4 Strong Signals Ripple (XRP) Has Reached Its Low Point, Ready for a Sharp Jump?

Jakarta, Pintu News – Ripple has recently shown a significant recovery after plummeting to a 15-month low of $1.12 on February 6. The price of Ripple (XRP) even shot up by 50% to a peak of $1.67, although it is still more than 60% behind its record high of $3.66.

A number of on-chain indicators and market data now suggest that the $1.12 level could be a new low, opening the door for a stronger uptrend. Here is a summary of four key data points that reinforce the potential for a Ripple (XRP) price revival in the near future.

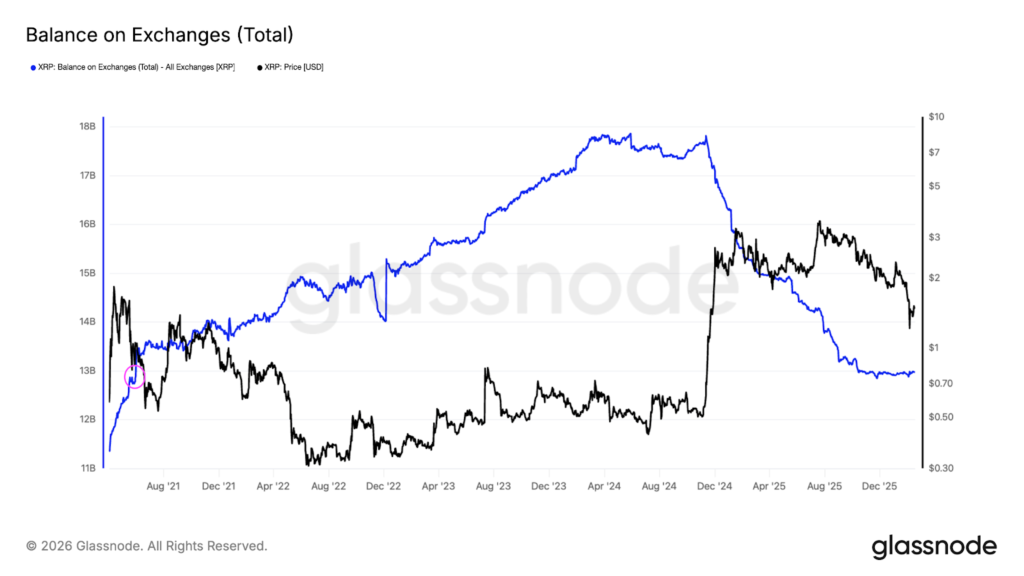

Ripple (XRP) Supply Decline on Exchanges: An Increasingly Strong Bullish Signal

The drastic drop in the supply of Ripple (XRP) on crypto exchanges is one of the main indicators in favor of a potential price increase. Data from Glassnode shows that Ripple (XRP) balances on exchanges fell to 12.9 billion XRP, the lowest level in the last five years and equivalent to the position in May 2021. This phenomenon indicates that more and more Ripple (XRP) holders are choosing to keep their assets in private wallets, which reduces selling pressure in the market.

This is usually a positive sign for future price movements. In addition, data from CryptoQuant revealed that Ripple (XRP) reserves on Binance also fell sharply to around 2.57 billion XRP, with the 50-day (SMA 50) and 100-day (SMA 100) moving average trends continuing to decline. The decline in reserves on exchanges, while prices are still in the low area, increases the chances of a short squeeze.

Short squeezes themselves often trigger sudden price spikes as traders who borrowed Ripple (XRP) to sell are forced to close their positions. Thus, the current market structure further strengthens the potential for a reversal in the price direction of Ripple (XRP).

