What Is World Liberty Financial (WLFI)?

Donald Trump is known as one of the U.S. presidents who has been relatively open to the growth of the crypto industry, including the Decentralized Finance sector. To drive broader adoption, Trump, together with his son Eric Trump, has supported a DeFi project called World Liberty Financial. The project was launched with the goal of providing wider financial access for everyone.

In this article, we will explore in more detail what World Liberty Financial is, the adoption of USD1, the tokenomics of the World Liberty Financial token, its latest developments, and the potential it holds.

Article Summary

- 👀 World Liberty Financial: A project backed by Donald Trump and his family, focusing on DeFi with its first product, the USD1 stablecoin, which is already available on four major blockchains.

- 🔎Token $WLFI: Launched in September 2025 as a governance token with a total supply of 100 billion. Token holders can participate in voting, including the latest proposal on allocating fees for buyback and burn.

- 📊 $WLFI Price Potential: The planned supply reduction has the potential to serve as a bullish catalyst for $WLFI, particularly as the token price remains in a consolidation phase.

What Is World Liberty Financial (WLFI)?

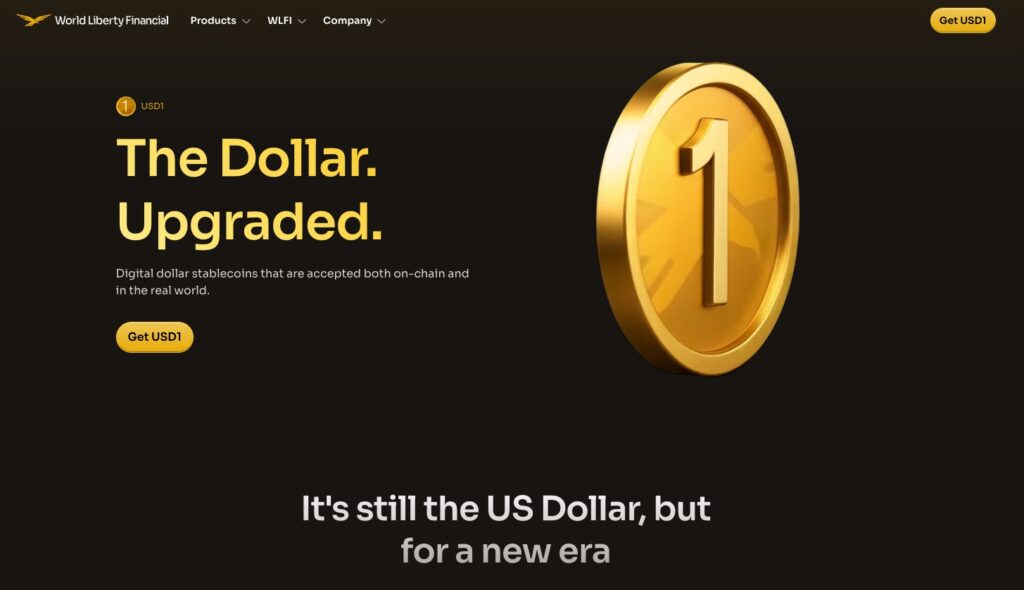

World Liberty Financial is a DeFi project backed by U.S. President Donald Trump and his family. One of WLFI’s main focuses is to introduce blockchain-based lending and borrowing services. Although this product has not yet been officially launched, the project has already released its stablecoin, USD1.

WLFI comes with an ambitious mission to drive broader adoption of DeFi and stablecoins. The project also aims to position the United States at the forefront of stablecoin development pegged to the U.S. dollar, aligning with the dollar’s longstanding role as a cornerstone of the global financial system.

Key Features of WLFI

- Stablecoin USD1: A native stablecoin pegged to the US Dollar, serving as a medium of transaction within the DeFi ecosystem. Through the WLFI platform, users can also utilize cross-chain bridging, enabling seamless transfer of USD1 from one blockchain to another as needed.

- Lending & Borrowing: WLFI offers DeFi services through lending and borrowing, allowing users to earn interest on the crypto assets they deposit on the platform. However, as of the time of writing, these services are not yet available.

- $WLFI Token: A governance token that plays a key role in shaping the future development of World Liberty Financial.

- Token Exchange Platform: WLFI facilitates the exchange of $WLFI with stablecoins USD1, USDT, and USDC. Conversely, users can also swap USD1, USDT, and USDC for $WLFI. Currently, only these four assets are available on the platform.

Adoption of USD1 Stablecoin

USD1 is a stablecoin issued by WLFI, launched as an initial product to promote wider usage. WLFI has partnered with 19 industry and crypto project collaborators and is available across four blockchain networks: Ethereum, Solana, TRON, and BNB Smart Chain (BSC).

With USD1 accessible on multiple networks, it can serve as an alternative medium for transactions with other tokens on each supported blockchain, depending on liquidity availability. This factor has contributed to the growth of USD1’s market capitalization over time. As of the time of writing, USD1’s market cap has reached US$2.66 billion, according to Coingecko data.

In addition, Justin Sun, the founder of the TRON blockchain, has also supported the development of USD1 by committing to increase the total circulation of the stablecoin on his network to US$200 million.

The steps taken by the WLFI team to boost adoption are also noteworthy. They recognize USD1’s position as a stablecoin offering a safe alternative from the volatility of other crypto assets. To this end, WLFI has partnered with various collaborators to promote the use of USD1, including within DeFi ecosystems such as Euler and KernelDAO. These platforms allow USD1 holders to earn interest by providing supply.

Introducing Project Wings by WLFI

On September 11, 2025, WLFI launched Project Wings in collaboration with Raydium, a DeFi protocol, and Bonk.fun, a token launchpad platform on the Solana network. This means that traders and token creators are required to use USD1 when conducting transactions on the platform.

