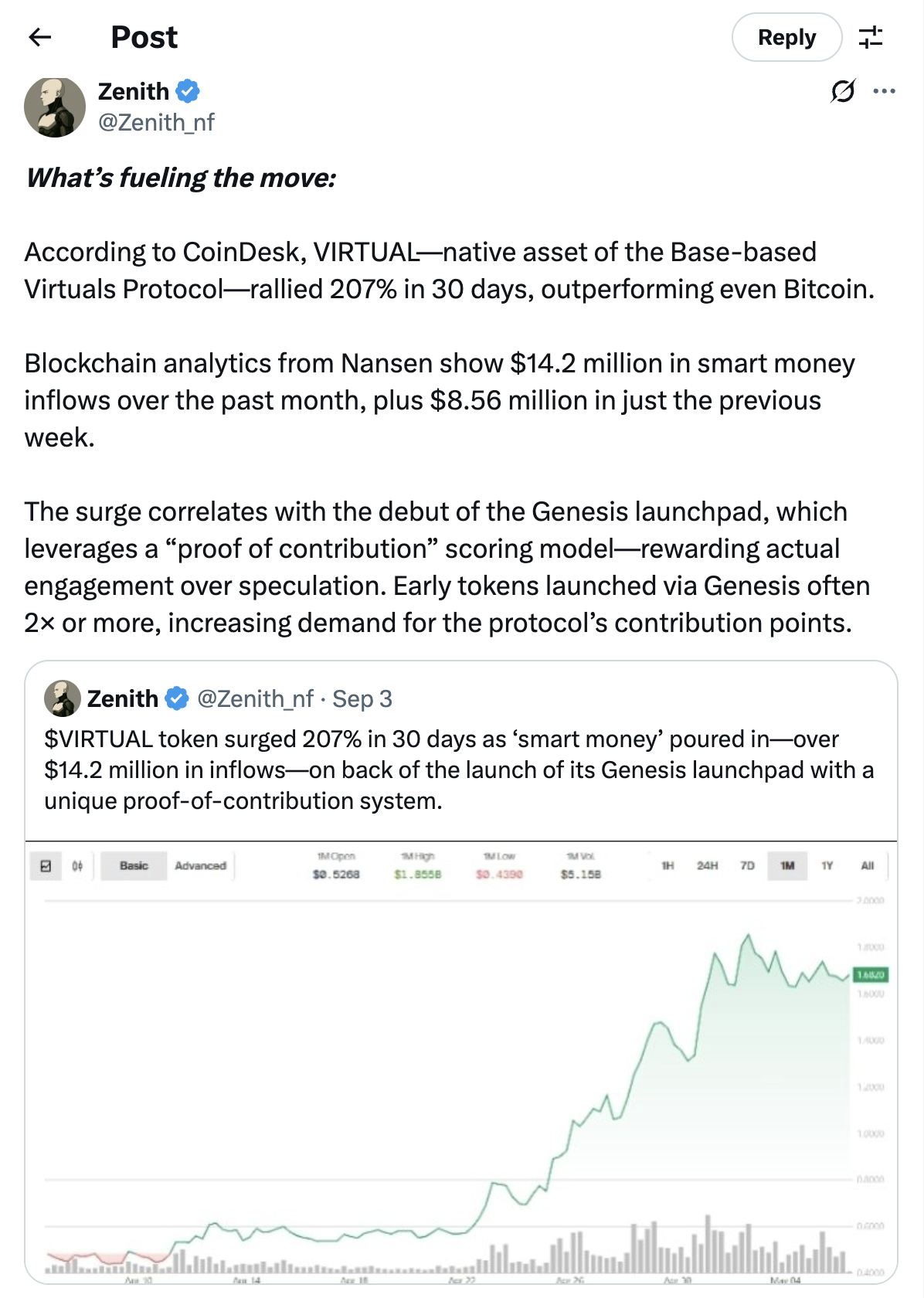

According to Zenith, a crypto analyst on X, VIRTUAL recorded a 207% price increase in the 30 days leading up to September 3, 2025. Blockchain data from Nansen also revealed “smart money” inflows of $14.2 million over the past month, with $8.56 million entering in just the previous week. This surge coincides with the launch of the Genesis Launchpad, which introduced a unique “proof of contribution” system.

