Pi Network Price is in Freefall, Will Pi Coin Hit a New Low?

Jakarta, Pintu News – Pi Network (PI) has experienced a significant price drop, with the token’s value now sitting below $0.70. This drop comes amid generally bearish crypto market sentiment, marking one of the worst phases for the digital currency.

In this article, we will delve deeper into the factors influencing the Pi Network’s price decline, as well as its future prospects.

Pi Network’s Drastic Decline

The Pi Network (PI) price recently fell below $0.70, approaching the all-time low of $0.6152 recorded in February 2025. This decline reflects a 77% drop from the all-time high price of $2.98, reached just a month earlier.

Read also: Binance Snubs Pi Network in Latest Listing Round — Here’s Why It Didn’t Make the Cut

Since then, Pi Network has lost more than $14 billion of its market value, dropping from nearly $20 billion to just $4.66 billion. According to Cointelegraph, this sustained decline was triggered by consistent supply pressure.

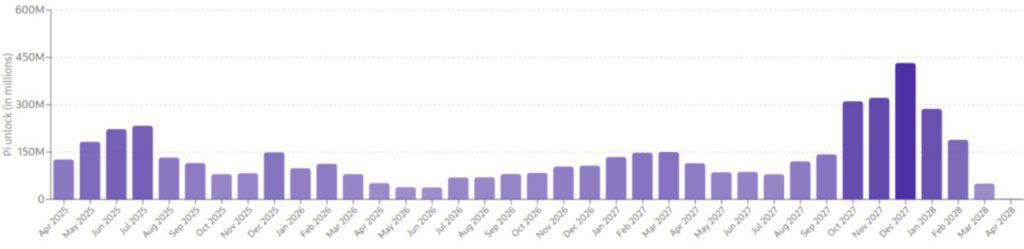

It is estimated that more than 1.5 billion tokens will enter into circulation within the next year, increasing the total supply to 8 billion tokens. With monthly openings peaking at 233 million in July, this pressure further exacerbates market conditions.

Lack of Support from Major Exchanges

Despite having significant community traction, Pi Network is still not listed on major exchanges such as Binance, Coinbase, Kraken, and Bybit. This absence from top listings continues to affect market sentiment, along with ongoing concerns regarding token utility and inflation.

This absence on major trading platforms makes Pi Network less liquid and difficult for large investors to access, potentially limiting further adoption. This lack of support also adds to the difficulty in building investor confidence, especially when the overall crypto market is under pressure.

Without a presence on major exchanges, Pi Network may continue to face challenges in increasing its value and stability.

Pi Network Price Outlook and Predictions

As of April 2, 2025, the price of Pi Coin was hovering around $0.6729, near the key support level of $0.65 on the 4-hour chart. If sellers manage to break below $0.65, the next key level will be $0.61.

Read also: Pi Network Price Plunges 15% Today (4/4/25): PiFest Announcement Fails to Boost Pi Coin Price!

This area is a critical psychological and structural support zone. If prices fall below this, the Pi Network may register a new unprecedented low.

The price recovery will face resistance around $0.70. Only a sustained close above $0.90 will confirm the trend reversal and validate the current bearish pattern.

However, with the MACD indicator remaining in negative territory and the RSI hovering near the oversold zone, the near-term outlook looks bleak.

Overall, with the challenges faced from both the supply side and exchange support, the future of Pi Network seems fraught with uncertainty. Investors and market watchers should pay close attention to this developing dynamic, as it could very well determine the long-term direction of Pi Network in the crypto market.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Markets: Pi Network Price Drops Below $0.70 as Bears Push Toward All-Time Low. Accessed on April 4, 2025

- Cointelegraph. Pi Network Sees New Lows as More Tokens Unlock. Accessed on April 4, 2025