Bitcoin to $100K or a Crash to $70K? Analysts Uncover Key Order Book Signals!

Jakarta, Pintu News – Bitcoin is showing signs of bullish momentum, surging 5% in the last 24 hours (March 5, 2025) to trade at $87,638. However, despite the price jump, market sentiment remains clouded by extreme fear, as reflected in the trader sentiment index.

Adding to the uncertainty, several technical indicators suggest that Bitcoin may struggle to maintain its upward trajectory. With the market at a crossroads, one pressing question remains: Will BTC soar past $100,000, or is a plunge to $70,000 on the horizon?

Bitcoin bounces to $87,000 after sell-off, ready for $90,000?

Bitcoin (BTC) saw a sharp rebound on Wednesday, recovering from a huge sell-off over the past 48 hours triggered by market concerns after Donald Trump announced 25% import tariffs for Canada and Mexico.

Read also: Top 3 Crypto Whales Are Accumulating as the Market Crashes!

Previously, investors pulled funds out of risky assets following the announcement on Monday, causing BTC prices to plummet to $82,000, the lowest level in over two weeks. However, as market sentiment stabilized, Bitcoin rallied again, jumping 9% in the last eight hours and briefly trading at $87,300.

Quoting Coingape’s report, the BTC/USD chart on the 4-hour timeframe shows a strong relief rally, with the price bouncing off the critical support at $82,000 and successfully reclaiming the important resistance level at $87,000.

This quick spike is indicative of aggressive short covering, where traders who previously bet against Bitcoin are starting to cover their positions.

Even so, spot market volumes are still moderate, signaling that a new bullish momentum has yet to fully take shape.

Despite its recovery, BTC remains vulnerable to renewed selling pressure if macroeconomic uncertainty persists. If it fails to hold above $87,000, Bitcoin could again test support at $83,500.

Conversely, if it manages to break $88,500, BTC could potentially retest the psychological barrier at $90,000.

Bitcoin long position holders account for 74% of total market liquidation

Although Bitcoin (BTC) price rose 5% and returned to the $87,000 level, liquidation data shows that the bullish momentum is still fragile.

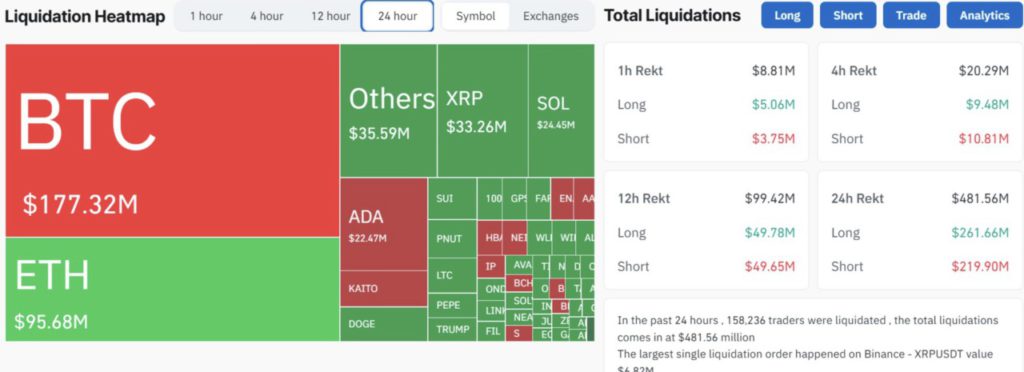

According to Coinglass, in the past 24 hours, long BTC traders saw $80 million in liquidations, accounting for 17% of the total $481 million in liquidations in the crypto derivatives market. These large losses on the bullish side indicate a lack of conviction in the current rally, thus increasing the risk of a trend reversal.

Usually, when long liquidation dominates the market, it indicates that bullish traders are using too high leverage, which then triggers a forced sell-off and further pushes prices down.

The 4-hour BTC/USD chart also supports this analysis, showing a relief rally after a large sell-off, but without significant buying activity. This suggests that the recent price increase is most likely due more to short-covering than new capital inflows.

If Bitcoin fails to hold above $87,000, bearish pressure could push the price back to $83,500 in the next few sessions, with $82,000 as the next major support.

Read also: Pi Network Breaks Into the Top 11 Largest Cryptos by Market Cap

On the contrary, if the bulls are able to push BTC through $88,500, the next crucial resistance is at $90,000, which could determine the direction of BTC prices in the medium term.

BTC Price Prediction: Analyst Cole Garner Identifies Bitcoin Order Book Depth Patterns

Analyst Cole Garner has identified another major signal in the Bitcoin price prediction that hints at a potential long-term recovery.

In a chart he shared on the X platform on Tuesday, Bitcoin’s price movements show a strong correlation between large liquidity on the bid side and explosive price spikes. This pattern is common during accumulation phases.

In the lower panel of the chart, which tracks the depth of the order book based on delta accumulation, we see a new spike in bid liquidity in green. Historically, this signifies accumulation by institutional investors (smart money) before a breakout.

This pattern has previously preceded major bullish rallies, and if history repeats itself, Bitcoin could soon enter the next phase of expansion.

If the price is able to hold above $85,000, then a breakout towards $92,000 could occur, with a potential further rally to the psychological $100,000 level if liquidity uptake remains strong.

Read also: Arthur Hayes Predicts Bitcoin Drop – Will BTC Crash to $70,000?

However, although the current setup appears bullish, the chart also shows the presence of historical cycles that point to a trend reversal.

Each previous surge in liquidity is followed by a sharp contraction, characterized by the dominance of sell-side pressure in red, triggering a price correction.

If Bitcoin fails to maintain support at $81,500, the imbalance in the order book could turn bearish. This could open the door for a drop to $76,800, and if deeper rejection occurs, the price could drop to $72,500, risking triggering further selloffs.

With Bitcoin at a crucial point, the next move will be determined by whether the existing bid liquidity is able to drive price expansion or if it dries up, potentially triggering a reversal.

Traders are now closely monitoring the dynamics of the order book, as the positioning of institutional investors (smart money) indicates that a big move may be imminent.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price to $100k or $70K? Analyst Cole Garner Spots BTC Order Book Pattern For Next Big Move. Accessed on March 6, 2025