China Braces for Trade War with US, Yuan Weakens and Tensions Rise!

Jakarta, Pintu News – Trade tensions between the United States and China are heating up again after US President Donald Trump threatened to impose an additional 50% tariff on imported products from China. The Chinese government immediately responded with a firm statement, stating that it would “fight to the end” if the US stuck to its decision.

This statement was made by China’s Ministry of Commerce, marking the latest escalation in the trade conflict between the world’s two largest economies. This adds to global market concerns about the possibility of a prolonged decoupling.

A Strong Response from the Chinese Government

China’s Ministry of Commerce called the new policy from Washington a “mistake on top of a mistake” in a statement on Tuesday. It emphasized that if the United States continues to impose its will, then China is ready to face up to the last point. This rhetoric comes in response to Trump’s threat to raise import tariffs by 50% if China does not lift the countervailing duties that have been applied previously.

The new move will increase the total tariffs announced so far this year to 104%, including the 34% increase planned from April 9 and the previous addition of 20%. Economist Michelle Lam of Societe Generale said that China will not back down easily. She also warned that without a change in attitude from the US side, investors should prepare for an economic separation between the two countries.

Also Read: Bitcoin (BTC) is recovering, but big hurdles still loom in April 2025

Impact on Market and Yuan Currency

In the midst of rising tensions, the Chinese government began to take economic stabilization steps to calm the domestic market. One of the strategies taken is to loosen controls on the yuan to support export performance. The onshore yuan weakened to its lowest point since September 2023, while the offshore yuan also fell to its lowest level in two months.

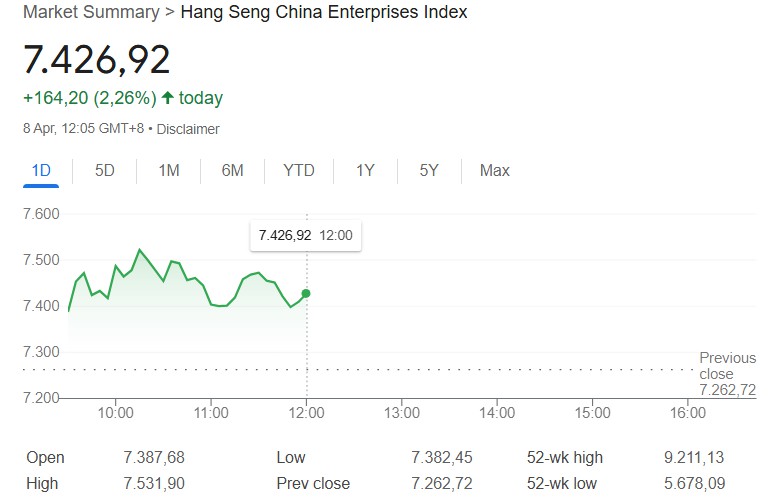

The government also instructed the national team of funds to buy market assets to maintain stability. This step was taken after the Hang Seng China Enterprises index recorded a sharp decline, then rebounded to rise 2.26% the next day. On the other hand, reports also indicated that the government would accelerate stimulus to strengthen the domestic economy.

Diplomatic Tensions and Potential Escalation

The political situation between Washington and Beijing shows no signs of easing. Since returning to office earlier this year, Trump has not had direct communication with Chinese President Xi Jinping. This is the longest period a US President has not had direct contact with a Chinese leader in the last two decades. This lack of high-level communication is feared to exacerbate the escalation of the conflict.

Although China’s dependence on American demand has diminished, trade observers warn that a sustained tariff war will still have a negative impact on both economies. If there are no compromise measures from both sides, the world could witness one of the most prolonged trade conflicts in modern history. Global investors are keeping a wary eye on the situation.

Conclusion

The trade conflict between the US and China is now not only impacting bilateral relations, but also creating uncertainty for the global economy, including the crypto and digital currency markets. The weakening of the yuan reflects internal economic pressures amid heightened external tensions.

The policy measures taken by China signal that the country is ready to face long-term challenges. However, in the absence of a constructive dialog between the two countries, concerns about the long-term impact on world economic stability will continue to loom large.

Also Read: First XRP ETF in the US Launched, Provides New Investment Opportunities!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cryptopolitan. China says it will ‘fight to the end’ against Trump tariffs. Accessed April 9, 2025.

- Featured Image: Spectrum