Bitcoin Faces Global Pressure: Can 2-Year Realized Price Levels Be a Key Defense?

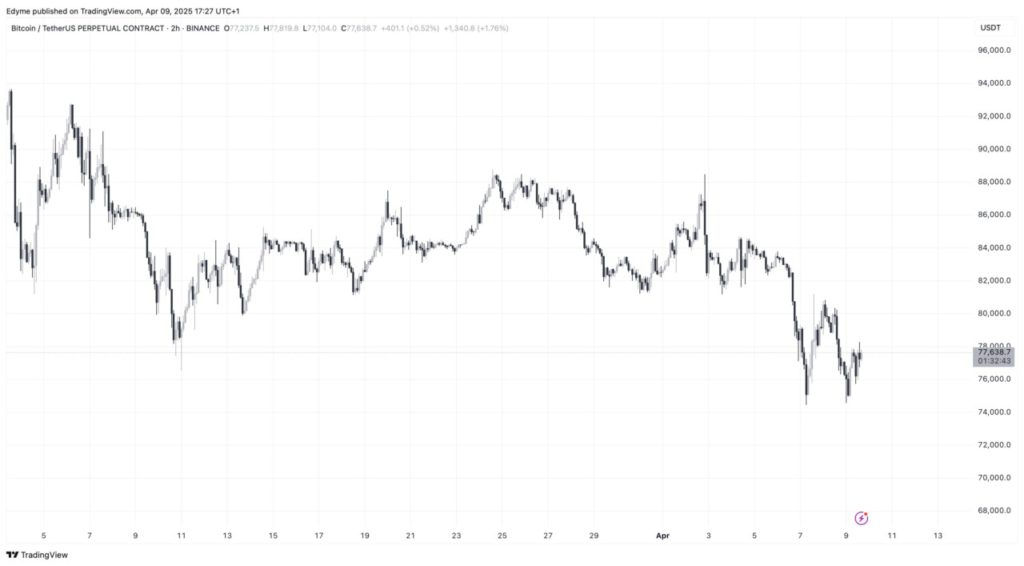

Jakarta, Pintu News – The price movement of Bitcoin is currently facing severe challenges amid global economic tensions, particularly regarding international trade tariff policies. This external factor adds pressure to the cryptocurrency market, causing Bitcoin’s price movement to lose its momentum.

Currently, Bitcoin is trading at just over Rp1.30 billion ($77,000 equivalent), registering a drop of almost 30% from its all-time high. In fact, in the last 24 hours, BTC has decreased by about 1.6%. This has led many investors to start doubting the possibility of a price recovery in the near future.

2-Year Realized Price Level is a Major Concern

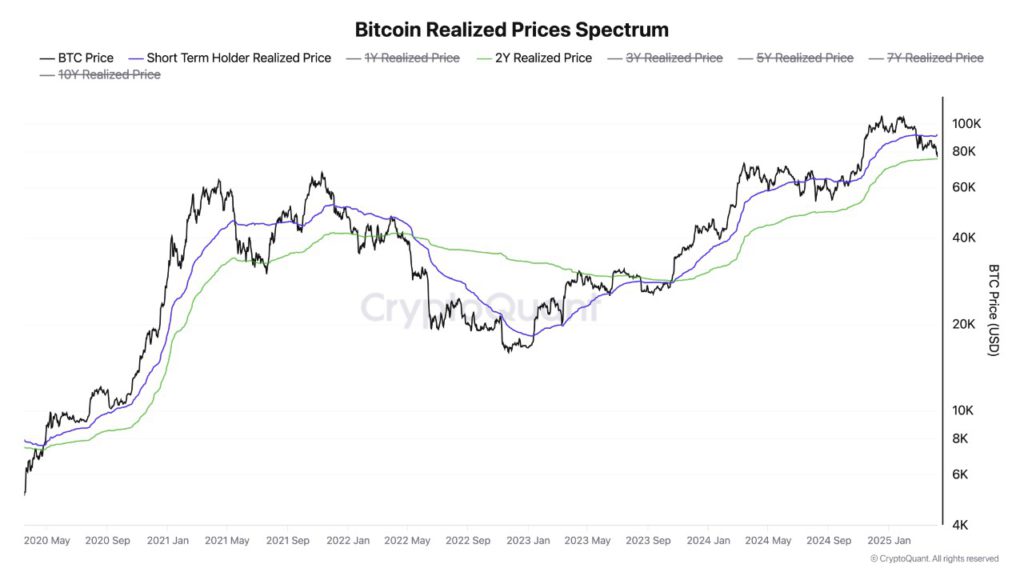

One of the important factors that crypto market participants are now focusing on is the convergence between the current Bitcoin market price and the 2-year realized price level. This method is used to calculate the average purchase price of Bitcoin moving on the blockchain network in the last 2 years.

