Bitcoin Stalls at $83,200 Today (March 18, 2025) – Are Short-Term Holders Finally Surrendering?

Jakarta, Pintu News – Bitcoin’s performance in 2025 has left holders frustrated. Despite positive news, such as Donald Trump’s announcement of a Bitcoin strategic reserve and the first crypto summit at the White House, Bitcoin’s price has continued to plummet, bottoming out at $76,600 on March 11.

Despite the bearish market sentiment, let’s analyze some on-chain indicators to understand how long-term holders (LTH) and short-term holders (STH) are dealing with this correction.

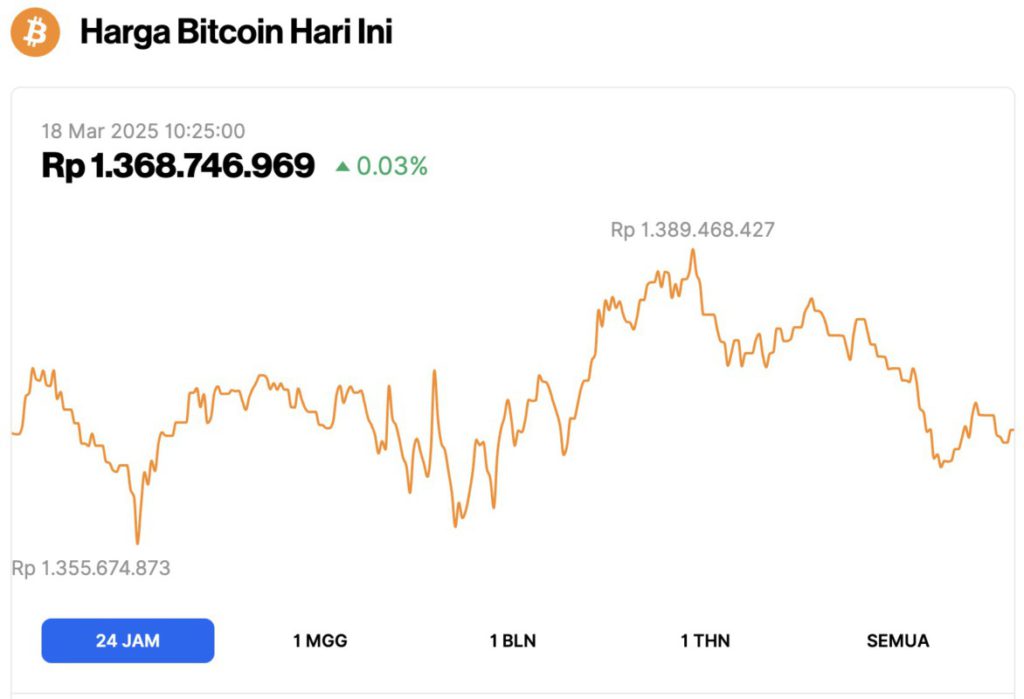

Bitcoin Price Up 0.03% in 24 Hours

As of March 18, 2025, Bitcoin (BTC) is trading at $83,222 (approximately IDR 1,368,746,969), marking a modest 0.03% increase in the past 24 hours. Throughout this period, BTC reached a high of IDR 1,389,468,427 and dipped to a low of IDR 1,355,674,873.

According to CoinMarketCap, Bitcoin’s market capitalization is now $1.64 trillion, with trading volume in the last 24 hours rising 5% to $24.04 billion.

Read also: Crypto Whale Buys ETH: Here’s Ali Martinez’s Price Analysis of Ethereum, Bitcoin, and Cardano!

What happened to the Bitcoin price today?

