Bitcoin price drops dramatically to around $80,000, massive selling by Bitcoin whales triggered?

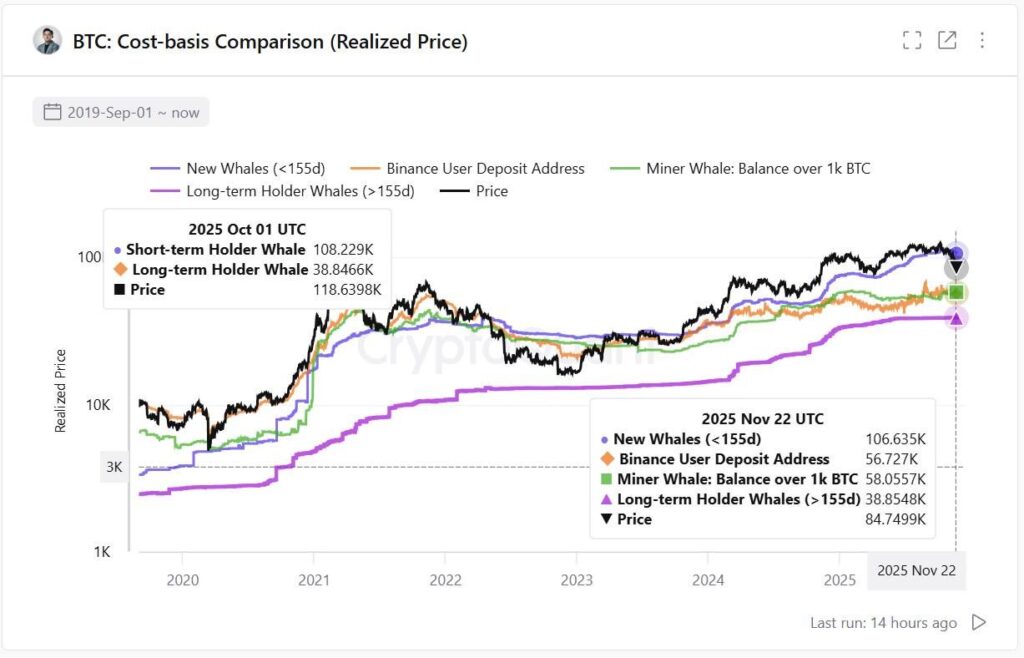

Jakarta, Pintu News – The recent sharp drop in Bitcoin price from $110,000 to around $80,000 has been attributed to a massive sell-off by early whales. CryptoQuant CEO Ki Young Ju revealed that analysis of on-chain metrics shows that Bitcoin is currently in the “shoulder” phase of its cycle, indicating limited short-term price upside potential. Read the full analysis here!

Sale by Bitcoin Whale

Ki Young Ju explains that the current market dynamics are influenced by the battle between two major whale groups. Legendary whales who own Bitcoin with an average cost base of around $16,000 are starting to realize huge profits, selling their assets in the hundreds of millions of US dollars every day. This persistent sell-off is putting immense pressure on the price of Bitcoin.

This sell-off not only indicates profit realization but also reflects a change in investment strategy among long-term Bitcoin holders. Further analysis suggests that this selling may continue if Bitcoin does not show signs of significant price recovery in the near future.

Read also: Cardano ETF Coming Soon? Cardano Foundation CEO Finally Opens Up

Market Cycle Analysis

According to Ki Young Ju’s analysis, using the Profit and Loss (PnL) index with a 365-day moving average, the market has entered a “shoulder” phase. This phase usually occurs towards the end of a market cycle and is often followed by a period of price correction or stagnation. This signals that the market’s growth potential is currently limited.

This indicator is very important because it gives a clearer picture of where we are in the market cycle and what might happen next. Investors and traders can use this information to make more informed decisions in managing their portfolios.

Read also: UK Regulator Surprises Market, Stablecoins Allowed to Enter Public Trials

Bitcoin Market Outlook

With the current market conditions, the short-term outlook for Bitcoin does not seem very encouraging. Although Bitcoin has shown remarkable resilience throughout the previous years, the current phase suggests that we probably won’t see any significant price spikes in the near future.

However, this does not mean that Bitcoin does not have a bright future. As an asset that has experienced many ups and downs, Bitcoin still has the potential to recover and reach higher values in the future. Investors may need to be patient and monitor market developments closely.

Conclusion

This significant drop in Bitcoin price is a reminder that the cryptocurrency market is highly volatile and is affected by a variety of factors, including the activity of the whales. Investors should always be prepared for changes and use on-chain data to make informed decisions.

FAQ

What caused the recent Bitcoin price drop?

Bitcoin’s price drop from $110,000 to around $80,000 was caused by massive selling by early Bitcoin whales who had an average cost base of around $16,000.

Who is Ki Young Ju?

Ki Young Ju is the CEO of CryptoQuant, a company that provides on-chain data analysis for the cryptocurrency market.

What is the “shoulder” phase in the Bitcoin market cycle?

The “shoulder” phase in the Bitcoin market cycle is a period where price growth is limited and often followed by price correction or stagnation.

How can investors use this information?

Investors can use market cycle analysis and on-chain metrics to make more informed investment decisions and manage their portfolios more effectively.

Is there still hope for a Bitcoin price increase in the future?

While the short-term outlook may be limited, Bitcoin still has the potential to recover and reach higher values in the future, given the volatility and ever-changing market dynamics.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Downtrend: Early Whale Selling. Accessed on November 28, 2025

- Featured Image: Generated by AI