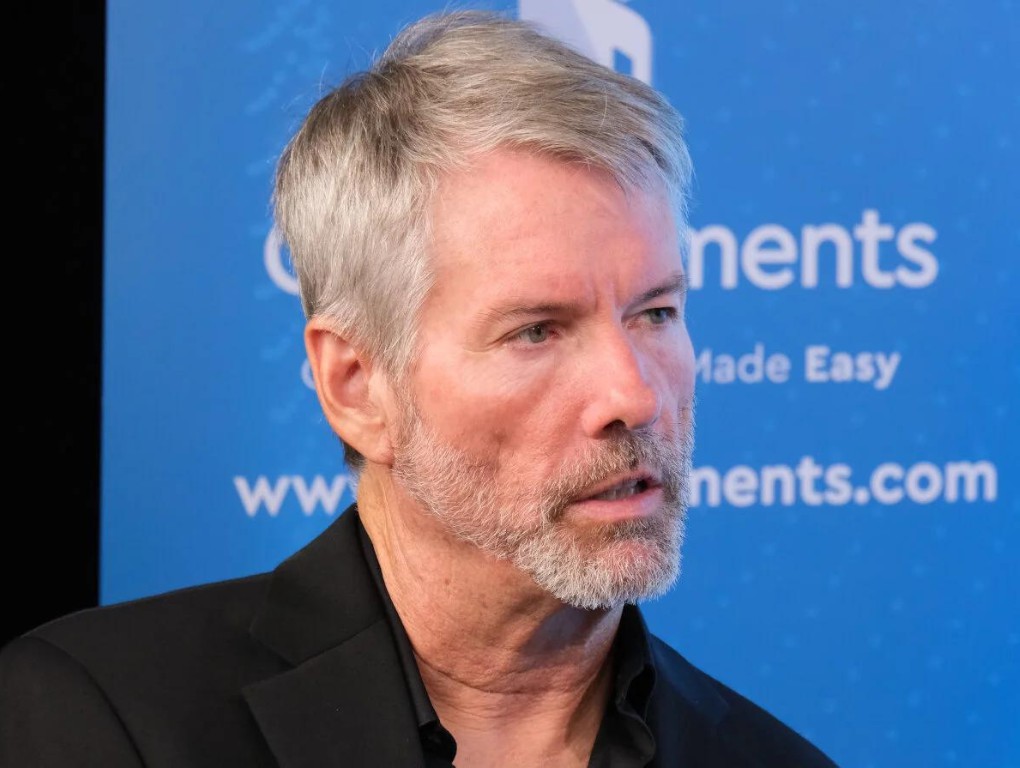

Michael Saylor: “Bitcoin is Getting Stronger!”, What Does That Mean?

Jakarta, Pintu News—In a poetic social media post, Michael Saylor, Chairman of Strategy, described Bitcoin as an “Orange Dwarf.” This statement attracted great attention from the crypto community.

Saylor says, “Bitcoin is the Orange Dwarf, the brightest object in the financial system, which gets stronger, hotter, and denser as capital grows.”

Check out the full news here!

Bitcoin: A Bright Star in the Financial System

Reporting from U Today, Michael Saylor compared Bitcoin (BTC) to an orange dwarf star, known for its resilience and intensity that increases over time. This analogy emphasizes the stability and power of Bitcoin (BTC) in the financial system.

With capital continuing to flow into its network, Bitcoin (BTC) increasingly shows its dominance as a digital currency. Saylor described Bitcoin (BTC) as a digital energy grid in another tweet.

This shows Saylor’s vision of Bitcoin (BTC) as a medium of exchange and a platform that can support various types of financial and energy transactions.

Read also: Solana (SOL) Celebrates 5th Anniversary: Here’s the Journey and Achievements!

MicroStrategy in Bitcoin Investing

Since August 2020, MicroStrategy has started purchasing Bitcoin (BTC) and now owns 499,096 BTC, making it the world’s largest corporate holder of Bitcoin (BTC).

Under Saylor’s leadership, the former software company has recently become the largest convertible bond issuer, raising around $9 billion.

It recently launched BMAX, an exchange-traded fund (ETF) that focuses on convertible bonds from companies with Bitcoin (BTC) on their balance sheets, including Saylor’s newly rebranded Strategy.

Bitwise also introduced a fund that follows an index of companies holding Bitcoin (BTC) as a corporate cash asset, with Strategy accounting for around a quarter of the index.

Read also: Bitcoin Price Stuck at $83,200 Today (3/18/25): BTC Short-Term Holders Starting to Give Up?

Bitcoin Volatility Ahead of Fed Meeting

Bitcoin (BTC) is down 1.14% in the last 24 hours to $83,263 amid investors considering macroeconomic risks and the upcoming Federal Reserve (Fed) meeting. The Fed is scheduled to meet on Wednesday to provide an update on inflation.

The Fed’s upcoming Federal Open Market Committee (FOMC) meeting is scheduled for March 18-19. Although the latest economic data looks more encouraging, investors expect the Fed, which targets a 2% inflation rate, will remain on hold when their two-day meeting ends on Wednesday.

Traders expect a rate cut of 0.75 percentage points by the end of the year, starting in June.

Conclusion

Michael Saylor’s statements and strategies towards Bitcoin (BTC) demonstrate a long-term view of the cryptocurrency’s potential and stability. As a leader in the corporate adoption of Bitcoin (BTC), Saylor and MicroStrategy continue to influence the crypto market and wider financial system.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Bitcoin Growing Stronger: Michael Saylor Stuns with BTC Statement. Accessed on March 18, 2025

- Featured Image: Decrypt