Drastic Drop in Web3 Game Funding Amid Global Economic Uncertainty

Jakarta, Pintu News—The blockchain gaming market saw a significant drop in funding in the first quarter of this year, reflecting the impact of geopolitical tensions and trade wars on the global market at large.

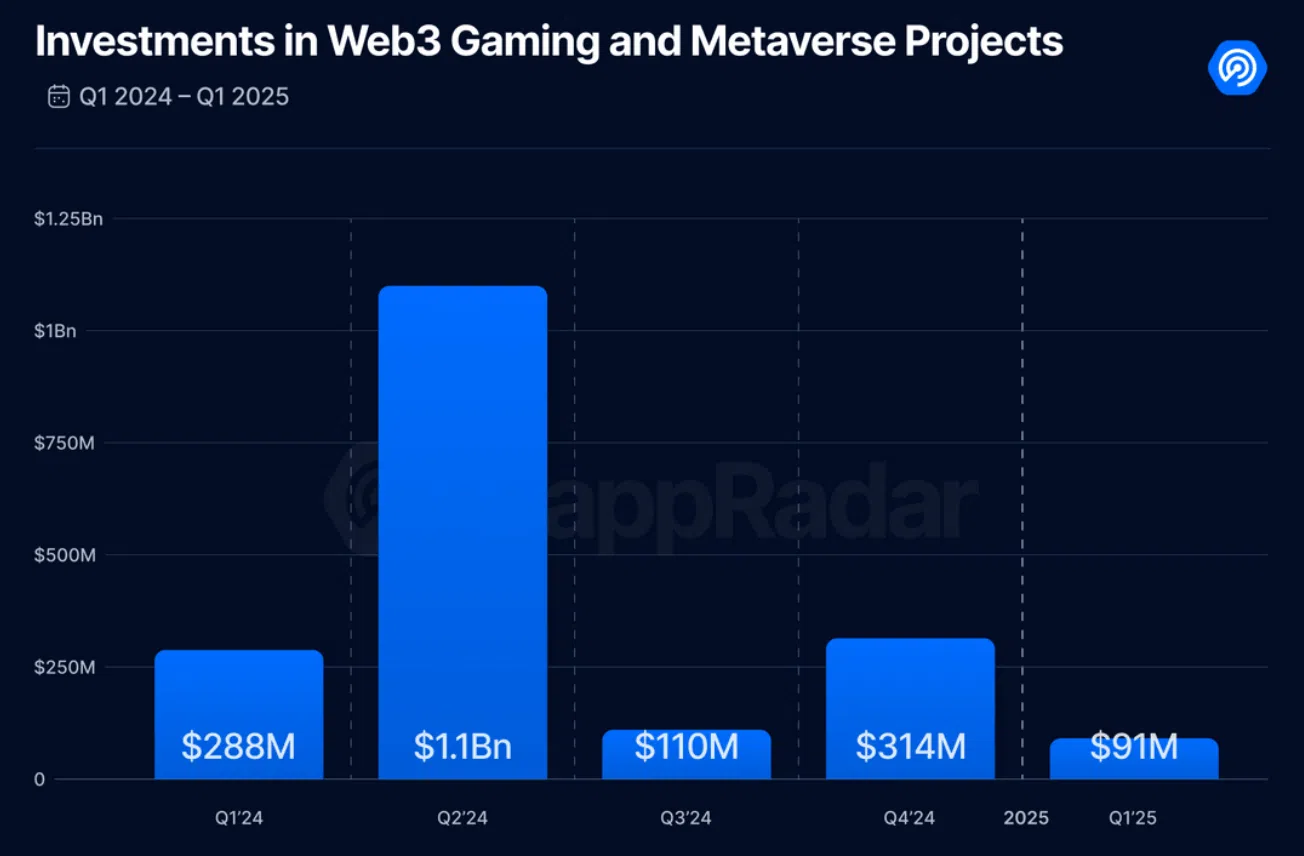

According to data from blockchain analytics platform DappRadar, investment in Web3 games fell by 71% from the previous quarter to just $91 million, although the number of deals increased by 35%.

Check out the full information below!

Declining Investment in the Blockchain Gaming Sector

In the first quarter of this year, the blockchain gaming sector did not escape the broader negative influences affecting the global economy. The data released by DappRadar clearly shows a sharp decline in funding allocated to Web3 games, which dropped by 71% to just $91 million compared to the previous quarter.

Nonetheless, the number of investment deals has increased, indicating that there is still strong interest in infrastructure development and innovation in the sector.

Sara Gherghelas, blockchain analyst from DappRadar, emphasized that despite the decline in the amount of funds invested, opBNB remained the most used gaming blockchain this quarter. This shows that despite the drop in funding, the use of blockchain technology in gaming is still ongoing and growing.

Also read: $13 Million NFT Tax Scandal Shakes Crypto Market!

Slowing Activity in Metaverse and NFTs

In addition to the decline in game funding, activity in the metaverse also saw a significant slowdown. According to Gherghelas, NFT trading volume dropped by 28%.