Bitcoin Short-Term Holders Give Up

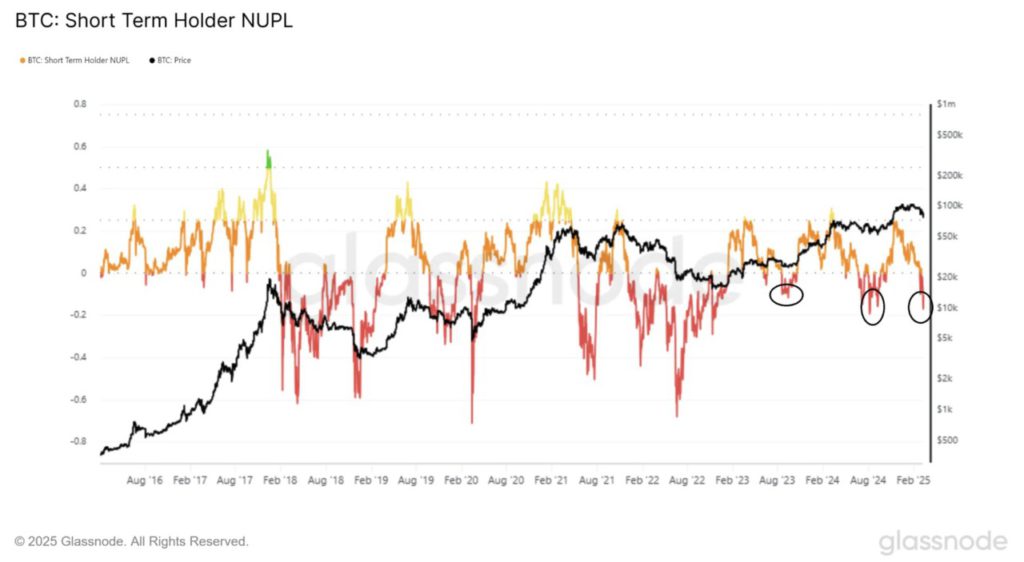

According to CCN (3/17/25), Bitcoin’s Net Unrealized Profit/Loss (NUPL) indicator helps determine market sentiment by measuring unrealized profits and losses and comparing them to market capitalization.

Historically, high values often coincide with the peak of the Bitcoin cycle.

The indicator is divided into short-term and long-term holding thresholds by separating UTXOs based on holding age-shorter or longer than 155 days.

The STH-NUPL indicator shows that short-term holders are currently experiencing large losses with a value of -0.06. This means that short-term holders have an unrealized loss of 6% of the market capitalization. This value has previously caused a price bounce in a bull market (marked with a black circle).

However, the indicator once dropped almost tenfold lower to -0.60 when Bitcoin price entered a bear market. Therefore, if Bitcoin remains in a bearish trend, the STH-NUPL indicator could potentially continue to decline.

Read also: 3 Crypto that Traders Are Watching in the Third Week of March: Big Trend on the Horizon?

