Bitcoin Breaks Past $87K on April 21, 2025 — Riding the Wave of Gold’s Explosive Surge?

Jakarta, Pintu News – In the latest development, China continues to add to its gold reserves, accumulating an additional five tons in the past month in a massive buying spree.

This aggressive action against gold triggered an unexpected impact on the price of Bitcoin , where BTC managed to hold steady at around $87,000 as of April 21, 2025.

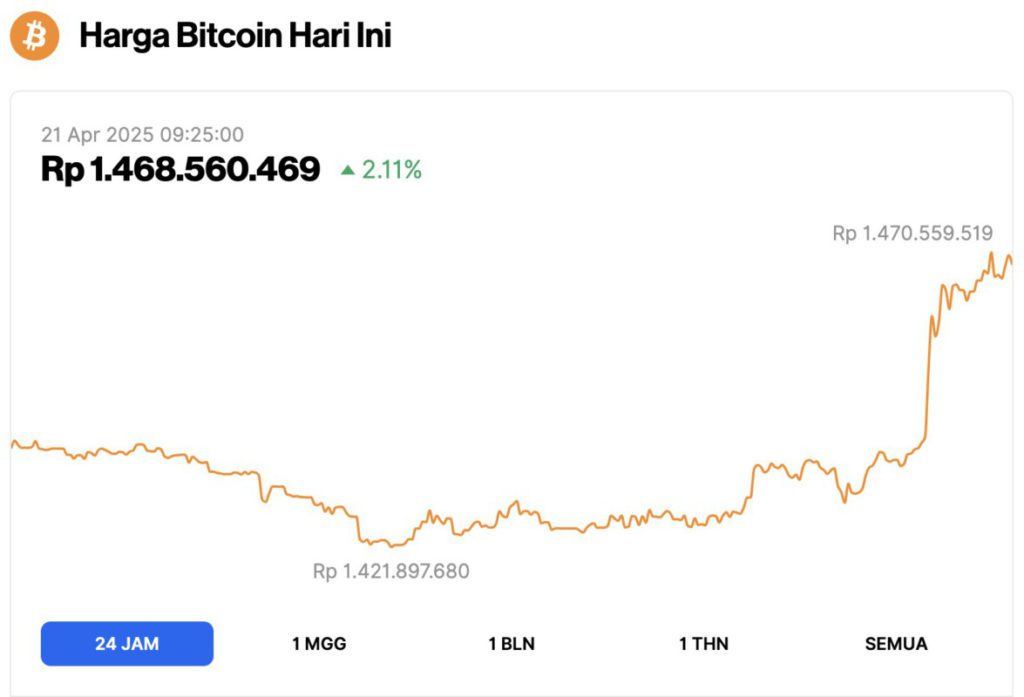

Bitcoin Price Rises 2.11% in 24 Hours

On April 21, 2025, Bitcoin (BTC) was trading at $87,373, equivalent to approximately IDR 1,468,560,469, marking a 2.11% increase over the past 24 hours. Throughout the day, BTC dipped to a low of IDR 1,421,897,680 and peaked at IDR 1,470,559,519.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $1.73 trillion, with trading volume in the last 24 hours also up 49% to $22.91 billion.

Read also: Top 5 Crypto Poised for Big Gains This Easter Holiday 2025

Bitcoin Price Shows Resilience Amid China’s Gold Rush

According to a post on platform X by Kobeissi Letter, China continues its gold accumulation trend. In the past month, the People’s Bank of China (PBoC) reportedly added five tons to its gold reserves.

While China’s gold buying spree has caught the attention of many, Bitcoin’s price has been boosted by this sentiment. Currently, Bitcoin is trading at around $87,000, despite being hit by various negative macroeconomic reports in recent days.

Four days ago, the price of Bitcoin and other crypto assets plummeted after US President Donald Trump imposed a 245% tariff on products from China.

However, after the PBoC announced its additional gold reserves, the Bitcoin price reversed course and rallied again, leaving many investors confused.

One possible reason for the rise in Bitcoin price is the growing perception of Bitcoin as a hedge asset, as China moves to reduce its reliance on the US dollar. Investors now see Bitcoin as an alternative to inflation risk.

Additionally, there is speculation that China may be moving towards establishing a Bitcoin Strategic Reserve. However, reports regarding China’s sale of 15,000 BTC through overseas exchanges cast a little doubt on the theory.

Gold Prices Skyrocket to Record Highs, Bitcoin Predicted to Follow Suit

Gold prices surged to new highs, fueling speculation that Bitcoin prices will follow suit.

Currently, gold is trading at around $3,326, having gained almost $100 in the past week. This surge has been driven by increased institutional interest in gold, with China being the main driver of this movement.

The tariff war between the United States and China is accelerating the hunt for hedge assets, with gold again becoming the top choice. On the other hand, Bitcoin is also expected to attract institutional attention as an alternative hedge asset.

However, market analyst Peter Schiff warned that Bitcoin is still in a bear market phase, dampening optimism that it will be able to replicate gold’s price surge.

In addition, the spot Bitcoin ETF experienced the largest outflows since its launch, although the Bitcoin price remained stable and showed resilience.

“A total of $4.8 billion has exited the ETF market since cumulative inflows reached their highest point,” said Darkfost crypto analysts. “However, BTC prices have so far held relatively steady, suggesting a limited reaction to this selling pressure.”

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price Flashes Brilliance As China Increases Gold Holdings By Five Tonnes. Accessed on April 21, 2025