This decline reflects a broader trend in the NFT market, which also saw trading volumes fall to $13.7 billion in 2024, from $16.8 billion in 2023. This is the lowest figure since 2020, with a 19% drop in trading activity and total NFT sales falling to 49.8 million from over 60 million the previous year.

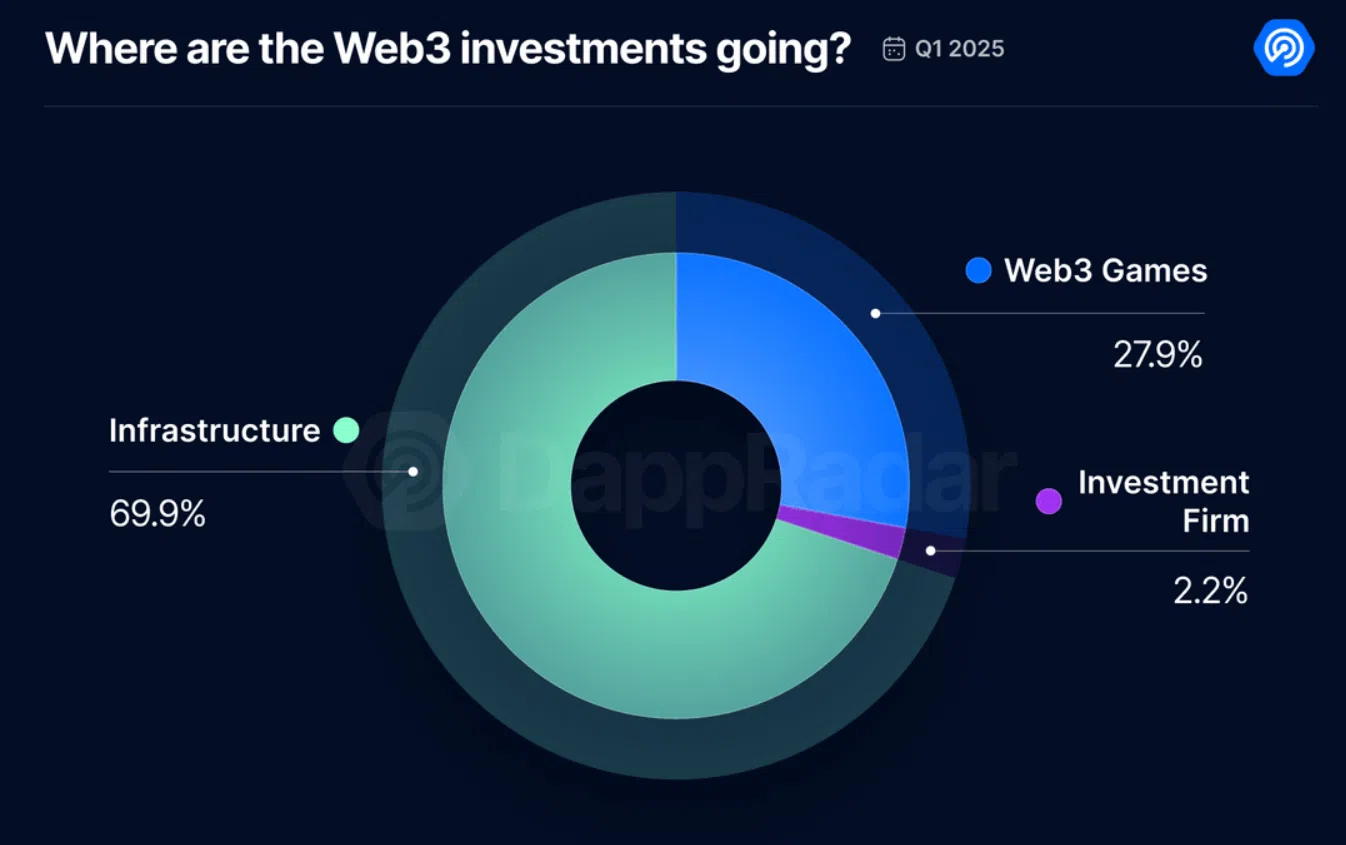

Despite the decline, significant investments are still allocated for infrastructure development within the sector. This quarter’s major funding rounds included $20 million for MARBLEX, $13.5 million for Beamable, and $10 million for The Game Company.

These investments show that despite economic uncertainty, there is still a strong commitment to building tools and backends that support scalable gameplay.

Read also: Why is Bitcoin (BTC) the Best Choice According to Robert Kiyosaki?

Future Prospects of Blockchain Games

Despite the challenges, the blockchain gaming sector is showing resilience. The increasing number of deals and ongoing infrastructure development show that this ecosystem is still thriving.

Gherghelas emphasized that top games’ consistent performance and continued development are important indicators of a resilient and adaptive ecosystem. Infrastructure-focused funding shows that there is a strong recognition of the need for a solid foundation to support high-quality gaming experiences.

This indicates that despite short-term obstacles, the long-term outlook for blockchain gaming remains positive, with significant growth opportunities as the technology develops and adoption increases.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Investor Funding in Web3 Games Drops 71% Amid Macro Headwinds – DappRadar. Accessed on April 15, 2025

- Featured Image: Generated by AI