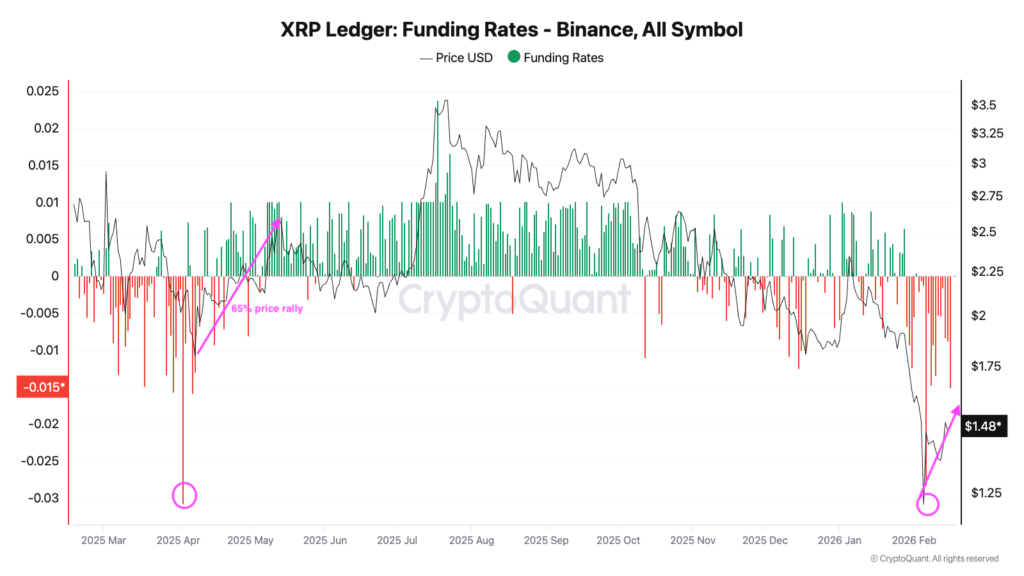

Ripple (XRP) Funding Rate is Extreme Negative: A Sign of Market Over-sold

One other important signal came from Ripple’s (XRP) funding rate on Binance which briefly dropped to -0.028% when the price touched $1.12 on February 6, the lowest level since April 2025. Extreme negative funding rates usually signal the dominance of short positions and the capitulation of leveraged traders who go long.

In the history of the Ripple (XRP) movement, similar conditions in April 2025 triggered a price rally of up to 65% to $2.65 from $1.60 due to a massive short squeeze. A similar situation also occurred in late 2024, which was followed by a sharp price surge. In addition, the open interest (OI) of Ripple (XRP) futures also fell dramatically to around $2.53 billion, a 55% drop from its peak of $4.55 billion in early January, according to CoinGlass data.

Read also: 5 Gold Jewelry Price Predictions Ahead of Eid

This decrease in open interest indicates that leveraged traders are starting to reduce exposure and are no longer opening new positions. This signals a weakening of bearish conviction in the market, leaving the door open for a price reversal if buying pressure picks up again. The combination of a negative funding rate and declining open interest is a strong signal that the Ripple (XRP) market is heavily oversold.

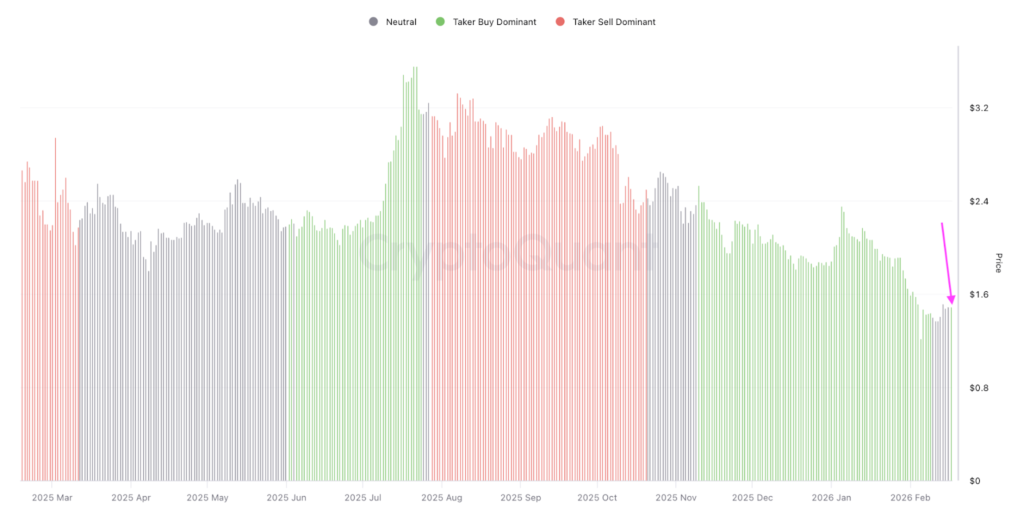

Buy Volume Dominance

Analysis of the cumulative volume delta (CVD) of spot Ripple (XRP) over the past 90 days shows that taker buy volume is again dominating the market. The initially neutral CVD has now turned positive, signaling that buying demand has started to strengthen and buyers are back in control. If the CVD trend remains positive, then buying at low prices has the potential to push Ripple (XRP) to higher levels, as has happened in previous recovery phases.

This data reinforces the belief that buying interest in Ripple (XRP) is recovering significantly. On the other hand, inflows into the spot Ripple (XRP) exchange-traded fund (ETF) product in the United States remained steady despite the price drop. Since its launch in November 2025, the spot Ripple (XRP) ETF has recorded inflows for 53 out of 59 trading days, with $4.5 million added last Friday.

Consistent Ripple (XRP) ETF Inflows

Cumulative inflows totaled $1.23 billion, while net assets under management surpassed $1.01 billion. Even as global crypto investment products recorded outflows of up to $173 million for the week, the Ripple (XRP) ETF was the top performer with inflows of $33.4 million, signaling that institutional demand remains solid.

Based on a combination of on-chain data, trader behavior, and institutional inflows, Ripple (XRP) is showing strong signs of having bottomed at $1.12. Declining supply on exchanges, extreme negative funding rates, dominance of buying volume, as well as consistent ETF inflows are the key foundations for a potential price reversal.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. 4 data points suggest XRP price bottomed at $1.12 – Are bulls ready to take over?. Accessed on February 21, 2026

- Featured Image: Generated by Ai