Ripple (XRP) Upside Potential: Latest Analysis and Predictions April 2025

Jakarta, Pintu News – Ripple is currently facing mixed signals in the crypto market. Although market activity is showing a decline, there are indications of potential positive momentum from the derivatives market. This article will delve deeper into the current dynamics of Ripple (XRP), map out its potential direction of travel, and identify key levels that investors and market watchers need to pay attention to.

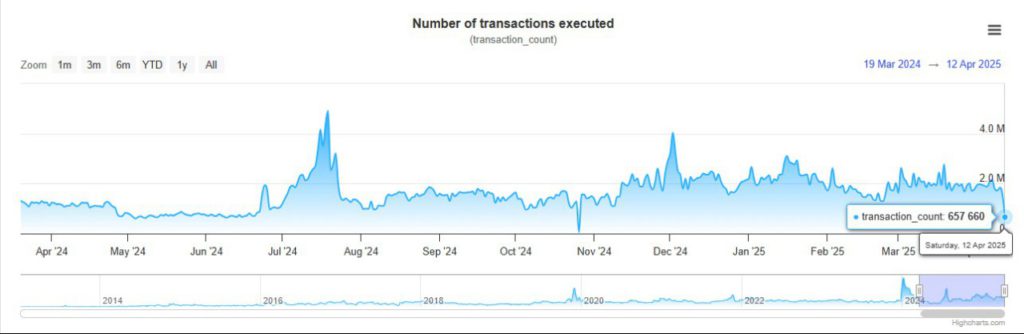

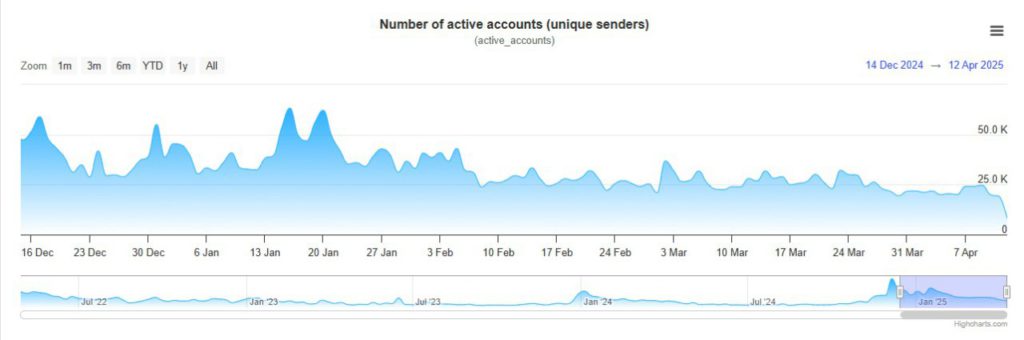

Decline in Market Activity

Recent on-chain insights show a decline in interest among market participants in Ripple (XRP) in recent days. Metrics that measure activity and engagement have shown a significant drop, which could be an early indicator of decreased interest or caution from investors. This decline may be influenced by various external factors affecting the crypto market as a whole.

This drop reflects the uncertainty currently hanging over the crypto market, where investors may be reassessing their positions in the face of high market volatility. However, this drop could also be an opportunity for investors looking for potential entry points at lower prices, especially if they believe in the long-term prospects of Ripple (XRP).

Also Read: Ripple (XRP) Movement and Potential Correction: What Crypto Investors Need to Watch Out for?

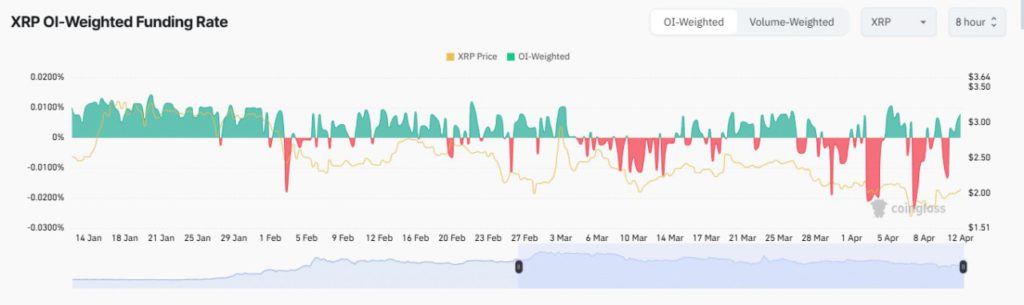

Bullish Narrative in the Derivatives Market

In contrast, the derivatives market shows a different story. There was an increase in the number of long contracts which suggests that some traders may see this as an opportunity to capitalize on the potential future price rise of Ripple (XRP). This indicates the belief of some market participants that Ripple (XRP) will rebound and reach higher values.

This increased activity in the derivatives market could be an early indicator of a change in market sentiment that may not yet be fully reflected in the spot price of Ripple (XRP). If this trend continues, it could encourage more buying which could help push the price of Ripple (XRP) past the existing resistance levels.

Ripple (XRP) Price Movement Prediction

Ripple (XRP) is currently facing strong resistance at the $2.1004 level. If it manages to cross this level, there is potential to reach even higher. However, in case of a pullback, Ripple (XRP) might find support at $1,923, $1,850, or $1,759. These levels could be stabilization points before Ripple (XRP) attempts to rebound.

On the upside, if Ripple (XRP) manages to cross the resistance at $2,233, it could pave the way for more significant gains. Investors and traders should monitor this level closely, as a successful breakout could signal the beginning of a broader bullish trend for Ripple (XRP).

Conclusion

Despite facing some challenges and mixed signals from the market, the long-term outlook for Ripple (XRP) still shows some bright spots, especially from activity in the derivatives market. Investors should remain alert to changing market dynamics and be ready to adjust their strategies according to the latest developments.

Read More: Pepe Coin (PEPE) Price Movement and Potential Golden Cross: What Does It Mean for the Crypto Market?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ripple’s Subtle Rebound Mapping XRP’s Potential Trajectory. Accessed on April 14, 2025

- Featured Image: Coinpedia