Crypto Black Monday Unleashed? Weekend Wipeout Erases Over $1 Billion in Shocking Liquidations!

Jakarta, Pintu News – Industry players are calling today, April 7, 2025, the “Black Monday” of the crypto world, a term that reflects the massive crash that occurred over the weekend.

Reporting from BeInCrypto (4/7/25), in the last two days, more than $1 billion of long and short positions disappeared due to market volatility that occurred over the weekend.

Crypto Market Black Monday After Crypto Liquidation Massacre

Data from Coinglass shows that on Saturday, April 5, crypto positions worth up to $116.59 million were liquidated. This amount consisted of $33.02 million in short positions and $83.57 million in long positions.

Read also: 3 Memecoins with the Sharpest Decline Today (7/4/25), Impact of Crypto Liquidation?

The following day, the number of traders and investors who were “hit” by the market further increased, with crypto liquidations reaching over $850 million. Like the previous day, most of the liquidation came from long positions, amounting to $743.115 million, compared to $107.881 million from short positions.

“In the last 24 hours, 320,444 traders were liquidated, with the total liquidation value reaching $985.82 million,” Coinglass wrote.

This wave of liquidations has sparked widespread pessimism across the crypto market. Data from CoinGecko shows that the overall crypto market capitalization fell by more than 10%, to around $2.5 trillion.

Historical Meltdown Resembles Black Monday

Among the top ten crypto assets, the price of XRP recorded the steepest decline, dropping more than 15.4% and trading at $1.7 at the time of writing. Ethereum also plummeted 14.3%, at $1,480 per unit.

Analysts on the X platform (formerly Twitter) were busy discussing the possibility of a historical crash resembling “Black Monday”.

“Tomorrow (meaning April 7) looks to be Black Monday 2.0,” commented analyst Maine.

The term “Black Monday” refers to the sudden and significant stock market crash on October 19, 1987.

At that time, major stock indices around the world plummeted, with the Dow Jones Industrial Average (DJIA) in the United States falling by 22.6%, marking the largest one-day percentage drop in its history.

Amidst this situation, panic set in as sharply surging trading volumes flooded the market. The absence of a mechanism to temporarily halt trading during extreme volatility meant that the price collapse continued unimpeded.

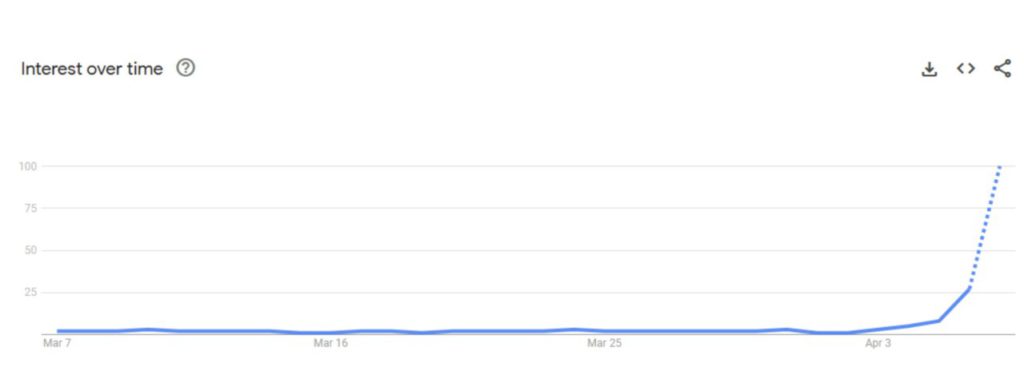

After a massive wave of liquidation, data from Google Trends shows that global searches for the term “Black Monday” reached the highest level.

Panic Week: What’s Behind Crypto’s Black Monday?

“Bearish sentiment is arguably at a historical high,” says The Kobeissi Letter.

Market commentators famously attributed the gloomy mood to the uncertainty surrounding the proposed new tariffs, referring to “Black Monday” as the now-consensus view.

Based on this, analysts from The Kobeissi Letter predict a “short-term capitulation” this week.

“Down and then up,” the analysts wrote, hinting at a market that would be volatile but potentially recover in the near future.

This sentiment is in line with the AAII Sentiment Survey results, which reported that 61.9% of investors have a bearish outlook-twice the historical average of 31.0%.

“Black Monday 2.0,” analyst TheMaineWonk wrote as a warning.

Analyst Duo Nine echoed this sentiment. He warned that Trump’s proposed tariffs could destroy global supply chains, lower productivity, and trigger a long-term bear market for crypto.

According to him, this could last for 1-2 years if a global recession does occur.

“If the US doesn’t change course soon, then the only conclusion is that this is intentional, and the damage will get worse over time. Unfortunately for crypto, this could mark the beginning of a prolonged bear market. It could last 1-2 years or more if a global recession begins,” Duo Nine explained.

While tariff concerns dominate, contrarian investors see this extreme pessimism as a buy signal. They assume that when bad predictions become mainstream, the bottom of the market may be near-opening up opportunities amidst mounting fears.

Read also: 3 Cryptos Sold by Whales After Donald Trump’s Liberation Day Tariff Policy!

Advice from Analysts on Black Monday Crypto

However, not everyone agrees with this tone of doom. Ryan Wollner, founder of Pearpop, advises against getting caught up in the overblown narrative on platform X.

He also rejected comparisons with the 1987 market crash.

“I think it’s just a 2-3 week transition period, and once the rates are better understood, investors will start coming back in,” Wollner said.

Wollner also suggests that savvy traders can profit by selling now and buying back when prices drop.

He emphasized that unlike previous recessions caused by fraud, this downturn is just a temporary shift-with the flow of funds likely to go to US companies and countries that benefit from the new tariffs.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Crypto Black Monday Kicks Off After $1 Billion Was Liquidated Over the Weekend. Accessed on April 7, 2025