Stablecoin Transfer Volume Reached 2 Times that of Visa: Stablecoins’ Dominance in the Crypto Ecosystem

Jakarta, Pintu News – The rapid growth of stablecoins in the crypto ecosystem marks a significant shift in the use of digital assets for global transactions. According to a recent report from Dune Analytics, the annual transfer volume of stablecoins has reached the fantastic figure of 35 trillion US dollars, surpassing twice the annual volume of global payments company Visa.

This development highlights the potential of stablecoins in redefining international payment systems through cryptocurrency technology.

The Dominance of Stablecoins in the Crypto Ecosystem

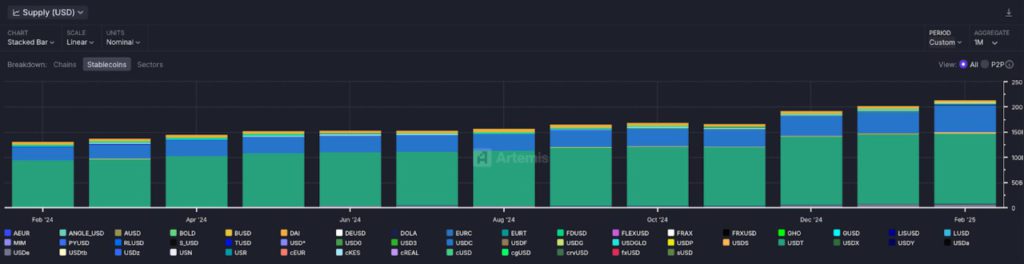

The total global supply of stablecoins was recorded at US$214 billion as of the end of last month. This significant increase was driven by the growing demand for stable and rapidly fungible digital assets. Unlike other highly volatile cryptocurrencies, stablecoins are pegged to fiat currencies, such as the US dollar, making them more attractive instruments for everyday transactions.

Tether and USD Coin remain the two dominant stablecoins in the market. USDT’s market capitalization grew to USD 146 billion (US$2,379.8 trillion), mostly used in peer-to-peer (P2P) remittances. Meanwhile, USDC saw a doubling to US$56 billion, thanks to regulatory support from MiCa in the European Union and DIFC in Dubai, as well as strategic partnerships with companies such as MoneyGram and Stripe.

Also Read: Bitcoin (BTC) Hasn’t Responded to Wall Street’s Demands, BlackRock Executive Warns

New Players and Increased Activity

Ethena Labs’ USDe is now the third-largest stablecoin with a market capitalization of $6.2 billion, a significant increase from the previous year. This surge reflects the growing market demand for alternative stablecoins, especially those integrated with the DeFi (Decentralized Finance) ecosystem. These developments are driving more investors and users to utilize stablecoins in various decentralized finance services.

The number of active addresses using stablecoins also saw a surge of 53%, reaching a total of 30 million users. This growth demonstrates the widespread adoption of stablecoins across a wide range of audiences, including individuals, institutions and businesses looking for fast and cost-effective cross-border transaction solutions. Increased accessibility through crypto platforms has also strengthened stablecoins’ position on the global digital finance map.

Infrastructure and Distribution Transaction Volume

According to Dune, stablecoin liquidity is mostly on centralized exchanges. However, the largest transfer volumes come from activity on decentralized exchanges (DEXs), lending protocols and yield farms. This reflects the important role stablecoins play in supporting a range of DeFi activities, from token trading to liquidity provision and funding.

Ethereum remains the leading network for stablecoins, with a market share of 55%. However, blockchains such as Solana and Base recorded high transfer volumes thanks to the growth of meme coins and activity in the DeFi sector. This shows that the stablecoin ecosystem is increasingly diversified, with various networks contributing to each other to support the scalability and efficiency of digital transactions.

Global Stablecoin Potential and Benefits

The use of stablecoins is considered to bring tangible benefits over traditional financial instruments, especially in terms of cost efficiency and speed of cross-border transfers. The Head of Product of the Base network stated that stablecoins provide a clear solution to the bottlenecks in the global financial system. While conventional banking faces time and cost constraints in sending funds internationally, stablecoins offer a fast, secure, and affordable alternative.

As more countries and institutions open up to cryptocurrency regulation, the future of stablecoins looks promising. Their use is not just limited to crypto activities, but also extends to traditional finance, e-commerce payments, and cross-border remittances. This combination makes stablecoins the bridge between the old world of finance and the new era of digital finance.

Conclusion

Visa’s doubling of stablecoin transfer volumes is strong evidence that cryptocurrencies, particularly stablecoins, are playing an increasingly important role in the global financial ecosystem. With growing adoption, strategic collaboration, and blockchain technology support, stablecoins have great potential to accelerate the transformation of payment and financial systems globally.

Also Read: This is Arhur Hayes’ BTC Price Prediction Based on April 2025 Fed Rate!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cryptopolitan. Stablecoin transfer volume is now twice that of Visa. Accessed March 21, 2025.

- Featured Image: PYMNTS