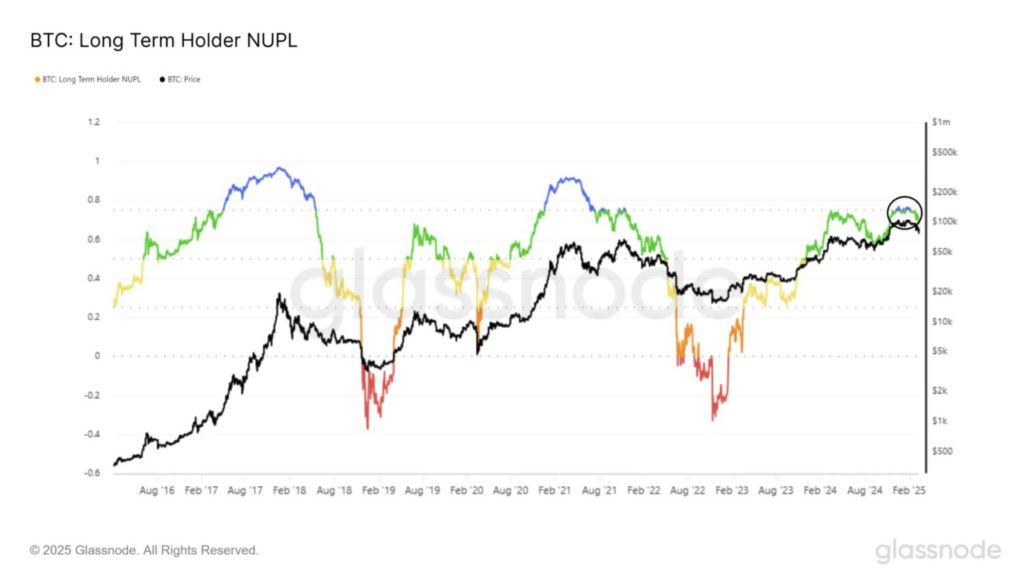

Bitcoin Long-Term Holders Start Distributing

In the two most recent cycles, the LTH-NUPL increased above 0.75 and lasted for several months before the market peaked. In 2017, this indicator lasted for six months, while in 2021 it lasted only four months.

However, the current Bitcoin cycle is different. The on-chain indicator (black circle) only passed 0.75 in less than a month before dropping back down. Currently, the indicator value is at 0.6.

Previously, whenever the indicator rose above 0.75 and then fell back, it signaled that a bear market had started.

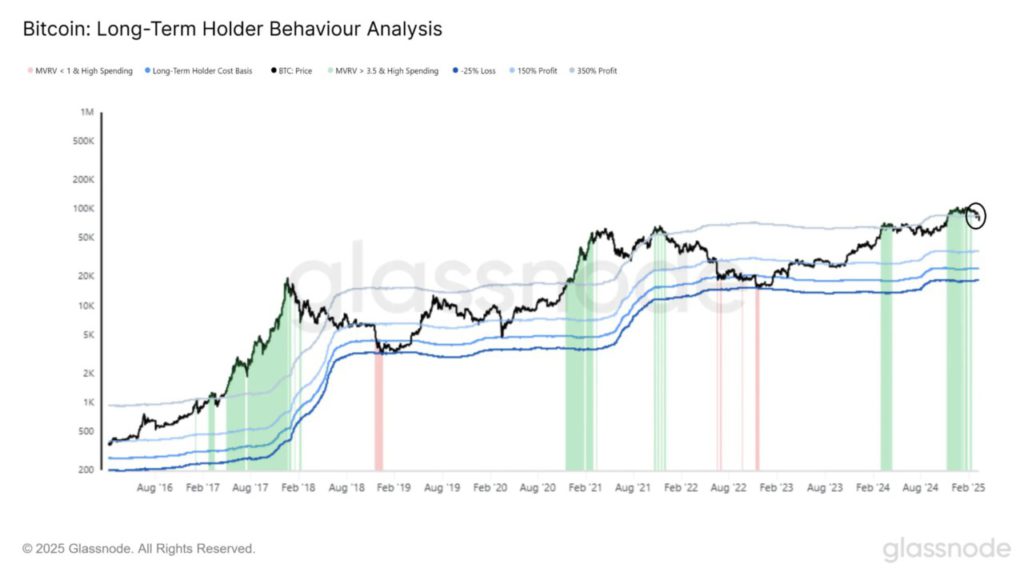

Periods of high spending rates that coincide with Market Value to Realized Value (MVRV) provide deeper insights into the behavior of long-term Bitcoin holders.

Historically, Bitcoin peaked when long-term holders started selling in large volumes with MVRV values above 3.5 (marked in green).

This big selling pattern usually lasts for a few months before the market reverses.

In the current cycle, this happened twice: once when BTC broke through its all-time high in March 2024, and once during the November rally.

The long-term holder cost basis (blue line) is currently at $24,896. As BTC prices continue to fall, the average long-term holder profit is now less than 350% (black circle).

Read also: Pi Coin value collapses 9%, how much is Pi Network to Rupiah today (3/18/25)?

In previous cycles, a drop below this level after a period of heavy selling by long-term holders was confirmation that a bear market had begun.

Overall, Bitcoin price has fallen by more than 20% since hitting an all-time high. Long-term holders (LTH) started distributing their holdings before the decline took place, while short-term holders (STH) bore most of the losses.

Citing the CCN report, data from various LTH and STH indicators show that Bitcoin has now entered a bear market.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Bitcoin Holders Shift: Long-Term Distribution Meets Short-Term Losses. Accessed on March 18, 2025