Will stablecoins trigger the next global financial crisis? This is what analysts say!

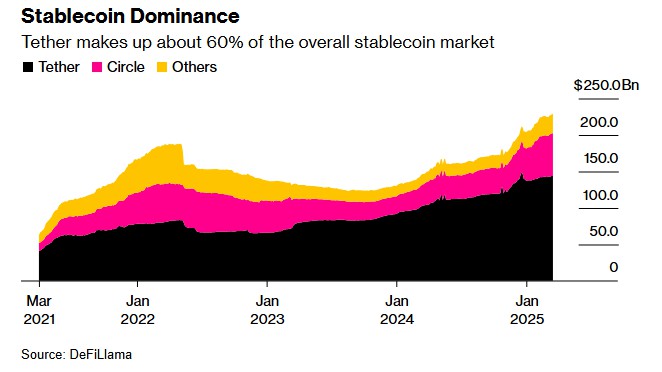

Jakarta, Pintu News – The stablecoin market has seen significant growth, with market capitalization increasing 90% since the end of 2023, reaching more than $230 billion. Stablecoins, whose exchange rates are designed to be stable because they are backed by a reserve of assets, now face the risk that they could trigger a financial crisis similar to the one that occurred in 2008. This concern is not unwarranted, given their potential impact on the stability of the global financial system.

Stablecoins and the Potential for a New Financial Crisis

In times of market turmoil, stablecoin holders may flock to exchange their tokens for cash. This forces issuers to sell their reserve assets quickly, which can create instability in financial markets. A similar phenomenon occurred in 2008 when the Reserve Primary Fund lost its peg to the dollar due to exposure to the failed Lehman Brothers debt.

This failure triggered widespread panic and a run on money market funds, which impacted the global financial system. According to Federal Reserve Governor Lisa D. Cook, similar risks could occur with stablecoins. This shows that while stablecoins offer stability of value, they also carry systemic risks that should not be ignored.

Also Read: Why is Bitcoin (BTC) Following the 2024 Summer Trend? Check out the Next Prediction!

Global Competition and US Dollar Dominance in Stablecoins

Stablecoins have played an important role in cementing the dominance of the US dollar, with significant global stablecoin transactions taking place in dollar-backed tokens such as Tether and USD Coin . This widespread adoption increases the dollar’s role in international trade, which in turn increases demand for US assets. However, it also raises concerns in some countries.

China has expressed concerns that growing US influence in digital currencies could threaten its financial sovereignty. In response, Beijing has accelerated the development of the digital yuan, aiming to reduce reliance on dollar-based stablecoins in cross-border transactions. The European Union also shares the same sentiment, seeking ways to reduce the dollar’s dominance in their digital economy.

Implications for the Future of Global Finance

The exponential growth of stablecoins and the potential risks associated with them demand stricter attention and regulation from global financial authorities. Without adequate oversight, the world may face a panic-fueled financial crisis similar to the one in 2008.

Therefore, it is important for regulators to understand and address the risks posed by stablecoins before they become too integrated in the global financial system.

Conclusion

With their increasing market capitalization and influence in the global financial system, stablecoins offer many opportunities but also carry significant risks. The balance between financial innovation and economic stability will be key in managing the future of stablecoins. Effective oversight and regulation will be critical to prevent potential crises that could be triggered by these digital financial products.

Also Read: Lighter Tariff Hike Triggers Altcoin Surge: Solana, DOGE, and ADA Shine

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Stablecoins and the Bank Run Problem in Financial Crises. Accessed on March 26, 2025

- Featured Image: BFA Global