This realized price level is often an important support area, especially when the crypto market is in a transitional phase from a bearish to bullish trend. According to a recent analysis by CryptoQuant contributor Onchained, Bitcoin has managed to stay above the 2-year realized price level since October 2023. This shows that long-term investor confidence is still quite strong.

If BTC is able to maintain a position above this level, then there is great potential that the area will become a new price foundation. This could trigger buying pressure from investors who see this price as a strategic accumulation opportunity.

Also Read: Solana’s Whale Movement and Selling Pressure: What is the Impact on Crucial Support Levels?

Correction Risk if Support Level Doesn’t Hold

Conversely, if Bitcoin price fails to hold above the 2-year realized price level, then a potentially deeper correction could occur. This condition might force Bitcoin price to move in a consolidation phase for longer before finding new bullish momentum.

The history of Bitcoin price movements shows that the realized price level is often an important indicator in determining the strength or weakness of crypto market trends. Therefore, the development of price movements against these levels will be a key reference for market participants in developing their investment strategies.

Massive Liquidations Amplify Crypto Market Volatility

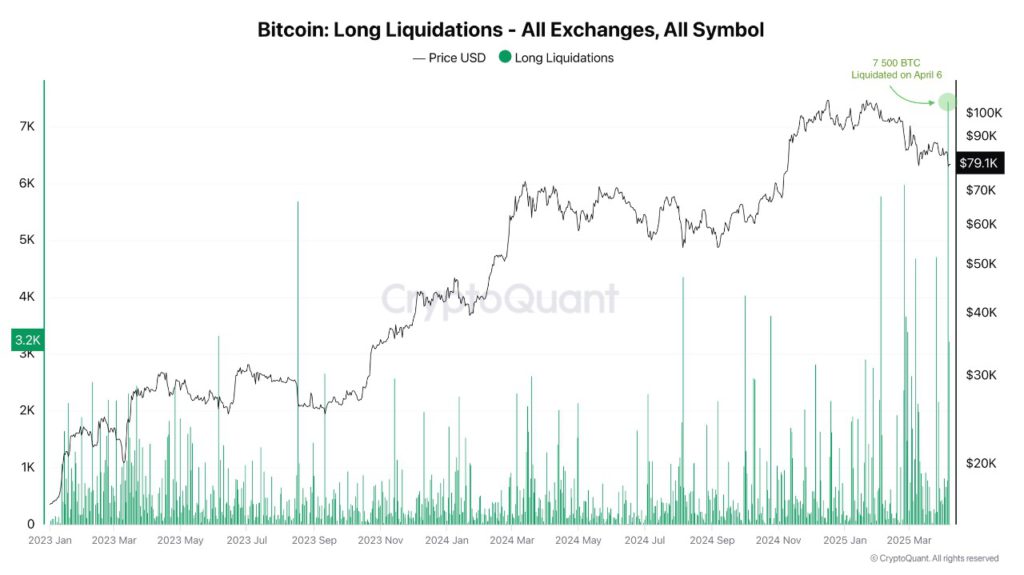

In addition to pressure from external factors, Bitcoin’s price movements are also affected by the conditions of the crypto derivatives market. On April 6, 2025, there was the largest Bitcoin long position liquidation event in this bull market cycle. A total of around 7,500 BTC was liquidated in a single day, recording the highest liquidation volume since the upward price trend began.

This event shows how crypto market volatility can increase sharply, especially when there is uncertainty regarding macroeconomic policies, such as the new tariff policies under President Trump’s administration in the United States.

According to CryptoQuant analyst Darkfost, this mass liquidation event is an important reminder for crypto investors, especially those who use high leverage. Volatile market conditions require extra vigilance to keep investment capital safe.

The Importance of Vigilance Amid Crypto Market Uncertainty

In the current situation, cryptocurrency investors and traders are faced with a major challenge. On the one hand, the price of Bitcoin (BTC) is approaching a crucial support level, which is the 2-year realized price. This could signal a potential trend reversal to the bullish zone if the level is successfully defended.

However, on the other hand, pressures from external factors such as global tariff policies and major liquidation events keep the risk of price corrections lurking. Therefore, it is important for market participants to remain disciplined in managing risks and not be tempted to take overly aggressive positions in high volatility conditions like now.

Conclusion

Bitcoin (BTC) is currently at an important junction in the price journey in the crypto market. The 2-year realized price level is the main line of defense that determines the direction of the next movement. Successfully defending this level could open up opportunities for price recovery, but the threat of correction remains to be watched. In an uncertain global market, vigilance and risk management are key for cryptocurrency investors.

Read More: Solana Price Moves Up: Potential Strengthening or Correction in April 2025?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Best Owie/NewsBTC. Bitcoin Battles Tariff Turmoil: Can The 2-Year Realized Price Hold The Line?Accessed April 11, 2025.

- Featured Image: Generated by AI