Altcoin ETFs: Prospects and Demand Challenges in the Crypto Market

Jakarta, Pintu News – Exchange-Traded Funds (ETFs) focused on altcoins could potentially launch in the United States in the near future, but analysts predict that demand will be limited.

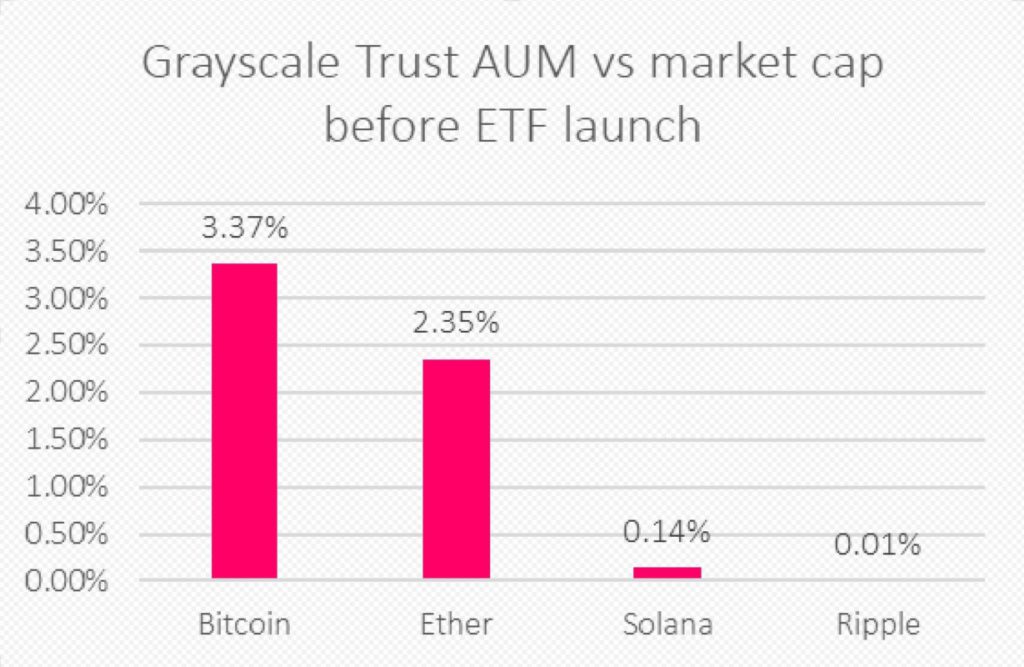

Although more than a dozen applications to launch ETFs holding alternative cryptocurrencies, such as Solana , XRP and Litecoin (LTC), are expected to gain regulatory approval by 2025, demand for these products will not be as strong as for Bitcoin or Ethereum ETFs. Many analysts believe that demand for altcoin ETFs will come more from retail rather than institutional investors, and even that may be limited.

Limited Demand for Altcoin ETFs Expected

Despite high expectations regarding the launch of altcoin ETFs, the demand for these products is not expected to be as great as that seen for Bitcoin or Ethereum ETFs. Katalin Tischhauser, head of research at Sygnum, revealed that while many people are hoping for altcoin ETFs to come to the market, there is no strong evidence of substantial demand for such products.

According to Tischhauser’s estimation, the inflow of funds into altcoin ETFs may only reach a few hundred million to one billion US dollars (approx. IDR 16.3 trillion), much lower compared to the more than $100 billion (IDR 1,633 trillion) in Bitcoin ETFs in the US.

In addition, investors who are already actively involved in crypto, especially those who know about altcoins such as Solana or Dogecoin , are likely to already own these assets through crypto exchange platforms or personal wallets. Bryan Armour, director of passive strategy research at Morningstar, also added that while Bitcoin attracts the attention of institutions and investment advisors, the same is not the case with altcoins, which tend to be of more interest to retail investors.

Also Read: Senator Dick Durbin Introduces Legislation to Stop Fraud at Crypto ATMs

Institutional Interest in Crypto ETFs

Some analysts believe that the adoption of altcoin ETFs could happen as crypto-related investment products evolve. While many institutional investors prefer to buy Bitcoin or Ethereum through ETFs, they might also be interested in altcoins if the products are incorporated in an index that monitors the crypto market as a whole.

ETFs holding Bitcoin and Ether, such as the new one launched by Franklin Templeton on February 20, 2025, show that asset managers have started to see the potential of managing a wider range of crypto products, albeit still limited to the two main cryptocurrencies.

Asset managers who are preparing altcoin ETFs are also more optimistic, pointing to JPMorgan research that estimates that demand for altcoin ETFs could reach more than $14 billion. Federico Brokate, head of US operations at 21Shares, said that even if genuine crypto investors already own altcoins, they could gain additional benefits by holding them in the form of an ETF. The main benefits of ETFs include more professional pricing and better safeguards for the crypto assets held.

Future Projections for Altcoin ETFs

While the growth potential of altcoin ETFs may not be as great as that of Bitcoin or Ethereum, analysts and asset managers still see them as an opportunity for portfolio diversification. Especially for professional wealth managers and independent investment advisors who want to offer investment products that are different from their competitors.

However, for new investment products like crypto ETFs, there is a spectrum of adoption to contend with. Matt Horne, chief digital asset strategist at Fidelity Investments, stated that while there is rapid adoption on Bitcoin and Ethereum, for altcoins, adoption will be slower and more gradual.

Conclusion

Altcoin ETFs are expected to come to market soon, but demand is expected to be limited, especially among retail investors. While there is optimism regarding the growth of these products, especially from asset managers targeting portfolio diversification, substantial demand from institutional investors remains doubtful. For investors interested in altcoins, ETF products may offer some benefits, but for now, widespread adoption remains a challenge.

Also Read: 3 Factors Causing the 50% Drop in Solana (SOL) Price from All-Time Highs

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph.“Altcoin ETFs Coming, Demand Limited – Analysts“. Accessed February 26, 2025.

- Featured Image: stormgain