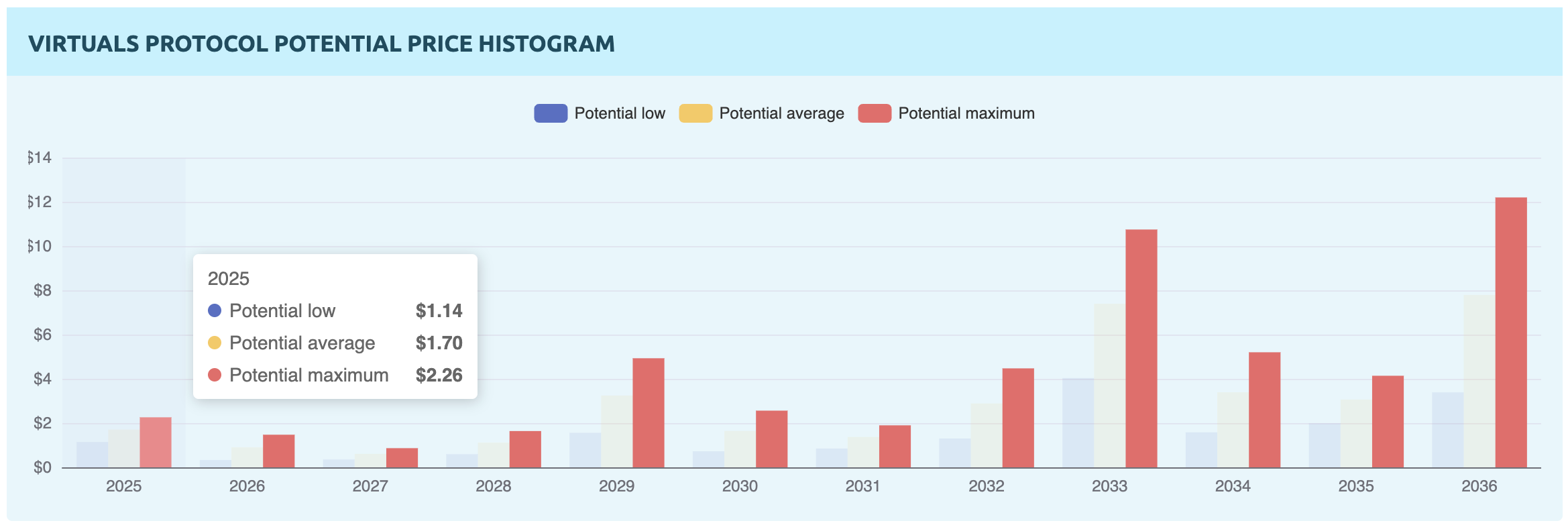

VIRTUAL Price Forecast According to CoinDataFlow

CoinDataFlow projects a potential price range for VIRTUAL between 2025 and 2036. For 2025, they estimate a lower-end target of $1.14 and an upper-end target of $2.26. This means that if VIRTUAL reaches its maximum projection, the token could increase by as much as 101.79% from its current price.

