Solana (SOL) in Crisis: Is a Drop Below $90 Inevitable This Week?

Jakarta, Pintu News – On April 7, 2025, the price of Solana recorded one of the largest daily declines in its history after plummeting 14% in the last 24 hours.

Since mid-January, SOL has been on a steady downward trend and has lost more than 60% of its value.

With market pressure still bearish, will Solana fall below $90 this week? Let’s discuss further.

Solana Prices Plummet Amid Massive Sell-offs

On April 7, 2025, the Solana price was trading at $101, with a daily low of $96, as risk assets experienced a brutal sell-off due to President Trump’s tariffs.

Based on data from CoinMarketCap (4/7), trading volume jumped more than 300% in the last 24 hours, reaching $6.79 billion. This suggests that Solana’s sales volume is in the billions of dollars.

Read also: 3 Crypto that Plummeted in Early April 2025!

This decline led to Solana recording the second highest amount of liquidation among other altcoins. According to data from Coinglass, over $62 million of long positions in Solana have been liquidated in the last 24 hours (4/7).

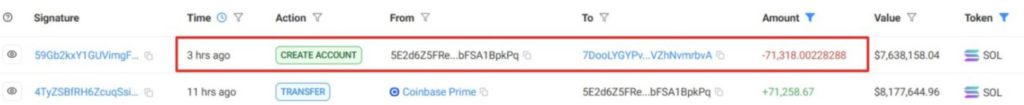

Despite the market turmoil, one Solana whale remains optimistic that SOL prices can recover. On-chain data shows that this wallet address has staked 71,318 SOL, worth over $7.63 million, despite being at a loss.

Meanwhile, the CEO of Helius Labs also stated that despite the declining price of SOL, the asset remains the most sensible choice amid the crypto market crash. He said:

“I’m not sure how far the general market will go down… but this is the most obvious asymmetric bet for anyone who is not time-bound.”

Despite the optimism, some analysts predict that the downward trend is not yet complete, and it is likely that the Solana price could fall below $90 in the near future.

Will Solana Fall Below $90 This Week?

Leading crypto market analyst, Jason Pizzino, stated that Solana’s price is likely to fall below $90 (IDR 1.5 million) within this week.

In his analysis, Pizzino noted that SOL is on the verge of a major correction, as are most of the other top altcoins.

As Solana has already dropped below $100 for the first time in twelve months, the analyst expects the next target to be $80.

If this level is reached, it could possibly trigger a deeper drop to below $60. Such a drop would reflect a correction of more than 80%.

Read also: Bitcoin Hashrate Reaches New Milestone, Jumping Over 1 Zetahash per Second!

In addition to bearish predictions from analysts, selling pressure is also expected to increase due to the massive unlock schedule this week.

According to Tokenomist, a total of 465,000 SOLs-worth over $50 million-will be unlocked this week, potentially adding to the selling pressure in the market.

On the other hand, the “crypto fear and greed” index plummeted to a monthly low of 23, indicating that most traders are in a state of extreme fear. This further strengthens the bearish outlook, as such fear could discourage traders from buying when prices drop.

This data suggests that the likelihood of Solana prices falling below $90 in the near future is quite high.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Solana (SOL) Price Crashes Below Key Support. Accessed on April 8, 2025

- Coingape. Solana Price in Freefall: Will SOL Crash Below $90 This Week? Accessed on April 8, 2025