Top 20 Crypto List for Mid 2025 According to Grayscale Research Report

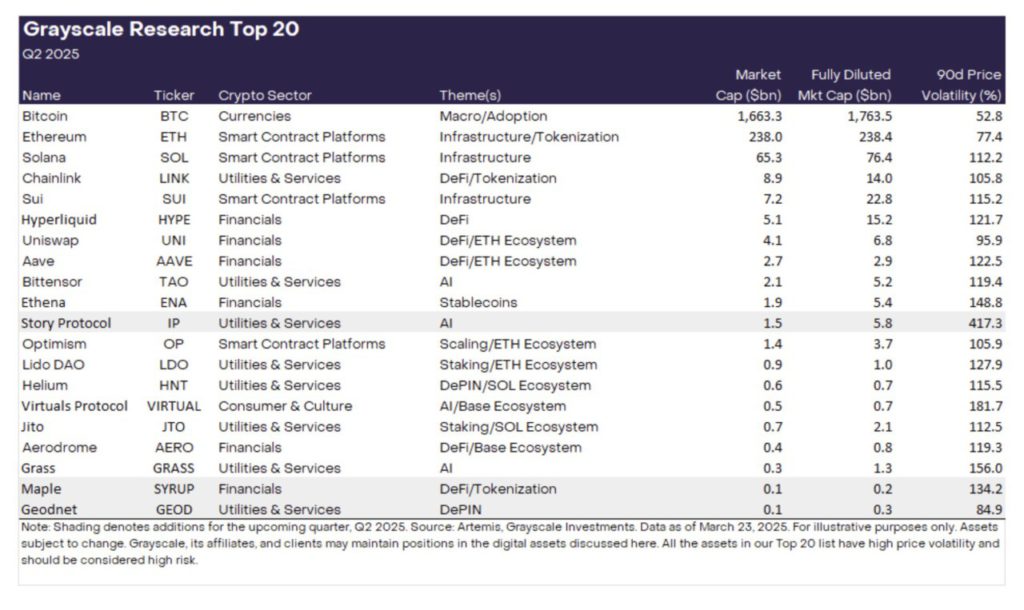

Jakarta, Pintu News – Recently, Grayscale Research has released their latest version of the top 20 digital assets list, which highlights the major cryptocurrencies with strong potential for the coming quarters.

The company updates this shortlist every quarter, based on an analysis of network adoption, market trends, and fundamental sustainability.

Grayscale Adds 3 Altcoins to Investment Consideration List

In its latest update, Grayscale added three new assets-Maple (SYRUP), Geodnet (GEOD), and Story Protocol (IP). The move shows interest in real-world applications in decentralized finance (DeFi), decentralized physical infrastructure networks (DePIN), and intellectual property (IP) tokenization.

Read also: World Liberty Financial Inc (WLFI) Officially Unveils USD1 Stablecoin, Backed by U.S. Treasuries!

Grayscale categorizes the digital asset market into five main crypto sectors: currencies, smart contract platforms, finance, consumer & culture, and utilities & services. This framework allows companies to monitor industry trends and evaluate high-growth opportunities in each category.

With the latest adjustments, these crypto sectors now include 227 different assets with a total market capitalization of $2.6 trillion, covering the majority of the global crypto market.

Maple Finance (SYRUP)

Maple Finance (SYRUP) is a leading DeFi protocol focused on institutional lending services. The project is run through two core platforms: Maple Institutional, which is aimed at accredited investors, and Syrup.fi, which caters to native DeFi users.

Over the past year, Maple Finance has shown significant growth, with Total Value Locked (TVL) reaching $600 million and annual network fee revenue of $20 million.

The project aims to increase Syrup.fi’s TVL to $2 billion by integrating the platform into other DeFi protocol ecosystems, such as Pendle .

Geodnet (GEOD)

Meanwhile, Geodnet (GEOD) has emerged as a leader in the DePIN (Decentralized Physical Infrastructure Networks) sector.

As the world’s largest provider of real-time kinematic positioning services, the network offers geospatial data with an accuracy level of up to one centimeter. These services are used in sectors such as agriculture, robotics, and autonomous vehicles.

Read also: 3 Altcoins that many are eyeing for the start of April 2025!

Geodnet’s network has grown to include over 14,000 active devices in 130 countries, with significant revenue growth. Annual network costs increased by 500% year-on-year (YoY) to reach $3 million.

Geodnet’s decentralized approach provides a more cost-effective alternative to centralized GPS solutions, making it a critical infrastructure provider in the blockchain ecosystem.

Story Protocol (IP)

Story Protocol (IP) comes as a solution to the growing challenges in the realm of intellectual property by bringing intellectual property (IP) rights into the blockchain.

Amidst the rising cases of copyright disputes due to AI-generated content, Story Protocol offers a way for companies and creators to monetize their IP. At the same time, it also opens up opportunities for investors to trade IP assets and earn royalties.

In addition, the project has signed up a number of well-known IP assets, including music rights from Justin Bieber, BTS, Maroon 5, and Katy Perry. Story Protocol is also launching its own dedicated blockchain for IP and tokens in February 2025.

Grayscale Removes 3 Altcoins from Investment Product List

In this latest update, Grayscale also removed three assets from the top 20 list, namely Akash Network (AKT), Arweave , and Jupiter (JUP).

“Grayscale Research still sees value in all three projects, and these assets remain an important part of the crypto ecosystem. However, we believe that this updated top 20 list offers more attractive risk-adjusted return potential for the coming quarters,” the firm explained.

Read also: BlackRock Launches Bitcoin (BTC) Product with Super Low Fees in Europe!

Beyond these additions and deletions, Grayscale also highlights key investment themes such as Ethereum scaling solutions, AI-based blockchain development, and innovations in the DeFi and staking sectors.

The sustainability of assets such as Optimism , Bittensor (TAO), and Lido DAO reflects the company’s focus on high-growth areas.

The Top 20 list update is also part of Grayscale’s broader expansion move in evaluating new digital assets. In January 2025, the company revealed that it was considering nearly 40 altcoins for potential investment.

Previously, in October, Grayscale also released a list of 35 assets that it may include in its investment products in the future.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Grayscale Adds 3 Altcoins to Its Top 20 Crypto Investment List for Q2 2025. Accessed on March 27, 2025