Ethereum Hits $2,000 Today (March 20, 2025) – Is a Massive Breakout on the Horizon?

Jakarta, Pintu News – Ahead of the announcement of the interest rate cut decision by the Federal Reserve in less than 12 hours, the crypto market is experiencing a recovery. Bitcoin is now above $86,000, while Ethereum is slowly approaching the $2,000 level.

Although most market participants expect the Fed to maintain current rates, the increased anticipation has fueled the short-term recovery.

Will this recovery be strong enough to push Ethereum through the $2,100 level with a breakout? Then, how will ETH price move today?

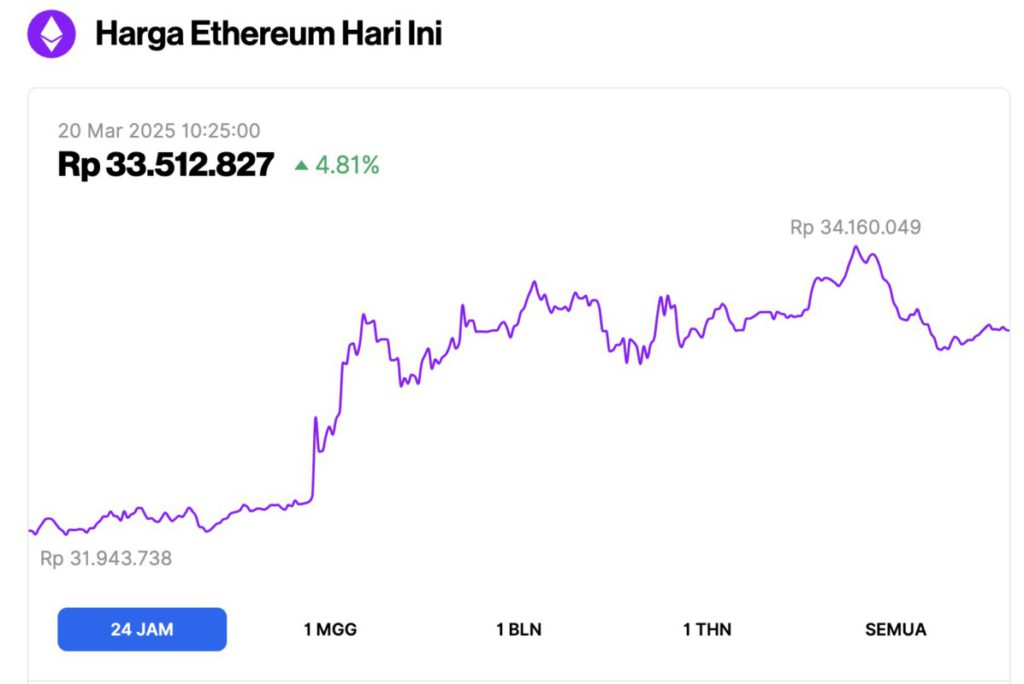

Ethereum Price Up 4.81% in 24 Hours

As of March 20, 2025, Ethereum (ETH) is trading at approximately $2,028 (IDR 33,512,827), marking a 4.81% increase in the past 24 hours. During this period, ETH hit a low of IDR 31,943,738 and peaked at IDR 34,160,049, showing strong momentum in the market.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $244.69 billion, with daily trading volume rising 83% to $19.21 billion within the last 24 hours.

Read also: Bitcoin Price Crawls Up to $86,000 Today (3/20/25): Analysts Highlight BTC’s Bullish Indicators!

Ethereum Price Getting Ready for a Breakout and Rally?

In the 4-hour price chart (3/19/25), Ethereum’s price trend shows a breakout from the short-term resistance line, indicating a possible end to the lower-high pattern formed earlier.

Moreover, the current breakout rally is targeting a breakout within the price range. Ethereum has been moving in a consolidation range between $1,850 to $1,950.

Currently, Ethereum’s price recovery has formed three consecutive bullish candles , which increases the chances of a breakout rally.

With the bullish sentiment continuing to improve, the MACD line and signal line started approaching positive territory. Moreover, the re-emergence of the bullish histogram strengthens the momentum, which triggers a buy signal for Ethereum.

Justin Sun Stakes $100 Million ETH Amid Short-Term Recovery

Amidst the short-term price recovery, one of the crypto industry’s major figures showed high confidence in Ethereum.

According to data from Arkham Intelligence, Justin Sun, founder of the Tron ecosystem, has staked $100 million in Ethereum.

Read also: Justin Sun Announces TRX Integration to Solana Blockchain – What’s the Impact for Investors?

This move aims to generate $3 million ETH per year in returns.

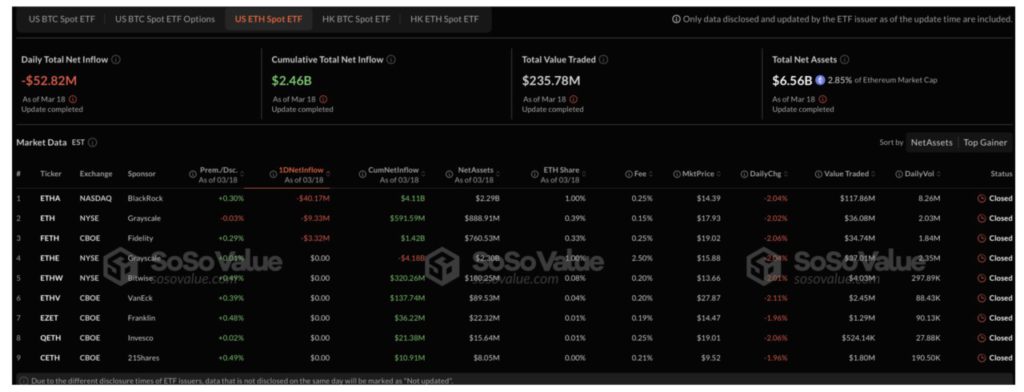

Ethereum ETF experiences outflows for the 10th consecutive day

Despite a short-term recovery and support from industry figures, fund flows into the Ethereum ETF have continued to decline. On March 18, 2025, Ethereum ETF recorded outflows of $52.82 million, marking the 10th consecutive day with outflows.

Of these, BlackRock recorded the largest outflow of $40.17 million, followed by Grayscale with $9.33 million, and Fidelity with $3.32 million.

Meanwhile, six other Ethereum ETFs recorded net-zero flow. Total trading volume on March 18 reached $235.78 million, with total net assets under management of $6.56 billion.

Ethereum Price Target

Based on price movement analysis reported by The Crypto Basic (19/3), Ethereum’s breakout amid rising expectations of interest rate cuts by the Fed could potentially trigger another rally.

Ethereum price is expected to retest resistance at $2,076, then head towards the 200 EMA at $2,260.

However, on the other hand, there is a possibility that prices will retest the broken resistance trend line, with potential test points around $1,900.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto Basic. Ethereum Eyes $2,100: Can FOMC News Spark a Bullish Rally? Accessed on March 20, 2025