Bitcoin (BTC) Starting to Rise? Crypto Analyst Predicts Price Could Rise to $90,000!

Jakarta, Pintu News – After experiencing pressure in recent weeks, the price of Bitcoin is now showing signs of forming a bottom.

According to a recent report from crypto analyst Markus Thielen of 10x Research, BTC has the potential to rebound and target a price of $90,000 or about 1.47 billion IDR, driven by favourable macroeconomic and policy factors.

US President Donald Trump’s more flexible stance on new tariffs and the Federal Reserve’s dovish tone were the initial catalysts for this bullish move. Does this signal the beginning of the return of the bull market season?

Fed withholds pressure, crypto market gets a breath of fresh air

In the Federal Open Market Committee (FOMC) meeting on March 18-19, 2025, the Federal Reserve signaled that it will ignore short-term inflationary pressures and open up opportunities for future policy easing.

Fed Chairman Jerome Powell made a light-hearted statement that sparked optimism among investors in risky assets, including cryptocurrencies. According to Thielen, this reinforced the belief that the “Fed put”—the policy of not letting markets fall too deeply—is still in place. The impact was felt directly on the stock and crypto markets, which experienced modest gains.

The Fed’s calm and unhurried response to inflation has breathed fresh air for investors. With interest rates expected to remain flat or even fall in the future, liquidity in the market could increase. This usually positively impacts assets like Bitcoin (BTC), Ethereum , and other altcoins. It’s no wonder that many analysts see this moment as the first phase of an overall crypto market recovery.

Also read: 5 Airdrops to Hunt for in April 2025

Trump Softens Tariffs, Bitcoin Has a Chance to Rise

In addition to monetary policy factors, US President Donald Trump’s change in stance regarding the “reciprocal” tariffs planned to be imposed on April 2, 2025, also positively affected market sentiment.

Trump stated that he is now more open to flexibility in trade policy, which differs from his previous harsh rhetoric. Global markets immediately responded positively to this statement, including crypto investors who were previously worried that protectionist policies would trigger economic uncertainty.

According to Thielen, Trump’s statement signals that the pressure on the market could ease soon. When uncertainty is reduced, investors tend to return to riskier assets, and Bitcoin is one of the most targeted.

The combination of fiscal and monetary easing is a strong reason why BTC has room to move upwards, even breaking the psychological level of $90,000 (1.47 billion IDR).

Read also: Merlin Chain and Hemi Network Collaborate, Opening New Opportunities in the Bitcoin Ecosystem!

Bullish Signals Emerge, BTC on the Verge of a Rebound

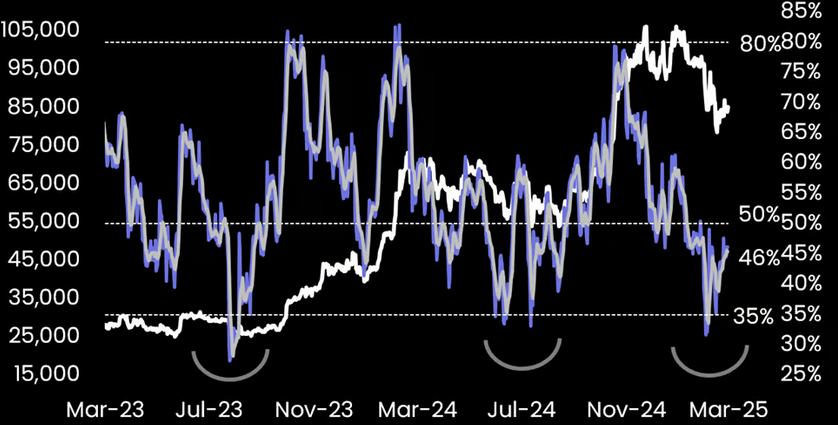

Currently, Bitcoin’s price is listed at around $85,720 or 1.4 billion IDR, up 2.1% in the last 24 hours based on CoinGecko data. Thielen highlighted that weekly technical indicators show a reversal pattern similar to the start of previous bull runs.

One of the main indicators, the 21-day moving average, is now at $85,200, which means that BTC has broken the important average level. This strengthens the signal that a bullish trend could be re-established.

Furthermore, Thielen explained that the current situation is similar to the market conditions in September 2023 and August 2024, when the previous bull market started.

In addition, some altcoins such as Ethereum (ETH), Tron , and Avalanche are also starting to show breakouts from their downward trends. This means that it’s not just BTC that has the potential to rise, but the entire cryptocurrency market could experience a revival if these conditions persist.

Read also: Anatoly Yakovenko Criticizes Layer-2 Solution, What Does He Say?

ETFs and Big Wallets are a Price Buffer

According to Thielen, BTC has not fallen below $73,000 (1.19 billion IDR) because most Bitcoin owners in the 100-1,000 BTC range are family offices and long-term wealth managers.

They are not tempted to sell at low prices, creating a strong foundation in the market. In addition, fund flows into spot-based Bitcoin ETFs in the US showed a positive trend for the first time since January.

According to Thielen’s report, the sell-off by ETF arbitrage investors has started to slow down as their profit opportunities have been covered. As such, selling pressure from the institutional side has decreased. This opens up more opportunities for a steady and organic price rise, rather than just a momentary spike.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin bottom forming as Fed eases, Trump softens on tariffs: Analyst. Accessed March 25, 2025

- Featured Image: Generated by AI