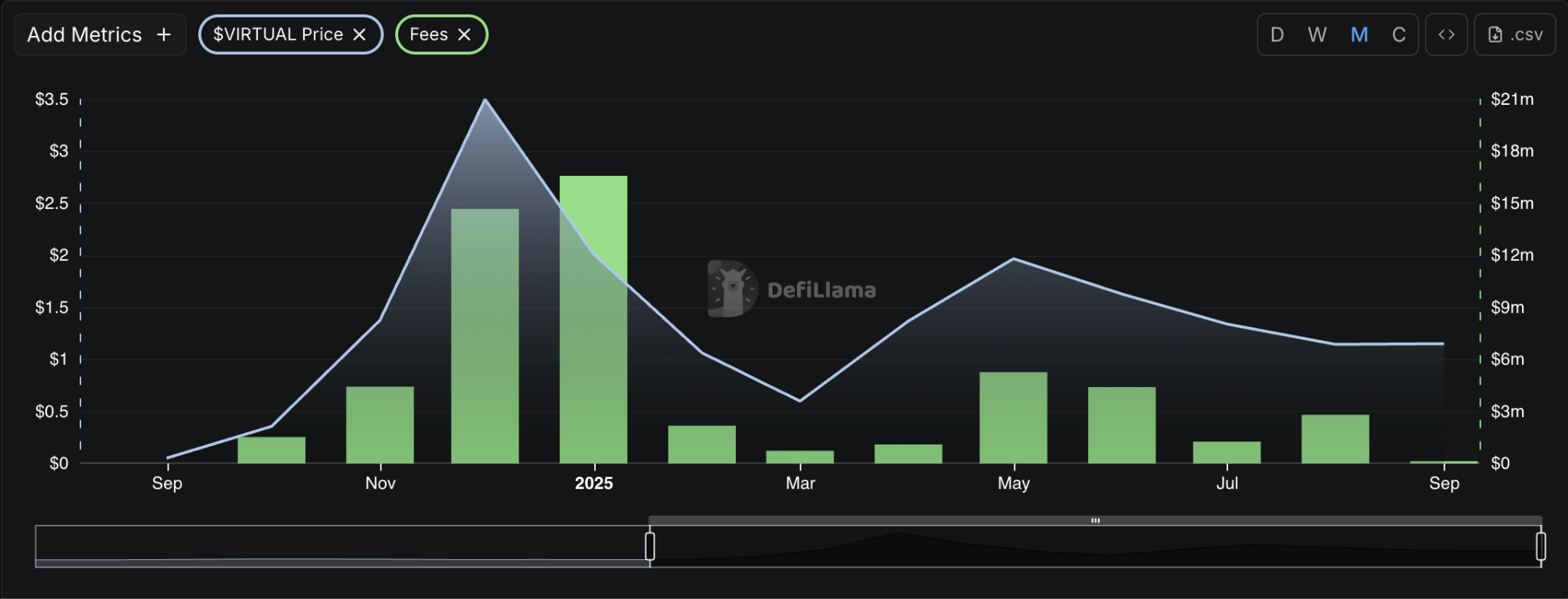

On-Chain Data Shows Strong Correlation

On-chain metrics reveal a significant decline in network fees. In January, fees peaked at $16.6 million but dropped drastically to $2.2 million just a month later. This sharp decline explains why VIRTUAL’s price also fell, as much of the AI agent hype began to fade.

By August, however, the protocol managed to generate $2.8 million in revenue. The most notable rebound occurred in May when the token price spiked to $2.5 alongside fees surging to $5 million. Data suggests a clear correlation between fee revenue and token price.

According to FX Empire, VIRTUAL’s price increases by roughly $0.23 for every additional $1 million in fees generated. Based on this model, the price in August should have reached around $0.70. However, it remained above $1, indicating that market participants were willing to pay a premium, likely due to improving conditions.

Agent Liquidity Engine (ALE)

Recently, Virtuals Protocol launched the Agent Liquidity Engine (ALE), a platform showcasing top-performing agent tokens. If ALE succeeds in driving higher fee revenue, VIRTUAL’s price could see a significant boost. Should fees climb back to $5 million, VIRTUAL could potentially rise to $1.5, based on a price-to-fee ratio of 0.3 per $1 million generated.

Roadmap for Virtuals Protocol (VIRTUAL)

- Agent Commerce Protocol (ACP) Expansion (Q3 2025)

The updated Genesis emissions now prioritize AI agents integrated with ACP, rewarding active on-chain activity instead of passive behavior. This is expected to drive stronger demand for VIRTUAL, as agents must stake the token to qualify for rewards. However, the sudden change may affect legacy users who relied on older incentive structures. - Ethereum AI Hackathon Outcomes (Q4 2025)

Virtuals Protocol has partnered with the Ethereum Foundation to host the “Ethereum is for AI” hackathon, offering $100,000 in prizes to encourage AI agent innovation. Winning projects will be deployed on Virtuals’ infrastructure with technical support and funding. The results of this hackathon will be announced on October 10, 2025.

How to Buy Virtuals Protocol (VIRTUAL)

Virtuals Protocol is available for trading on Pintu. Steps to buy:

- Open the Pintu app.

- Go to the Market section.

- Search for Virtuals Protocol (VIRTUAL).

- Enter the amount and follow the purchase steps.

Conclusion

Virtuals Protocol is a breakthrough combining AI and blockchain, providing infrastructure for autonomous AI agents to thrive in decentralized ecosystems. Its VIRTUAL token underpins the economy, ensuring transparency, utility, and aligned incentives. With its rapid growth, innovative features, and solid roadmap, the project stands as one of the most promising developments in the cryptocurrency space.

To deepen your knowledge about blockchain, crypto, and innovations like Virtuals Protocol, visit Pintu Academy for educational content updated weekly. Download the Pintu app on App Store/Play Store—regulated and supervised by OJK—for secure transactions and easier access to learning about crypto.

Disclaimer: All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

References:

- Bybit Learn. Virtuals Protocol (VIRTUAL): Future of AI in Digital Media. Accessed by September 6, 2025

- Binance. What Is the Virtuals Protocol (VIRTUAL)?. Accessed by September 6, 2025

- Crypto.com. What Is Virtuals Protocol (VIRTUAL)?. Accessed by September 6, 2025

- Crypto Potato. What is Virtuals: The Launchpad for AI Agents. Accessed by September 6, 2025

- FX Empire. VIRTUAL Bounces Off Key Trend Line Support With Strong Volumes – $2 In Sight?. Accessed by September 6, 2025

- Coinmarketcap. Latest Virtuals Protocol (VIRTUAL) News Update. Accessed by September 6, 2025

Share

Related Article

See Assets in This Article

ATH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-