Read more about Bonk.fun here: Solana Launchpad: Analysis and the Future of the Launchpad Wars

Such a strategy has proven effective in accelerating the growth of new stablecoins within the DeFi ecosystem. For example, USDT and USDC have experienced rapid expansion due to their availability across numerous leading DeFi platforms. Both facilitate transactions, serve as trusted primary choices for users, and offer opportunities to earn interest through liquidity provision, lending, and borrowing.

With strong reputations and increasingly established adoption, USDT and USDC now dominate the market. If USD1 can follow in their footsteps and continue to drive wider usage, it is not unlikely that USD1 could rival the adoption levels of USDT and USDC.

WLFI Tokenomics

On September 1, 2025, World Liberty Financial officially launched its governance token under the ticker $WLFI and expected to serve as a bridge between Traditional Finance and DeFi.

Token holders also receive exclusive rights, such as participating in votes that determine the development direction and future of the platform.

Tokenomics Overview:

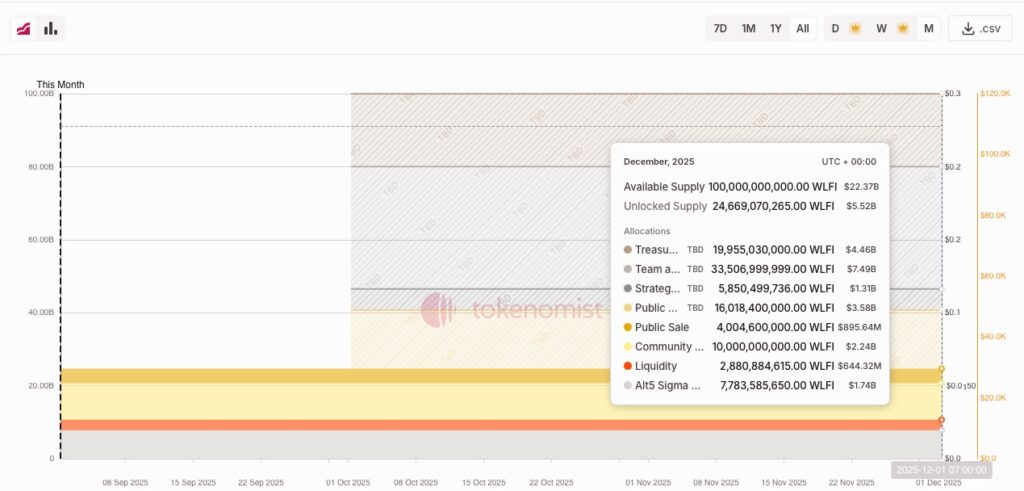

- Token Supply: 100 Billion

- Circulating Supply: 24.669 Billion (24.67%)

Circulating Token Allocation:

- Public Sale: ~4 Billion Tokens

- Community Growth and Incentives: 10 Billion Tokens

- Liquidity: ~2 Billion Tokens

- Alt5 Sigma Corporation: ~7 Billion Tokens

On the other hand, currently, 75% of the remaining locked tokens are still under discussion regarding the unlocking process. Follow their official social media account on X for the latest updates.

Latest Updates on WLFI Token

A WLFI governance proposal has emerged bringing positive news regarding a potential supply reduction. Token holders can participate in voting on this proposal, which includes the following points:

- Fees generated from liquidity positions (as per tokenomics) on various networks such as Solana, Ethereum, and BSC will be allocated for buyback and burn. Until now, these fees have been stored in the Treasury.

- Community members or third-party liquidity providers receiving fees in WLFI tokens will not be affected by this proposal.

- FOR → in favor of the proposal.

- ABSTAIN → neutral, neither supporting nor opposing.

- AGAINST → opposed, meaning the fees will remain in the Treasury.

The voting period runs from September 12, 2025, at 02:27 AM to September 19, 2025, at 02:27 AM.

So far, the majority of WLFI token holders have voted FOR, indicating support for the supply reduction.

WLFI Project Potential

From a technical analysis perspective, the $WLFI token has exhibited high volatility, dropping approximately 56% on its launch day.

However, candlesticks prior to September 1, 2025, represent pre-market prices, indicating that the token was traded before its official launch.

After the initial correction, $WLFI experienced two rejections at the 78.6% Fibonacci Retracement level (around $0.2409) and failed to break out. Currently, the price is in a consolidation phase. With the recent update of a supply reduction approved by the majority of holders through the governance proposal, this could act as a bullish catalyst for $WLFI price movement.

On the other hand, WLFI offers an advantage in terms of liquidity. It is available not only on DEXs (Decentralized Exchanges) but also listed on various CEXs (Centralized Exchanges), which makes it easier for beginner users to purchase the token.

Additionally, WLFI simplifies DeFi access through features such as bridging and asset swapping.

Making the platform more user-friendly compared to most other DeFi platforms that require users to access separate platforms to perform similar actions.

Note: This analysis is subjective and intended for educational purposes only, not as financial advice.

Conclusion

World Liberty Financial is a project supported by prominent figures with a vision to drive the adoption of stablecoins and DeFi services. The launch of the $WLFI governance token provides the community with the opportunity to influence the direction of the project. Moving forward, the effectiveness of USD1 adoption strategies and the successful implementation of governance proposals will be key factors in assessing how well WLFI can compete with other major DeFi projects.

Disclaimer: All articles from Pintu Academy are intended for educational purposes only and do not constitute financial advice.

Referensi

- Loke Choon Khei, “What Is World Liberty Financial (WLFI)? Donald Trump’s Crypto Project”, Coingecko, accessed on September 12, 2025.

- Michael Le, “What Is World Liberty Financial (WLFI)? Trump-Backed Crypto Token” , NFT Evening, accessed on September 12, 2025.

Share

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-