Bitcoin Price Update: BTC Dips 4% as Bulls Lose Steam — Is the Rally Running Out of Fuel?

Jakarta, Pintu News – In recent days, a wave of liquidations in the crypto market has shaken investor confidence, leaving many traders feeling wary. With the bearish pressure getting stronger, many Bitcoin holders have started to distribute their coins.

Long-term holders of Bitcoin (LTH), usually known for keeping their coins for a long time, are now starting to sell their assets. This adds pressure to an already cautious market. What does this mean for Bitcoin in the short term?

Before that, let’s explore Bitcoin’s price movements today.

Bitcoin Price Drops 4.03% in 24 Hours

On April 9, 2025, Bitcoin (BTC) was trading at $76,047, or around IDR 1,302,869,261, marking a 4.03% drop over the past 24 hours. Throughout the day, BTC reached a high of IDR 1,366,448,806 and dipped to a low of IDR 1,281,124,115, reflecting the market’s ongoing volatility.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $1.5 trillion, with trading volume in the last 24 hours also down 42% to $51.19 billion.

Read also: 3 ‘Made in USA’ Coins Shaking Up the Crypto Market Right Now!

BTC Long on the Exchange – Are Long-Term Holders Starting to Lose Faith?

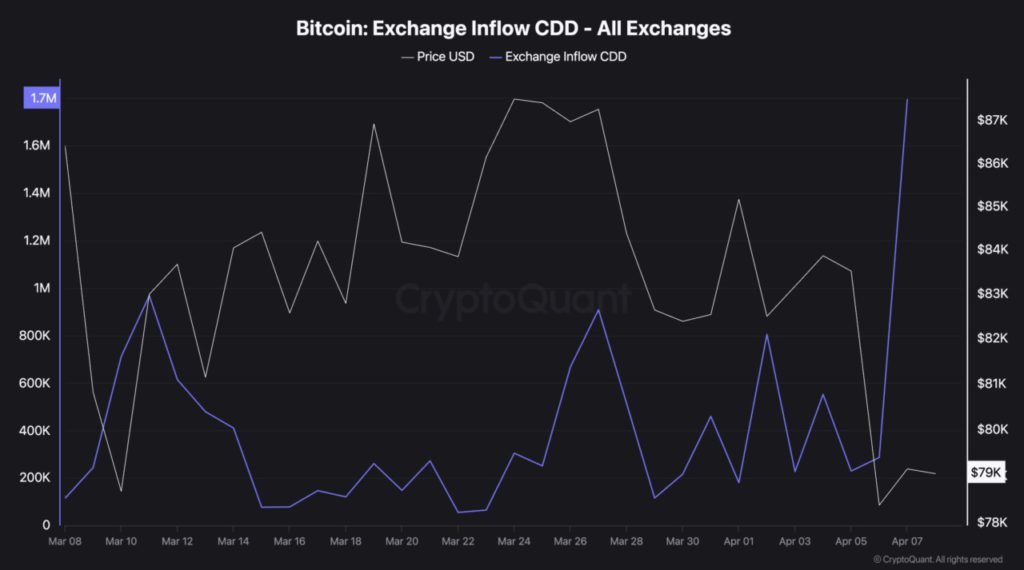

Coin Days Destroyed (CDD) for Bitcoin sent to exchanges has reached its highest point in the last 30 days.

According to data from CryptoQuant, this figure currently stands at 1.79 million – a jump of over 850% since the beginning of April.

This spike suggests that coins that have been held for a long time are now starting to be moved to exchanges, a classic sign that usually precedes a major sell-off.

BTC’s Exchange Inflow CDD tracks the movement of old coins into the exchange. This value is calculated by multiplying the amount of BTC moved by the number of days the coins are held without being used.

If there is a spike, it means that long-term holders (LTH) are moving their coins to exchanges, most likely for sale. This trend is noteworthy because this group of investors is known to have a “strong hand” – they rarely sell unless market conditions are really worrisome.

So, when they start to move, it could be a signal that their confidence is starting to waver and hint at the potential for further price declines.

This selling pressure is also reflected in the derivatives market. BTC’s buy-sell taker ratio is currently below one, signaling that the number of sell orders outnumber buy orders in futures and perpetual contracts.

This suggests that Bitcoin derivatives traders are preparing for a potential further decline, further reinforcing the ongoing bearish sentiment.

Read also: Is the Crypto Bull Run Dead? 444,000 Traders Just Got Wiped Out!

BTC rally stalls as buying power weakens

The crypto market briefly tried to recover on April 8, 2025, with the total crypto market capitalization increasing by $48 billion in the last 24 hours. This activity pushed the price of BTC up by around 4% in the past day.

However, the Chaikin Money Flow (CMF) indicator for BTC is showing warning signals as it continues to decline sharply, forming a bearish divergence. As of April 8, the CMF value has dropped below the zero line to -0.15 and is still showing a downward trend.

A bearish divergence occurs when the price of an asset rises, but its CMF decreases. This indicates that buying pressure is weakening behind the price increase.

If this trend continues, BTC could lose its recent gains and drop towards the $74,389 level.

However, if there is a new surge in demand for BTC, this rally could still hold and push the price up to the $80,776 range.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Long-Term Holders Break Silence – Is the Market Heading for a Big Sell-Off? Accessed on April 9, 2025