Bitcoin market is in turmoil due to tariff fake news: Crypto Market’s Long-Term Implications!

Jakarta, Pintu News – Fake news about the White House’s plan to halt import tariffs for 90 days except for China, has created chaos in global financial markets today. Bitcoin and other cryptocurrency markets experienced significant price fluctuations, fueled by widespread speculation. The fast-circulating news initially pushed risk assets sharply higher, but was later dismissed as “fake news” by the White House.

Seconds of Market Jitters

At 10:10 AM ET, a rumor regarding the White House’s consideration of halting tariffs for 90 days surfaced and immediately affected the market. According to The Kobeissi Letter on the X platform, Bitcoin (BTC) which was originally trading around $75,805 jumped to $81,200 in less than half an hour. However, the market excitement was short-lived, as at 10:25 AM ET, reports surfaced that the White House was unaware of the plan.

Also Read: Bitcoin (BTC) is recovering, but big hurdles still loom in April 2025

Market Reaction and Analysis

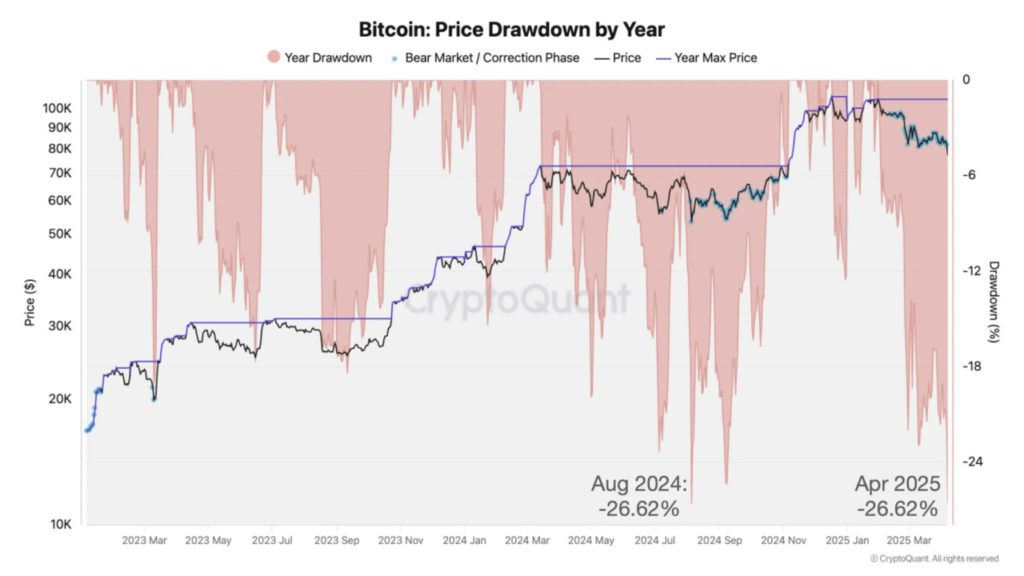

The uncertainty generated by this fake news shows how sensitive markets are to geopolitical news. Market analyst Alex Krüger mentioned that this event opens up the possibility for more extreme market fluctuations in the future. Meanwhile, Julio Moreno of CryptoQuant pointed out that the current Bitcoin (BTC) price drop is close to hitting the bottom in this cycle, with a decline of -26.62%, similar to the correction that occurred in August 2024.

Long-term Implications and Conclusion

Although markets quickly recovered from this shock, the event highlighted the vulnerability of financial markets to unverified information. EU Commissioner, Ursula von der Leyen, confirmed Europe’s readiness to negotiate with the US, including the possibility of zero tariffs on industrial goods. This shows that despite the short-term chaos, there are opportunities for long-term stability and cooperation.

Lessons from Market Anxiety

Today’s events provide an important lesson on the importance of information verification in this digital age. Investors and market participants should always be aware of the potential for market manipulation through the dissemination of inaccurate information. This incident also emphasizes the importance of transparency and clear communication from policymakers to maintain market stability.

Also Read: First XRP ETF in the US Launched, Provides New Investment Opportunities!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Whipsaws on Fake Tariff Bombshell News. Accessed on April 8, 2025

- Featured Image: Generated by AI