Bitcoin Holds Above $85K: Does this signal the end of the bull market in April 2025?

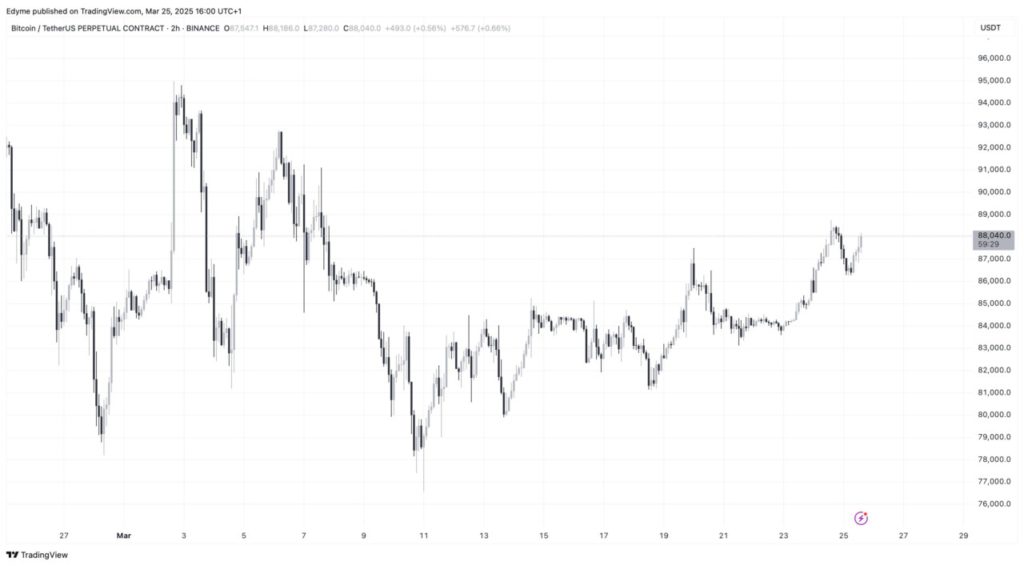

Jakarta, Pintu News – Amidst volatile market fluctuations, Bitcoin has managed to maintain its position above $85,000, with the current price hovering around $87,000. Despite a 0.4% drop in the past 24 hours, the cryptocurrency had previously risen to over $88,000. Market analysts are now turning their attention to several on-chain metrics to predict the next direction of Bitcoin (BTC).

Internal Funding Pressure Indicator

One of the metrics analyzed by Burak Kesmeci of CryptoQuant’s QuickTake platform is the Internal Funding Pressure (IFP) Indicator. Currently, the IFP stands at 696K, below the 90-day moving average (SMA90) of 794K. While historically, an increase above the SMA90 often signals bullish momentum, currently the indicator suggests that the forces for a reversal are not strong enough yet.

Also Read: Why is Bitcoin (BTC) Following the 2024 Summer Trend? Check out the Next Prediction!

Bull and Bear Market Cycle Indicators

Another indicator to consider is the Bull and Bear Market Cycle Indicator. Kesmeci notes that the current configuration resembles the mild bearish signals seen earlier in this cycle. The 30-day moving average (DMA30) stands at -0.16, while the 365-day moving average (DMA365) is 0.18. This indicator will trend bearish until the DMA30 can surpass the DMA365.

MVRV and NUPL scores

Kesmeci also evaluated the Market Value to Realized Value (MVRV) and Net Unrealized Profit/Loss (NUPL) scores. The MVRV is currently still below the SMA365, which historically often precedes increased selling pressure. Meanwhile, NUPL stands at 0.49, below the 365-day moving average (SMA365) of 0.53. While this doesn’t definitively end the bullish trend, the positioning of these metrics suggests that more strength is needed for Bitcoin (BTC) to return to a bullish stance.

Conclusion

Despite uncertainties in the short and medium term, the on-chain indicators analyzed by Kesmeci have not fully confirmed that the market has peaked. Taking into account external factors such as economic uncertainties and tariff-related tensions that have recently emerged, the stabilization of macroeconomic conditions could drive a Bitcoin (BTC) recovery like the one in 2024.

Also Read: Lighter Tariff Hike Triggers Altcoin Surge: Solana, DOGE, and ADA Shine

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Holds Above $85K, But These 4 Metrics May Decide What Happens Next. Accessed on March 27, 2025

- Featured Image: Generated by AI