CryptoQuant CEO Ki Young Ju’s Warning Against Crypto Market End of March 2025

Jakarta, Pintu News – CryptoQuant CEO Ki Young Ju, who previously dismissed concerns about a downturn, has now issued a warning that Bitcoin’s upward cycle may be over.

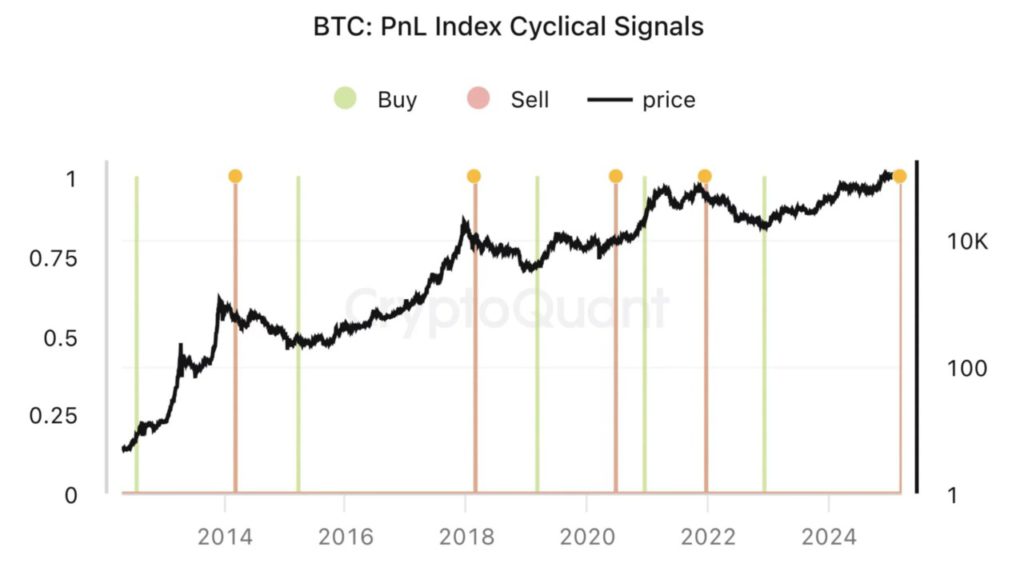

Recent analysis indicates a significant change in the Bitcoin (BTC) market cycle, with several key metrics suggesting a bearish or sideways trend for the next six to twelve months. This represents a drastic change in outlook from previous optimism.

Ki Young Ju Analysis

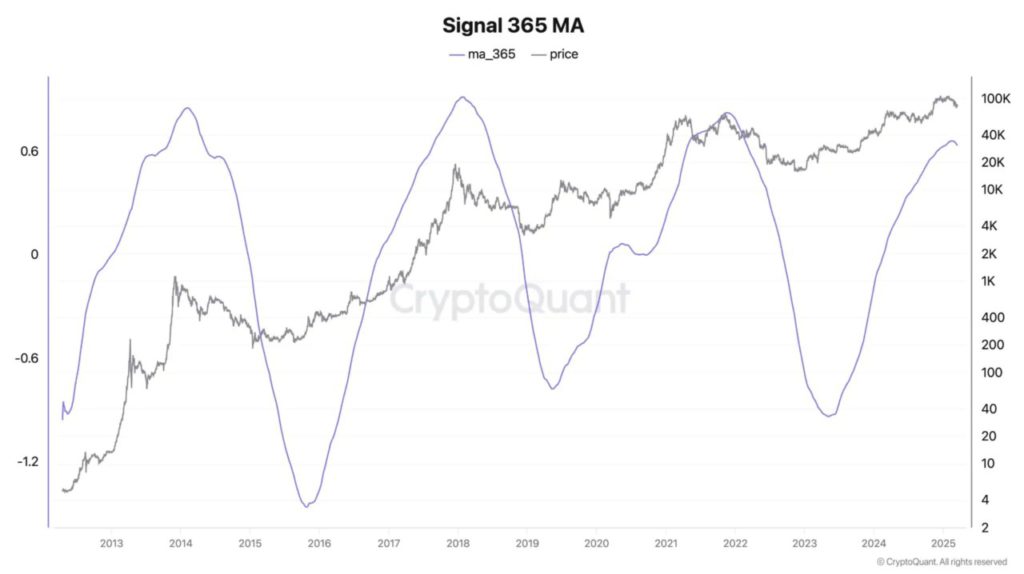

Ki Young Ju uses Principal Component Analysis (PCA) on indicators such as Market Value to Realized Value (MVRV), Spent Output Profit Ratio (SOPR), and Net Unrealized Profit/Loss (NUPL) using a 365-day moving average to identify trend reversals.

The results show that incoming liquidity flows are weakening, while newly emerged whales are starting to sell their holdings at lower prices. This signals that there could be a long period without significant price increases.

Also Read: Bitcoin Miner Sales Still High, On-Chain Data Reveals Bearish Trend (3/19/25)

Key Warning Signs

One of the key warning signs revealed by Ju is the decline in new liquidity, which is a key driver of price stability and growth. Additionally, demand from institutions seems to be waning, as evidenced by Exchange Traded Fund (ETF) inflows remaining negative for three consecutive weeks.

These sustained outflow events are often taken as an indication of decreased buying pressure, which raises doubts about Bitcoin’s (BTC) ability to return to bullish momentum in the near future.

Is there still hope?

Although the current bearish signals are quite strong, historical trends suggest that Bitcoin (BTC) may be on the verge of another major rally. An analysis of Bitcoin (BTC) price movements since 2015 shows a seasonal growth pattern, with the biggest gains occurring between April and October.

If this trend continues, Bitcoin (BTC) may stabilize in the coming months before resuming its upward trajectory. Some projections even suggest that Bitcoin (BTC) could surpass its previous record highs by mid-2025.

Conclusion

Although short-term uncertainty still exists, long-term indicators may point to significant upside potential for this flagship cryptocurrency. Therefore, it remains to be seen whether Ju’s prediction will be proven or Bitcoin (BTC) could re-trigger another bull run.

Also Read: Ethereum (ETH) has the potential to surge sharply, analysts reveal similarities with 2020 trends

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin’s bull cycle is over, warns CryptoQuant CEO as liquidity dries up. Accessed on March 20, 2025

- Featured Image: Katana Inu