Ripple (XRP) Price Ready to Surge to $3? CME Group Predicts 99% Fed to Hold Interest Rates!

Jakarta, Pintu News – As of March 13, 2025, the price of Ripple had risen to $2.24 after data from CME Group showed that investors expect the Fed to hold interest rates in next week’s FOMC meeting.

A dovish policy from the Fed could potentially trigger further rallies for XRP, which might open up opportunities for a move towards $3 in the near future.

Ripple (XRP) Rises 18% to $2.24 as Market Recovers

The price of Ripple (XRP) surged to $2.24 on Thursday (13/3), recording the highest opening price of the week. The rise came after the latest US Consumer Price Index (CPI) data showed that inflation is starting to ease, prompting traders to bet on the possibility of the Fed keeping interest rates on hold.

Read also: Ethereum Price Struggles at $1,800 Today (3/14/25) – Is This the Start of a Bigger Crash?

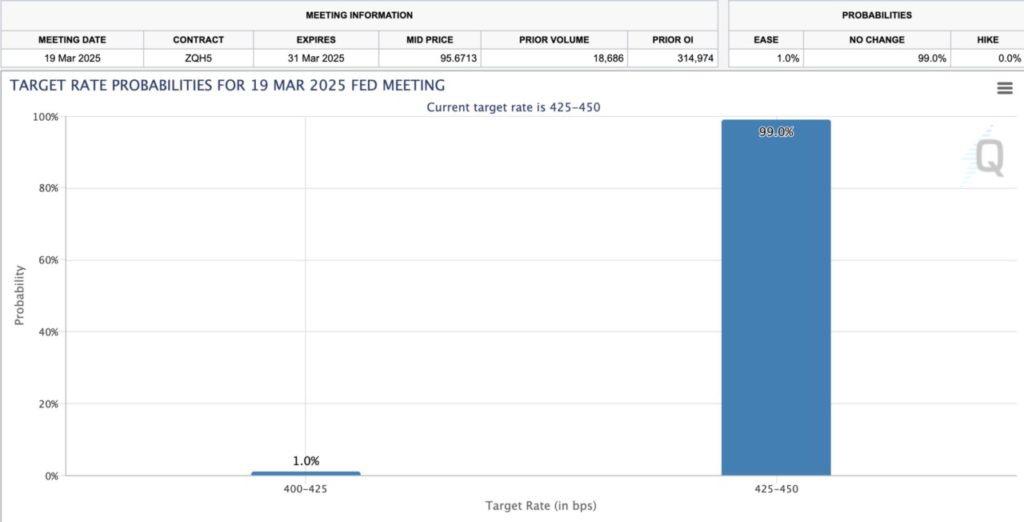

CME Group’s FedWatch tool now shows that there is a 99% chance that the Fed will not change interest rates at its March 21 meeting.

Although macroeconomic sentiment favors a bullish trend, XRP price still faces resistance around $2.50. To sustain its upward momentum, a significant increase in trading volume is required.

If capital flow into the crypto market increases further, XRP could potentially extend its rally to reach the critical $3 level.

RP Traders Optimistic on New Capital Flows, CME Group Predicts 99% Fed to Hold Interest Rates

Ripple (XRP) has experienced a significant price recovery in the past 48 hours, driven by a series of positive macroeconomic developments. On Thursday (13/3), XRP opened at $2.24, registering an 18% increase from the local low of $1.90 on Tuesday (11/3).

This price increase coincides with growing optimism towards a potential ceasefire in the Russia-Ukraine conflict, as well as the easing trend of US inflation.

February’s Consumer Price Index (CPI) data showed that inflation fell to 2.8%, lower than January’s 3% and the forecast of 2.9%. On a monthly basis, the CPI rose only 0.2%, much lower than the 0.5% increase in January.

Market sentiment suggests that the better-than-expected inflation data has eased concerns that were triggered by last week’s disappointing US Non-Farm Payroll report, which previously sparked fears of a recession.

In response, traders began to change their outlook, anticipating a longer period of stable interest rates, which boosted investor confidence in risky assets like XRP.

Read also: SEC Delays XRP and Solana ETF Decision, What’s Really Going On?

Given this, CME Group’s FedWatch tool-which is often used by institutional investors-now shows a 99% probability that the Fed will keep rates on hold in its March 21 decision.

If this projection materializes, the crypto market, including XRP, could experience a re-entry of capital flows, as traders who previously exited due to NFP uncertainty, now start to come back in and prepare for a more sustained bullish trend.

XRP Derivatives Market Analysis: Bullish Sentiment Gets Stronger

Furthermore, recent data from Coinglass shows increasing bullish sentiment towards XRP, with various key metrics reflecting higher trader confidence.

Open interest rose 3.48% to $3.05 billion, signaling traders’ increased commitment to maintain their positions, while open interest in options jumped 10.69% to $1.37 million, reflecting greater institutional interest in leveraged XRP price movements.

Although spot volume fell 3.96% to $8.35 billion, the rise in open interest shows that traders prefer to maintain their positions rather than exit the market.

In addition, data from Binance and OKX also support the prospect of price increases, where the long/short ratio on Binance for the XRP/USDT pair stands at 2.49, while on OKX it stands at 2.14, indicating that more traders are opening long positions in expectation of further price increases.

Liquidation data also further strengthens the bullish scenario, with $4.25 million of long positions liquidated in the last 24 hours, compared to $4.61 million of short positions, indicating that bears are starting to lose control. With this trend, XRP has the potential to break the $2.50 resistance level in the near future.

XRP Price Prediction: Bullish towards $2.60 as Market Recovers from Sell-off Phase

XRP price is trying to bounce back after a sharp correction of 27.53%, now stabilizing above $2.24, with buyers maintaining the early recovery.

Read also: Market Activity Plummets, XRP Price Held Above $2.00 – Ready for a Big Rebound?

Market volume data shows that the rebound in XRP price came along with a contraction in volume, following a sell-off of 1.63 billion tokens, indicating a weakening of selling pressure.

In the past two days, XRP recorded a price surge of 18.88%, signaling bullish pressure returning. Currently, XRP is trying to break the resistance at $2.34, which coincides with the 20-day Exponential Moving Average (EMA).

If XRP manages to breakout above this level, the asset could potentially continue its rally towards $2.60, where the Upper Bollinger Band is currently located as the next major resistance zone.

Conversely, if the price fails to hold above $2.24, selling pressure could increase again, with the Lower Bollinger Band at $1.92 being the key support level.

However, long/short ratio data from Binance and OKX shows a strong bullish bias, signaling that market sentiment is more inclined towards the upside.

If this momentum holds, XRP could be pushed up to $2.76, which is a key level from the recent highs.

Conversely, if XRP fails to break $2.34, then the potential upside could be delayed, with prices likely to move sideways before a larger breakout occurs.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ripple (XRP) Price Eyes $3 Rebound as CME Group Signals 99% Chance of Fed Rate Pause. Accessed on March 14, 2025