Solana (SOL)’s Performance Weakens Amid TVL Decline and Big Investor Caution

Jakarta, Pintu News – Over the past seven days, Solana has experienced significant price pressure, struggling to stay above the $130 level. In the past 30 days, the value of SOL has corrected by nearly 36%, reflecting broader weakness in the cryptocurrency market.

This decline was influenced by two main factors, namely the reduction of Total Value Locked (TVL) in the Solana ecosystem and the activity of large investors or whales showing mixed signals. As SOL moves within a narrow price range, investors continue to monitor support and resistance levels to determine the next direction of movement.

Solana’s TVL drop below IDR146.8 Trillion

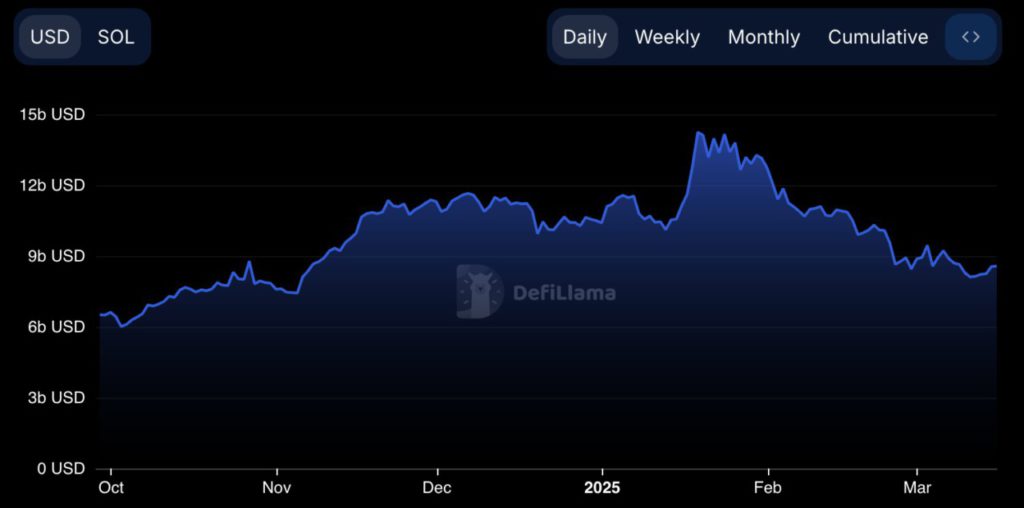

The TVL in the Solana ecosystem currently stands at $8.57 billion, still below the $10 billion mark since February 23rd. This figure reflects the low capital flow into the Solana ecosystem, indicating a more cautious attitude from investors as well as DeFi platforms operating on the network.

Despite the decline in TVL, Solana remains one of the key blockchains in the decentralized finance ecosystem. However, staying below the $10 billion mark signals market uncertainty and reduced investor interest in locking up their funds in Solana-based platforms.

TVL is an important indicator that reflects the amount of capital locked up in various DeFi protocols on a blockchain, including lending services, staking, and liquidity pools. The higher the TVL, the stronger the user participation, liquidity, and developer confidence in the network. On January 18, Solana’s TVL peaked at $14.24 billion (approx. IDR 231.1 trillion), but has since been on a steady decline, reflecting a more cautious market attitude.

However, there are signs of stabilization and a slight recovery, with Solana’s TVL rising from a low of $8.11 billion on March 10 to the current figure, indicating a potential change in market sentiment.

Also Read: CryptoQuant CEO Ki Young Ju’s Warning Against Crypto Market End of March 2025

Big Investors Start Accumulating SOL

The number of whales or large investors who own at least 10,000 SOLs is currently recorded at 5,031, a slight increase from 5,008 two days earlier. However, this figure is still lower than the latest high of 5,053 on March 3.

These fluctuations in whale numbers indicate that the market is still in a transitional phase, where large holders are reassessing their position in the Solana ecosystem.

The number of whales is an important indicator as these large holders have the potential to influence market movements with their buying and selling activities. If the number of whales increases, this could be a signal of increased confidence from large investors, potentially driving price stability or even an upward trend.

Currently, the increase in the number of whales to 5,031 could be interpreted as the first sign of major investors’ renewed interest in SOL. However, as the number is still below the previous peak, it suggests that some large investors are still cautious, which could limit the upside potential of SOL prices in the short term.

Potential SOL Drop to IDR1.82 Million

Currently, the price of Solana is moving within the range of support at $120.76 (approximately Rp1.97 million) and resistance at $131 (approximately Rp2.13 million). With the market trend still showing bearish tendencies, there is a risk that SOL could test the $120.76 support level again.

If this level is unable to hold, SOL prices could potentially drop further to the next support level of $112, which would indicate a deeper correction within the current bearish pressure.

On the other hand, if SOL manages to gain positive momentum, the price could break the resistance at $131. If this level is successfully broken, the upside potential towards $152.9 (approx. IDR2.49 million) is open, with a chance to go higher to $179.85 (approx. IDR2.93 million) if the bullish sentiment gets stronger.

The price consolidation between the levels of $120.76 and $131 will be the deciding factor whether SOL will continue its downward trend or start forming a more sustainable upward trend.

Conclusion

Currently, Solana is facing challenges in terms of declining TVL and fluctuating whale activity. Although there are indications of stabilization, there are still many factors that need to be considered before SOL can experience a bullish trend again. With market conditions tending to be cautious, investors need to monitor key support and resistance levels to anticipate further price movements.

Also Read: When will Chainlink (LINK) reach $24? Check out the prediction! Here’s LINK’s Technical Analysis!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Solana Slips Amid Declining TVL and Cautious Whale Activity. Accessed March 20, 2025.

- Featured Image: Euronews