Ethereum Plummets Over 15% Today (4/3/25) – What’s Behind the ETH Crash?

Jakarta, Pintu News – The price of Ethereum slumped below $2,200 again, dropping to even lower levels than before the announcement of the strategic crypto reserve by US President Donald Trump, who previously mentioned that Ethereum would be included in the reserve.

This sudden drop saw ETH plummet more than 15% in a single session, a sharp reversal that took many investors by surprise.

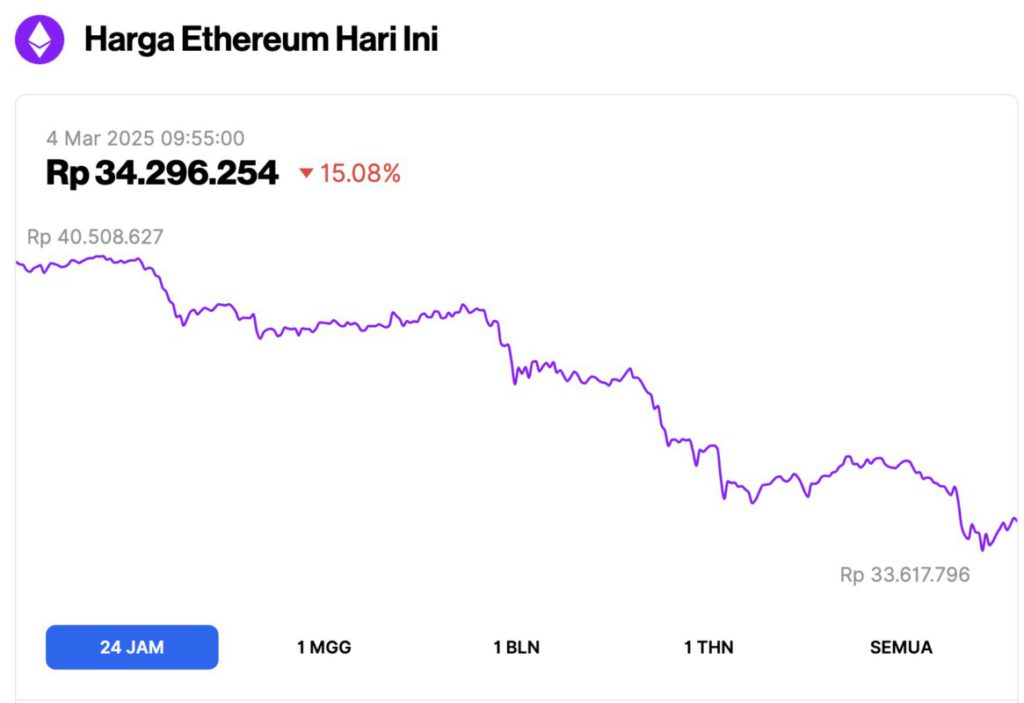

Ethereum Price Drops 15.08% in 24 Hours

On March 4, 2025, Ethereum (ETH) plunged 15.08% in the past 24 hours, trading at approximately $2,066 (34,296,254 IDR). Earlier in the session, ETH peaked at 40,508,627 IDR before undergoing a sharp correction, dropping to its lowest point at 33,617,796 IDR.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $249.22 billion, with daily trading volume also plummeting 4% to $35.11 billion in the last 24 hours.

What happened to the ETH price today?

Read also: Bitcoin Plunges 10% to $83,300 Today (4/3/25) – What’s Causing the Drop?

Macro Factors and Market Concerns

On Monday (3/25), crypto markets were pressured by macroeconomic concerns, including the impact of D.O.G.E’s austerity policies and Trump’s trade war, as well as uncertainty over how the Federal Reserve will respond to the economic slowdown.

The Atlanta Federal Reserve’s GDPNow index, which estimates US economic growth based on the latest economic data, plunged to -2.8% for the first quarter of 2025-a sign that a recession could be approaching.

Traders who FOMOed their way into the crypto market on Sunday seem to have suffered heavy losses. Based on data from Coinglass, nearly $78 million in leveraged ETH futures long positions were liquidated in the last 12 hours.

In addition, FUD (Fear, Uncertainty, and Doubt) related to market manipulation and insider trading further weakened investor confidence.

Alleged Insider Trading Before Trump’s Announcement?

One suspicious incident occurred just before Trump’s crypto reserve announcement. A trader went long $200 million worth of Bitcoin with 50x leverage, and made a profit of $6.8 million after the price of Bitcoin spiked on the news.

Some users on X also highlighted the fact that the five coins Trump mentioned-Bitcoin, Ethereum, Solana , XRP , and Cardano -are the top five assets in the Bitwise 10 Crypto Index Fund.

In addition, David Sacks, who serves as the White House Crypto Czar, is known to have ties to Bitwise through his company, Craft Ventures.

