OCC’s new policy could be a breath of fresh air for Ripple (XRP)!

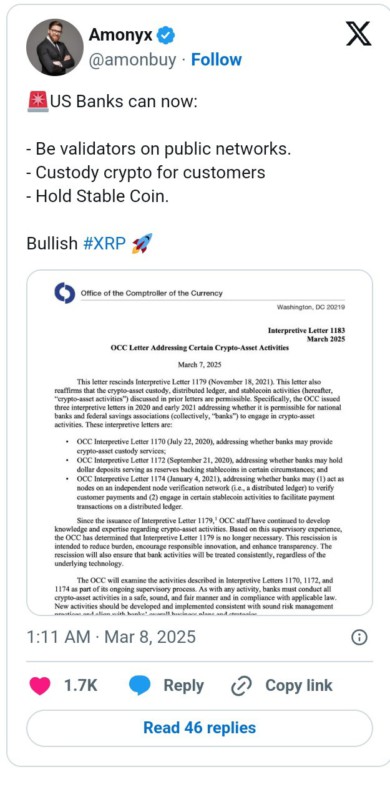

Jakarta, Pintu News – Recently, the United States Office of the Comptroller of the Currency (OCC) issued a policy that allows national banks and federal savings associations to engage in crypto-asset custody activities, certain stablecoin-related activities, as well as participation in independent node verification networks.

This policy is expected to reduce the burden for banks to engage in crypto-related activities and ensure that these bank activities are treated consistently by the OCC, regardless of the underlying technology.

New Policies and Their Impact on Banks

According to Rodney E. Hood, Acting Comptroller of the Currency, banks are expected to maintain robust risk management controls to support new bank activities just as they do for traditional banks.

It also revoked the OCC’s participation in the joint statement on cryptoasset risks as well as the joint statement on liquidity risks for bank organizations that largely led to cryptoasset vulnerabilities. The move comes in the wake of the FTX exchange crash in 2023, which marked a tipping point in crypto regulation.

Also Read: El Salvador’s President Closes Bitcoin Animal Hospital: Controversy and Impact

Reaction from the American Bankers Association

Rob Nichols, President and CEO of the American Bankers Association (ABA), praised this decision as a major step in engaging banks in the rapidly growing crypto market. The ABA has long urged that this misguided policy, which created atypical standards for many product and technology implementations, be repealed.

Banks have a critical role to play in the digital asset ecosystem, which has the potential to be a catalyst for change in traditional financial markets, and today’s action by the OCC is an important step towards empowering that success.

Impact on Ripple (XRP) and the Crypto Market

This latest decision is expected to allow banks to actively participate in blockchain networks such as XRP Ledger, which is a highly scalable and efficient blockchain created for institutional-scale financial transactions.

A successful adoption is also expected to have a major impact on the price of Ripple , which has been predicted to see a rise this cycle. Moreover, this policy might provide more legal certainty and confidence for investors and users in the crypto ecosystem.

Conclusion

With this new policy, the OCC not only reduces the regulatory burden for banks, but also opens up new opportunities in the adoption of blockchain and crypto technologies. This move is expected to bring more innovation and integration between the traditional financial sector and digital asset markets, providing a positive boost to the overall digital economy.

Also Read: Cardano and Check Point Collaborate for AI-Based Blockchain Security!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News Flash. XRP News: Will the OCC’s Crypto Custody Rule Benefit Ripple?. Accessed on March 10, 2025

- Featured Image: Crypto Rank