A $4 Billion Ethereum Buyout: Crisis Coping Strategy or Pure Speculation?

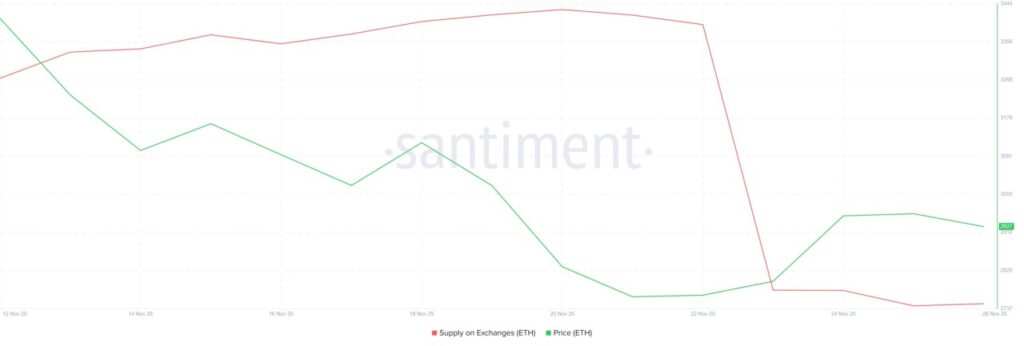

Jakarta, Pintu News – This week, the cryptocurrency market witnessed a drastic drop in the amount of Ethereum held on exchanges. From 2.77 million ETH, the figure dropped to just 1.41 million ETH. This drop of 1.36 million ETH, valued at nearly $4 billion, signaled a massive buying spree by Ethereum holders. This phenomenon is happening at a time when Ethereum is trying to break the crucial resistance level of $3,000.

Decrease in the Number of ETH on Exchanges

This week, it was noted that the amount of Ethereum stored on trading platforms has decreased significantly. The drop from 2.77 million ETH to just 1.41 million ETH indicates a large outflow from exchanges. This could be an indication that investors are starting to store their assets in personal wallets, which are often considered more secure.

A decline in stock on an exchange is often interpreted as a sign that holders do not intend to sell in the near future. This could be because they expect prices to rise in the future or because they prefer to take advantage of staking systems that offer returns.

Also Read: JPMorgan Predicts Oil Price Fall to $30 by 2027

Market Reaction to Ethereum Price

Ethereum is currently at $3,035, trying to stabilize its position above the $3,000 level after several declines. This level is considered very important because it serves as a psychological boundary that can trigger a chain reaction in the market, be it buying or selling.

When the price of Ethereum fell below $3,000, it triggered a huge wave of buying as many investors considered this to be the bottom. They hoped that by buying at a low price, they would benefit when the price went back up.

Long-term Implications

This massive buying could have two sides. On the one hand, it could stabilize Ethereum’s price and prevent further declines. However, on the other hand, it could also be a risky speculation if the market doesn’t move in line with investors’ expectations. It will be important to monitor how these dynamics will affect Ethereum’s volatility in the coming weeks and months.

If these purchases do show investor confidence in Ethereum, we may see an increase in price. However, if this is just a quick reaction to the price drop, volatility will probably remain high.

Conclusion

With the decline in the amount of Ethereum on exchanges and the market reaction to critical price levels, the future of Ethereum seems to be full of uncertainty. Investors and analysts alike should be on the lookout for further price movements. Whether this will be a turning point for Ethereum or just a momentary reaction, time will tell.

Also Read: True XRP Holders Keep Calm Amid Weak Markets, Here’s the Outlook for December 2025!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: How much Ethereum went off exchange this week?

A1: This week, the amount of Ethereum held on exchanges fell from 2.77 million ETH to 1.41 million ETH, representing a decrease of 1.36 million ETH.

Q2: Why is the decline in Ethereum stock on exchanges important?

A2: A decrease in Ethereum stocks on exchanges is important because it suggests that holders may not be planning to sell in the near future, which could be due to predicted price increases or gains from staking.

Q3: What happens when Ethereum price drops below $3,000?

A3: When the price of Ethereum fell below $3,000, it triggered a huge wave of buying as many investors took this as a price floor and an opportunity to buy at a low price.

Q4: What are the potential risks of massive Ethereum purchases?

A4: Risks of massive Ethereum buying include the possibility that it’s a risky speculation if the market doesn’t move as expected, which could lead to high volatility.

Q5: How will this massive buying affect the price of Ethereum?

A5: This massive buying could stabilize the price of Ethereum and prevent further declines, but it could also increase volatility if it is perceived as speculation by the market.

Reference

- BeInCrypto. Ethereum Selling Triggers Death Cross. Accessed on November 28, 2025