Bitcoin “whales” are back in action, is this the trigger for the end of March 2025 BTC price hike?

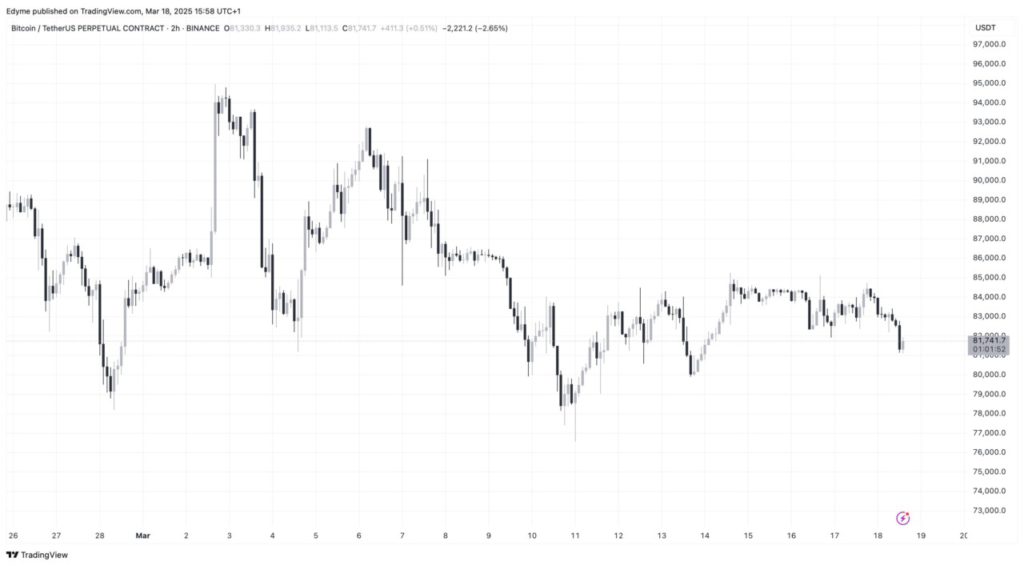

Jakarta, Pintu News – Bitcoin remains below the psychological level of $90,000, with the current price standing at $82,346. This represents a decline of 24.3% from the record high above $109,000 recorded in January.

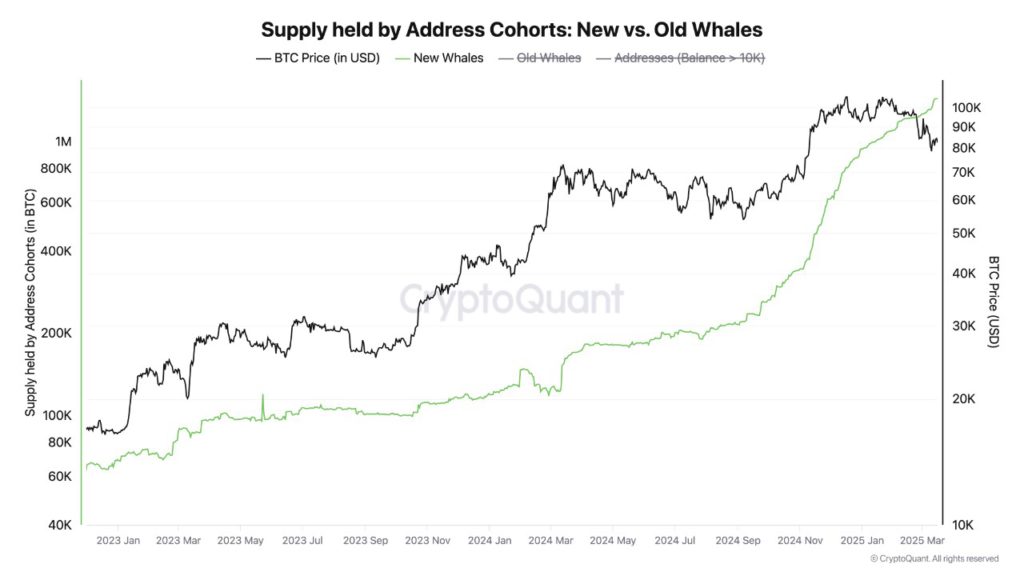

Although the current price trend suggests a decline, the latest on-chain data shows that newly wealthy investors, or “new whales,” have begun aggressively accumulating Bitcoin (BTC). This could have a significant impact on the future direction of the market.

Stacking by New Whale

Analysis from Onchained shows that this unprecedented accumulation trend signals strong confidence in Bitcoin’s (BTC) long-term prospects. The rapid expansion of new whale holdings suggests that institutional investors or high-net-worth individuals are increasing their exposure to Bitcoin (BTC).

The data further reveals that most of these newly acquired holdings are held for short periods (less than six months). This reinforces the idea that investors see value in current price levels and are willing to retain holdings despite market fluctuations.

Also Read: CryptoQuant CEO Ki Young Ju’s Warning Against Crypto Market End of March 2025

Potential Price Support

If this accumulation trend continues, it could serve as a strong support mechanism for the Bitcoin (BTC) price in the coming months. Onchained also speculates that Bitcoin (BTC) could revisit its record high and potentially surpass it, mentioning a possible price target of $150,000 or even $160,000.

While accumulation by whales indicates strong long-term conviction, another analyst from CryptoQuant, BilalHuseynov, has pointed out potential concerns about Bitcoin’s (BTC) demand momentum.

Concerns about Demand Momentum

BilalHuseynov’s analysis shows that Bitcoin (BTC) experienced peaks in demand in March and December 2024, marking the first time two peaks in demand have occurred in close proximity. However, after the March peak, there was a significant drop in demand.

BilalHuseynov compared the current trend to previous market cycles, specifically the 2017-2018 period, when peaks in momentum were followed by price fluctuations and a gradual decline in demand.

Although factors such as market size, trading volume, and liquidity have changed significantly since then, current trends suggest that demand for Bitcoin (BTC) may be weakening, which could affect price movements in the short term.

Conclusion

With Bitcoin (BTC) whales back in action and indications of significant accumulation, the market may witness a change in dynamics in the near future. However, it is important to consider external factors and demand trends when assessing the potential future price movement of Bitcoin (BTC).

Also Read: When will Chainlink (LINK) reach $24? Check out the prediction! Here’s LINK’s Technical Analysis!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Whales Are Back, Could This Be the Catalyst for the Next Rally. Accessed on March 20, 2025

- Featured Image: Generated by AI