Whale Starts to Return: Will Big Activity Help Pepe Coin Recover from 60% Loss?

Jakarta, Pintu News – Pepe memecoin recorded a significant spike in whale activity throughout this week, signaling a potential change in direction in the price trend after experiencing a sharp decline since the beginning of the year. Despite losing more than 80% of its peak value last December, a 63% recovery in March sparked questions as to whether heavy interest from institutional investors could be the key to the token’s revival.

Spike in Whale Activity and its Impact on Prices

According to data from Spot On Chain, one new wallet was recorded withdrawing 500 billion PEPE worth about $4.3 million from Binance. In addition, an early investor who previously made a 110% profit from PEPE re-entered the market by withdrawing 506.2 billion tokens worth $4.4 million, making his total investment around 699.8 billion tokens or the equivalent of $5.11 million (Rp84.9 billion).

AMBCrypto notes that whale activity against PEPE surged by 170% this week, with over 14.5 trillion tokens purchased by large investors. This surge had a noticeable impact on the price of PEPE, which jumped 63% from its March low of $0.0000056. However, the token is still a long way off its high of $0.000028 (€0.465) reached last December.

Also Read: Will Bitcoin (BTC) Break $90,000? Check out the Analysis!

Market Signals Are Still Mixed

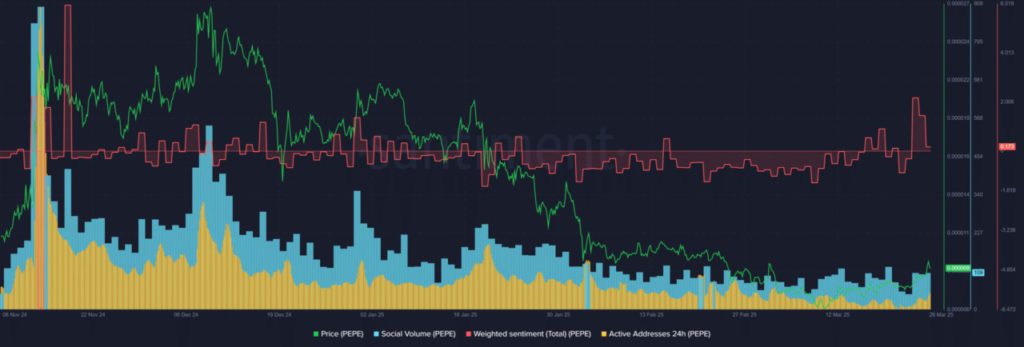

Although the increase in whale activity reflects short-term optimism, data from Santiment shows that key demand indicators such as social volume and wallet address activity are still low. Market sentiment also returned to the neutral zone after a brief uptick, signaling that the direction of price movement remains uncertain.

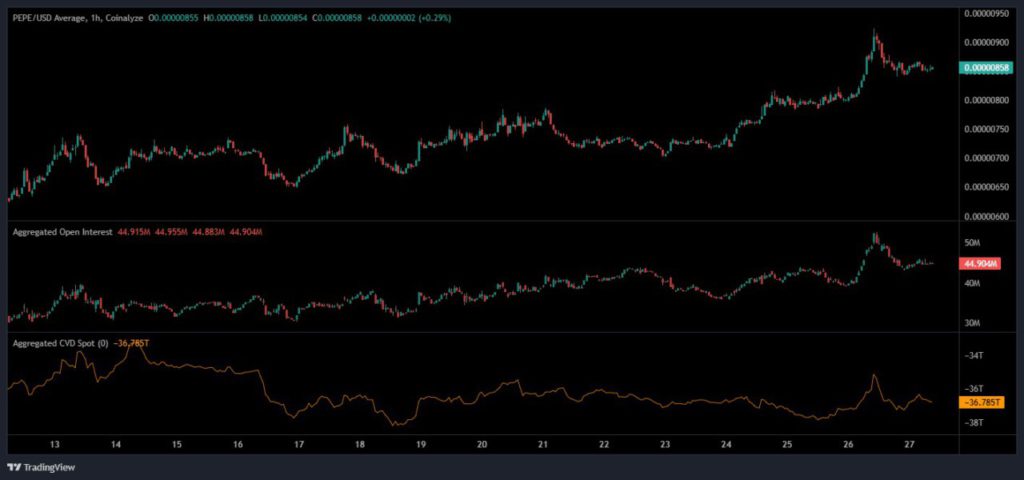

In the derivatives market, PEPE ‘s Open Interest (OI) rose from $26 million to $50 million before dropping slightly to below $45 million. However, the Cumulative Volume Delta (CVD) showed little movement, hinting that the price surge was largely driven by leverage rather than real demand in the spot market.

Technical Analysis: Not Out of Risk Zone Yet

On the three-day price chart (3D), the 63% gain in March managed to cover all of PEPE’s losses during the month. However, the price is still below the bull market trend line and the 200 daily moving average (200DMA). This suggests that although a recovery is in sight, the technical pressure has not yet been fully overcome.

In order to break out of the larger downtrend in the first quarter of 2025, the price of PEPE will need to break both major resistance levels. If it does, it’s likely that the token could regain the attention of investors who previously avoided high-risk assets like memecoins.

Cover

The return of interest from large investors in Pepe Coin provides an early signal of a potential price resurgence. However, various market indicators suggest that this recovery is still fragile and not yet supported by strong demand from the spot market. Investors should continue to monitor whale dynamics, market volumes, as well as important technical levels before deciding to dive deeper into this risky asset.

Also Read: Ethereum (ETH) Prepares for the Next Big Move, Will it Rise April 2025?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMBCrypto. PEPE: Will whale interest reverse the memecoin’s 60% loss?. Accessed March 28, 2025.

- Featured Image: Generated by AI