Ethereum Stuck at $1,900 Today (3/17/25) – Is a Big Move Coming?

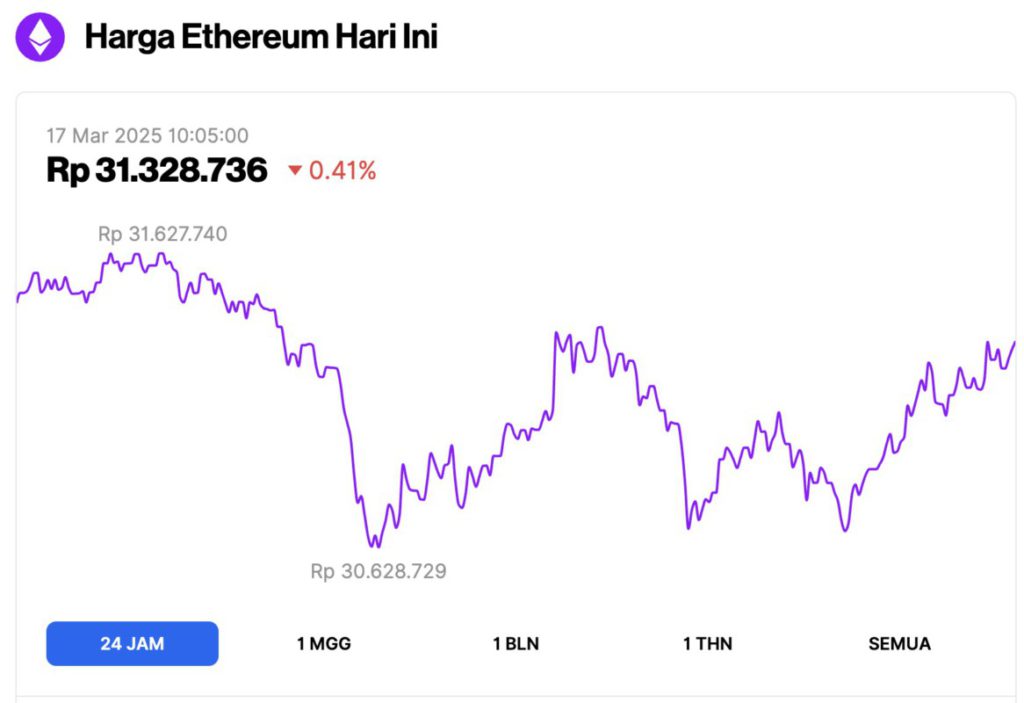

Jakarta, Pintu News – Ethereum saw a slight dip of 0.41% today, March 17, 2025, remaining stuck at the $1,912 level.

After days of volatile price swings, investors are now eagerly watching for new signals that could determine ETH’s next move. Will it gain momentum to break through resistance, or is a deeper correction on the horizon?

Ethereum Price Drops 0.41% in 24 Hours

On March 17, 2025, Ethereum (ETH) was trading at approximately $1,912, or around IDR 31,328,736, after a slight 0.41% dip over the past 24 hours. During this period, ETH briefly reached a high of IDR 31,627,740 before slipping back toward its lowest point of IDR 30,628,729.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $230.59 billion, with daily trading volume rising 48% to $9.64 billion in the last 24 hours.

Read also: 5 Cryptos that Went Up Today (3/17/25): Number 1 Altcoin Rocketed up to 174%!

ETH price hit by worsening sentiment

Despite today’s slight decline, the price of Ethereum (ETH) saw a tentative recovery on Friday, as risk appetite increased in the broader crypto and traditional financial markets.

However, don’t get me wrong-with the price still holding slightly above $1,940, Ethereum remains in a medium-term downtrend.

Currently, the price of Ethereum has dropped by more than 50% compared to its highest level in recent years, which was around $4,200 in December.

Much of this decline has occurred in the past three weeks, during which overall financial market sentiment has deteriorated significantly.

Markets are facing the harsh reality that the Trump administration may be deliberately implementing policies that cause economic pain in the short term in favor of stronger economic growth in the long term.

These policies include aggressive budget austerity to cut the deficit, as well as trade wars aimed at bringing industry back to the US.

Some also argue that the Trump administration is trying to cool the economy in order to keep US interest rates down, especially with $9 trillion of government debt (about 25% of the total) scheduled for refinancing later this year.

With the risks still tilted towards further weakness in the US economy in the near future, the likelihood of a major uptrend reversal in Ethereum price seems slim in the near future.

Where is Ethereum Price Headed Next? Bearish Trend Continues

Since reaching oversold levels earlier this week, it’s no surprise that Ethereum’s current price rebound could continue.

However, based on chart analysis, unless Ethereum price is able to hold above the $2,100 resistance area and surpass the 21-day moving average (21DMA) at $2,230, the market will most likely still be dominated by the bears.

Risks are still likely to point towards a decline towards $1,500 in the next few weeks, unless there is a significant improvement in macroeconomic sentiment-which for now seems unlikely.

However, for long-term investors, Ethereum’s current price drop could be a golden opportunity to accumulate as many assets as possible.

As macro barriers ease and liquidity conditions improve-which is expected to happen by the end of 2025-Ethereum could potentially experience a huge surge.

Read also: Dogecoin price ready to explode to $3? Indicator confirms low!

Macro factors aside, the Trump administration’s return to the White House marks a new golden era for crypto in the US.

A more favorable regulatory environment in the world’s largest economy is expected to drive rapid growth in the Ethereum ecosystem in the coming years.

Ethereum remains the undisputed leader in the DeFi world, backed by BlackRock, and is the only altcoin that currently has a spot ETF in the US, which will soon also start offering staking yields.

Additionally, it’s worth noting that many officials in the Trump administration are ETH holders (HODLers). This narrative alone is strong enough to push Ethereum’s price to reach new record highs once macro headwinds subside.

In fact, the price of Ethereum could surpass $10,000 by the end of Trump’s term-a jump of more than 5 times from current levels.

So, while there is still potential for a decline in the short term, Ethereum remains one of the best crypto assets to buy right now.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Ethereum Price Recovers, But Chart Suggests Slump to $1,500 Coming. Accessed on March 17, 2025