Bitcoin Hits $86,900 Again Today (March 25)— Is This the Calm Before a Major Bull Run?

Jakarta, Pintu News – According to Coingape, Bitcoin showed strength over the weekend after experiencing a 5.93% gain. This small increase was in line with the positive outlook of the US stock market and increased global liquidity, which encouraged investors’ risk-taking behavior.

With the Z score on the global liquidity index giving a buy signal, Bitcoin price has the potential to experience rapid growth in the near future.

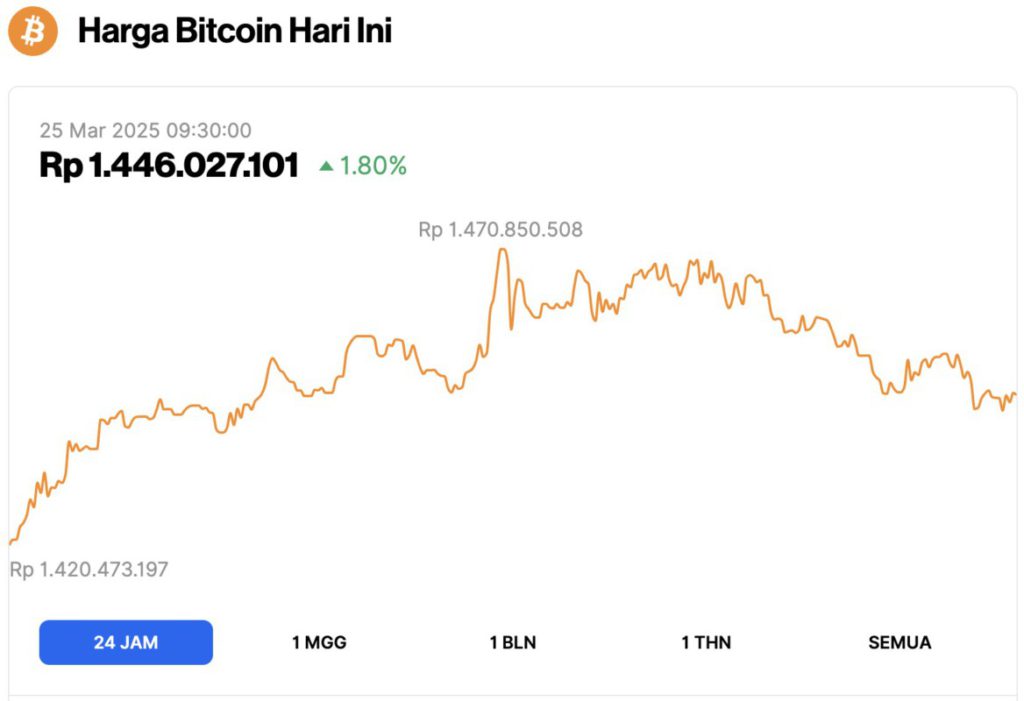

Bitcoin price rises 1.80% in 24 hours

As of March 25, 2025, Bitcoin (BTC) was trading at $86,932, or approximately IDR 1,446,027,101, marking a 1.80% increase over the past 24 hours. During this time, BTC hit a low of IDR 1,420,473,197 and reached a peak of IDR 1,470,850,508, reflecting notable intraday volatility.

According to CoinMarketCap, Bitcoin’s market capitalization has now risen to $1.72 trillion, with trading volume in the last 24 hours also jumping 128% to $34.04 billion.

Read also: Don’t Miss These 3 Hottest Crypto Airdrop to Watch Before March 2025 Ends!

BTC rally chances increase as global liquidity explodes

According to data provider Alpha Edge, the traditional Global Liquidity Index is actually not the most ideal tool to monitor.

However, the Z score of this index shows that whenever the value drops to -3, it becomes a strong signal to buy.

Conversely, if the Z score reaches +3, it becomes a signal to sell. After the market crash in early March, the global liquidity index gave a buy signal, which signaled that a sharp upward trend in BTC prices may be imminent.

“The divergence metric between Global Liquidity and Bitcoin shows a rare green buy signal. Historically, any green buy or red sell signal provides a good opportunity to buy or sell.”

With an abundance of liquidity, risk-on behavior becomes a necessity-as seen in late 2021 and 2023-which is then followed by a rapid BTC price rally.

Decreasing Selling Pressure Indicates a Bullish Outlook for Bitcoin

Adding credence to this outlook is the Net Taker Volume indicator, which has been steadily declining since late February 2025. The decline in this metric indicates that selling pressure is starting to ease, which is an additional signal of a potential bullish reversal in Bitcoin’s price trend.

Read also: Michael Saylor All-In! Raises a Fantastic $722 Million to Buy Bitcoin

Analyst Axel Adler Jr, who highlighted this view, stated:

“As long as there are no negative macroeconomic or market catalysts, this week could potentially bring moderate growth.”

To conclude, two positive weekly closes, coupled with increasing global liquidity and decreasing volume takers, signal that Bitcoin’s price outlook is bullish.

BTC Price Levels to Watch

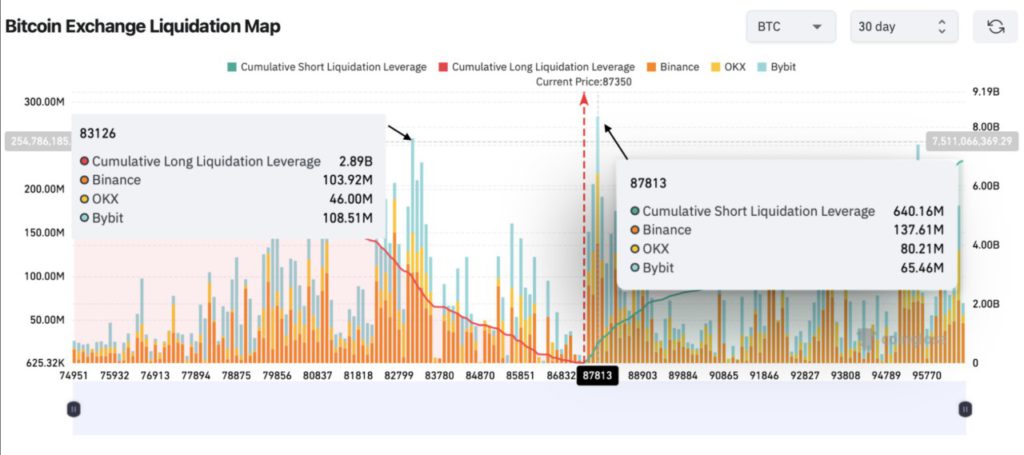

Liquidation map data from CoinGlass shows that the $87,813 level is a crucial point-if BTC prices break above this level, then $640 million worth of short positions could potentially be liquidated. Conversely, if BTC drops below $85,633, then $942 million worth of long positions will be liquidated.

All in all, Bitcoin’s price surge that briefly dipped below $85,633 and then resumed its uptrend towards $90,000 could trigger a wave of liquidation worth more than $1.5 billion.

The combination of buy signals indicated by the Global Liquidity Index‘s Z score, declining Net Taker Volume, and a positive weekly close indicates that Bitcoin price is poised for explosive growth in the near future.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price Set To Explode as Global Liquidity Z Score Flashes Buy Signal. Accessed on March 25, 2025