Read also: 3 Crypto with Rebound Potential in March 2024 According to Elliott Wave Analysis

With various factors weighing on the market, a big question arises: Will Ethereum continue to plummet to new lows this year? And more worryingly, is the bull run that started in late 2022 now really over?

Where is Ethereum Price Headed Next?

Concerns over economic conditions are a major risk to the short-term outlook of cryptos, including Ethereum (ETH), which could be heading for a new low in the near future.

How bad is the worst-case scenario? If the US economy falls into recession, but the Federal Reserve is slow to respond, the price of Ethereum could potentially plummet back to the $1,500 range. Is this the end for Ethereum? Of course not, according to a report by Crypto News.

A US recession may trigger sharp volatility in the short term, but it will likely be followed by massive stimulus from the Fed and/or the US government. If we look at the pattern in 2020-2021, this could be rocket fuel for the crypto market.

Moreover, crypto adoption by major countries and institutions is on the rise, coupled with the possibility of a US crypto strategic reserve that could be a major trigger for a new bull run.

If interest rates return to near 0%, Quantitative Easing (QE) is implemented again, and there is fiscal stimulus and massive buying from the US government and financial institutions, then Ethereum prices could soar to levels above $5,000 in the next few years.

Ethereum selling pressure eases, bullish signal in sight?

The day before today, the BeInCrypto page (3/3/25) reported that whale addresses that had 10,000 to 100,000 ETH previously made a large sell-off.

In the past week, they have offloaded 640,000 ETH worth $1.5 billion, which contributed to Ethereum struggling to break the $2,500 level. However, the selling pressure is now starting to ease, signaling a change in market sentiment.

In the last 24 hours (3/3/25), whales started to stop their sell-off, in line with the stabilization of Ethereum (ETH) price. This change in behavior could be an indication that large investors are starting to believe in ETH’s recovery.

Read also: Dogecoin Price Prediction: Will DOGE Skyrocket to $1? Crypto Whales Are Making Moves!

If large holders continue to hold onto their assets, Ethereum’s volatility may decrease and build stronger price support.

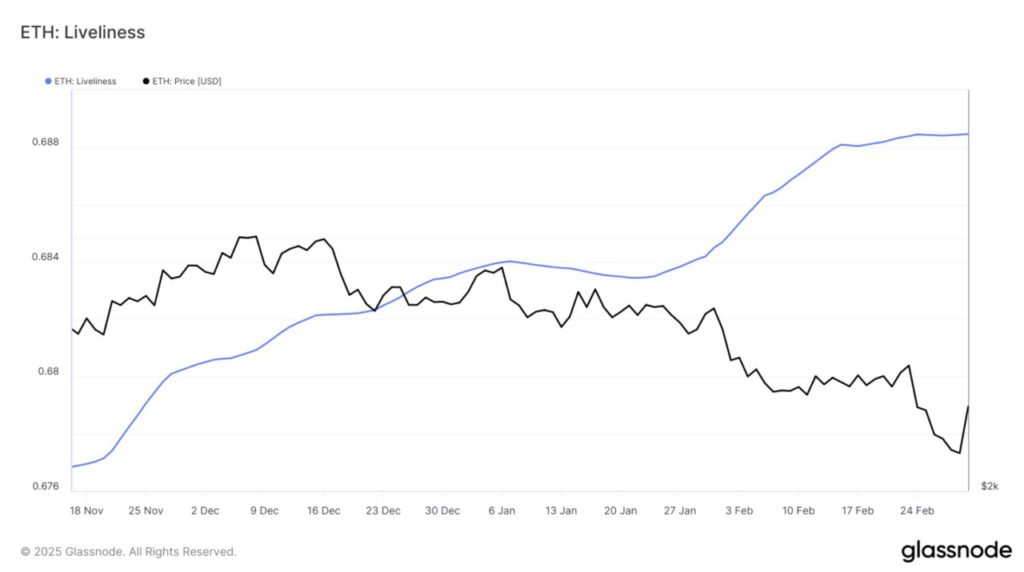

Ethereum’s Liveliness Indicator also shows that long-term holders (LTHs) have stopped their sell-off. This indicator usually rises when LTHs sell their assets and falls when they hold or accumulate more ETH.

In recent days, this indicator has remained flat, indicating that the sell-off has stalled.

This trend further strengthens Ethereum’s price stability, as long-term investors help maintain market confidence. If LTHs continue to hold their assets, Ethereum could potentially build momentum for a breakout.

In addition, if the Liveliness indicator continues to decline, this will be a bullish signal, indicating that investors are accumulating more ETH rather than selling it.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Stabilizes at $2,300 as Whales Halt Sell-Off, Indicating Potential Recovery. Accessed on March 4, 2025

- Crypto News. Ethereum Price Crashes 13% Despite Trump Crypto Reserve Announcement – Why? Accessed on March 4, 2025