MicroStrategy Shares Down 16% This Year Amid Bitcoin Price Decline (2/26/25)

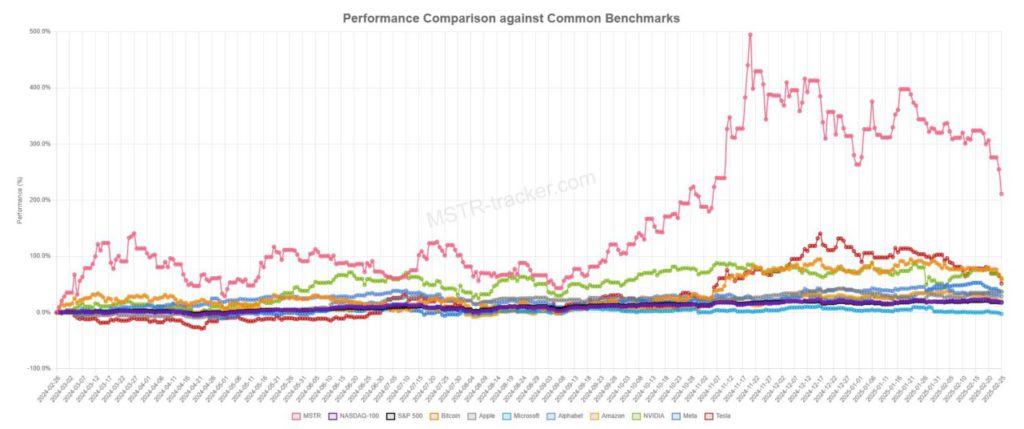

Jakarta, Pintu News – Shares of tech company MicroStrategy, now known as Strategy, have fallen about 16% this year in line with the correction in the price of Bitcoin .

The stock’s sharp decline sparked concerns about the viability of the company’s long-standing Bitcoin buying strategy. On February 25, the price of Bitcoin fell about 4% to around $88,000 (IDR 1,436,040,000), worsening the situation for companies with significant Bitcoin stashes.

Bitcoin Buying Strategy that Continues

Since 2020, Strategy has spent more than $33 billion (IDR538,890,000,000,000,000) buying Bitcoin, at an average price of around $66,000 (IDR1,076,000,000,000) per coin. The company has made an unrealized profit of more than $10 billion (IDR163,300,000,000,000) based on the higher Bitcoin price. The purchase was funded through the issuance of shares and about $9.5 billion (Rp155,140,000,000,000) of convertible debt, almost none of which matures until 2027 or later.

However, the market is beginning to question the sustainability of this strategy, especially after the significant drop in Bitcoin price. In an analysis published on February 25, The Kobeissi Letter, a market analysis firm, stated that their “ability to raise additional capital” depends heavily on the growth of the company’s Bitcoin reserves. They also cautioned that if a company’s liabilities exceed its assets, this ability could be drastically reduced.

Also Read: Senator Dick Durbin Introduces Legislation to Stop Fraud at Crypto ATMs

Risks of Bitcoin Price Decline to Corporate Finance

While the price of Bitcoin continues to fluctuate, Strategy’s long-term debt provides some comfort in terms of liquidity. The Kobeissi Letter reveals that the company needs to avoid a more than 50% drop in Bitcoin price from current levels and maintain it for a long period of time, at least until 2027, in order to avoid being forced to liquidate their Bitcoin stash.

On February 25, Strategy’s shares plummeted more than 10% to around $245 (IDR 4,000,000), while the price of Bitcoin was below $90,000 (IDR 1,467,000,000) for the first time since November 2024. The company’s shares have also fallen nearly 50% from the all-time high of $473 (IDR7,715,000) recorded in November 2024, after the company revealed their ambition to buy $42 billion (IDR685,860,000,000,000,000) worth of Bitcoin until 2027.

Future Outlook and Analyst Confidence

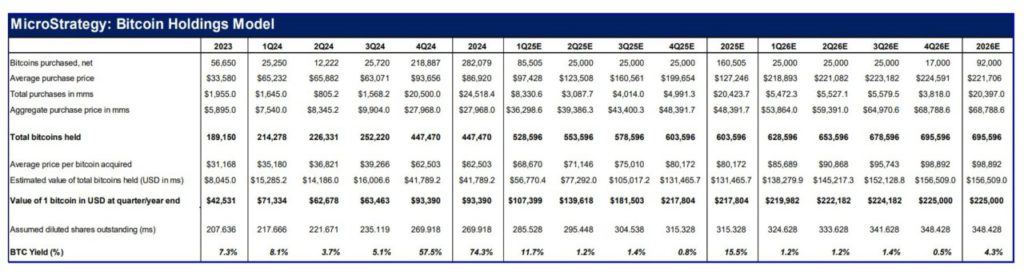

While this drop in share price is cause for concern, some stock analysts are still optimistic about Strategy’s rebound prospects. Benchmark, a stock research firm, even raised its target price for MSTR shares to $650, believing that the company will continue to raise capital to fund its Bitcoin buying strategy. Analysts believe that the company will continue to earn a “yield” on Bitcoin, which measures the ratio of Bitcoin deposits to shares outstanding. This will be an important benchmark for the company’s future financial performance.

However, some investors are focusing on Strategy’s lower market capitalization compared to its net asset value. Benchmark suggests that it is better to use the “BTC-per-share” ratio to assess the value of this company. Strategy is targeting a 15% Bitcoin yield by 2025, which is expected to boost investor confidence.

Also Read: 3 Factors Causing the 50% Drop in Solana (SOL) Price from All-Time Highs

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. MicroStrategy Stock Down 16% YTD Amid Bitcoin Rout. Accessed February 26, 2025.

- Featured Image: CoinPro.ch