Crypto Whales Dump These 3 Altcoin After Trump’s ‘Liberation Day’ Tariff Shock!

Jakarta, Pintu News – Crypto whales have begun to quietly shift their positions on altcoins in the wake of the Liberation Day tariffs announced by Trump.

Reporting from BeInCrypto, there was a decrease in the number of wallets holding between 10,000 and 100,000 tokens for Uniswap , Chainlink , and Ondo Finance .

While this sell-off has not been drastic, the uniformity of its timing across tokens suggests heightened caution or a short-term adjustment strategy.

With these altcoins at important support and resistance levels, the behavior of the whales could potentially continue to influence price direction in the next few days.

Uniswap (UNI)

The number of addresses holding between 10,000 to 100,000 Uniswap (UNI) tokens continues to show a gradual decline. This trend actually started before Trump’s “Liberation Day” tariff policy and has continued since.

Read also: 3 Altcoins to Watch After Donald Trump’s ‘Liberation Day’!

In just the span of April 2 to 3, the wallet count of this group of crypto whales decreased from 825 to 821. This small but significant drop indicates a loss of confidence or repositioning of large investors who are usually very strategic and responsive to market conditions.

While this decline may seem mild, it reflects a broader sentiment of caution among large UNI holders-which is often an early signal or amplifier of potential price weakness.

As of April 5, 2025, the price of UNI is still in a clear downward trend, with a risk of falling to $5.50 or even lower if the selling pressure continues. However, in the event of a reversal, the token is expected to test the resistance level at $5.97 first.

If it manages to break the resistance, UNI could potentially climb higher towards $6.23-a level that could indicate a more solid recovery.

But for now, the decline in the number of whale-scale wallets and the dominance of bearish sentiment keep UNI’s technical position vulnerable.

Chainlink (LINK)

While the number of Chainlink whale wallet addresses (LINKs)-those holding between 10,000 and 100,000 LINKs-has only slightly decreased after Trump’s “Liberation Day,” from 2,859 to 2,855, the context before this decrease is even more important to note.

Between March 29 and April 1, the whale group was actually seen actively accumulating, with the number of wallets increasing from 2,852 to 2,860. This brief spike suggests increased confidence in LINK’s price upside potential towards the beginning of the month.

This latest decline likely reflects only small-scale profit-taking or caution amid the ongoing correction, rather than signaling a broader change in sentiment.

Technically (5/4/25), LINK is at a crucial point. If the correction continues, the price risks falling below $12 for the first time since November 2024, with important support levels around $11.85.

However, if the trend reverses and buyers regain control of the market, LINK could potentially test the resistance at $13. If it manages to break through it, the price is likely to continue rising towards $13.45.

Read also: PayPal Takes a Bold Step into Crypto: Solana (SOL) and Chainlink (LINK) Now Supported!

Ondo Finance (ONDO)

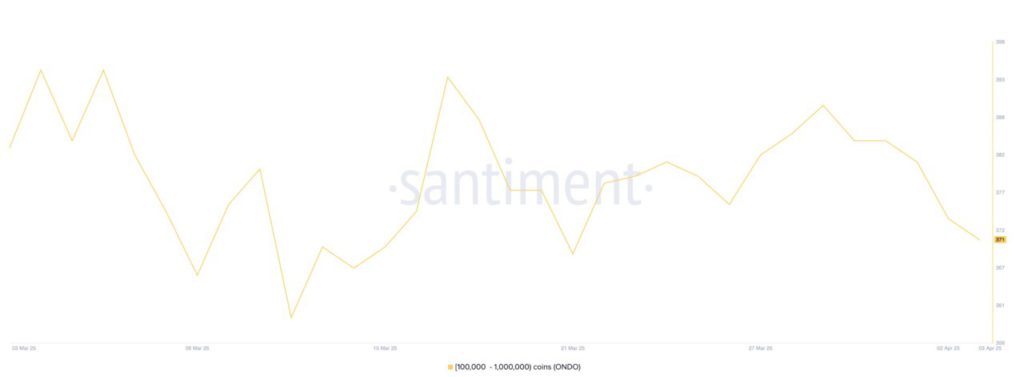

Ondo (ONDO) showed a similar pattern to Chainlink, where there was accumulation by whales between March 26 and 29. During this period, the number of addresses holding between 10,000 and 100,000 ONDO increased from 376 to 390.

This surge in accumulation signaled growing interest and confidence from large holders. However, after reaching its peak, the number of whale wallets began to decline-from 374 to 371-post Trump’s “Liberation Day” announcement.

Although the decline was slight, it could reflect a pause in optimism or a more cautious shift in positioning from the big players.

In terms of price (5/4/25), ONDO is now at a crucial point. If it is able to restore bullish momentum like last month, the token has a chance to break the resistance at $0.82, and could even rise further to $0.90 or $0.95 if the buying power continues.

However, if momentum continues to weaken, downside risks increase, with important support levels around $0.76 and $0.73 likely to be tested.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins Crypto Whales Are Selling After Trump’s Liberation Day Tariffs. Accessed on April 7, 2025