Why the Crypto Market Is Surging Ahead of Today’s FOMC Meeting

Jakarta, Pintu News – The crypto market experienced a significant recovery in the past 24 hours, continuing its upward trend after recording a weekly gain of 1.58%. The market capitalization now stands at $3.03 trillion after this latest surge.

This rise comes ahead of the important United States Federal Open Market Committee (FOMC) meeting scheduled for today, January 28. The meeting will take place at 2:00pm local time (ET) and will be followed by a press conference by Fed Chairman Jerome Powell.

Reasons Why the Crypto Market is Surging

The crypto market is experiencing a significant surge today, triggered by several important developments. The Federal Reserve’s FOMC meeting taking place today has crypto markets bracing for possible policy changes. Investors are eagerly awaiting clues regarding interest rates as well as the views of Fed Chairman Jerome Powell.

Read also: Donald Trump Hints at Announcing New Fed Chair Soon and Promises Interest Rate Cuts!

In addition, the Crypto Market Structure Bill is up for a vote by the US Senate tomorrow, which adds to the regulatory uncertainty in the sector.

Interest in perpetual contracts also increased by 7.96%, indicating renewed interest in leveraged long positions. In addition, the now positive funding rate further indicates that the market is in a very bullish trend.

Some altcoins such as Hyperliquid (HYPE) and PIPPIN (PIPPIN) recorded tremendous growth of 20% and 60% respectively. This influx of high-risk assets with large potential returns is driving more capital into the industry, as well as increasing attention to altcoins.

Meanwhile, gold prices set a new record, reaching $5,283 per ounce on January 28. This surge in the precious metal helped boost investor confidence in various markets, including crypto.

Bitcoin Price Breaks $90 Thousand: ETH and XRP Poised for Potential Upside

The crypto market is showing signs of recovery this week after last week’s sharp correction. Bitcoin price surged past $90,000, Ethereum price traded above $3,000, and XRP price rose to over $1.90.

These three cryptocurrencies are the leaders by market capitalization and are approaching major resistance levels. If the prices manage to close strongly, the current uptrend could potentially continue. Specifically for XRP, if the bullish trend remains above $1.90, then the next resistance is at the $2.00 level.

Read also: 5 Cryptos That Surged as Much as 77% Today – January 28, 2026

The Next Crypto Market Direction

If Bitcoin price in the long term is able to hold above the $90,000 support level, it is likely to head towards the next resistance at $92,000. Meanwhile, Ethereum could gain stronger momentum if it is able to break the daily resistance at $3,020 and close above $3,100.

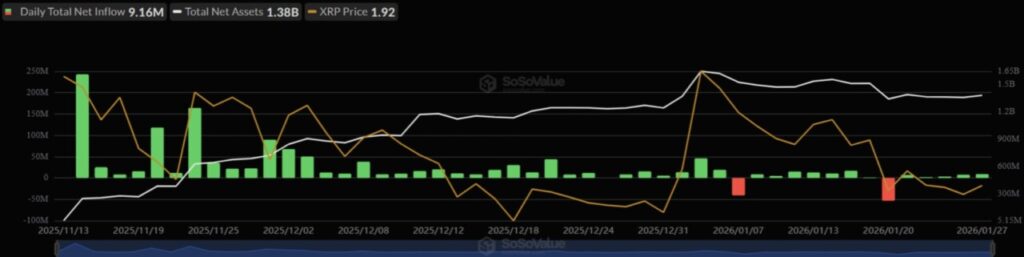

Other cryptocurrencies such as Binance Coin , Solana (SOL), and Dogecoin also performed positively with price rallies. In addition, the spot XRP ETF recorded high net inflows of 9.16 million, which also supported the positive sentiment of the market.

Overall, the current crypto market gains are fueled by expectations of the FOMC meeting and interest rate decision from the US Federal Reserve. Record gold prices hitting all-time highs as well as optimism towards altcoins are also fueling investor enthusiasm. The market is currently bullish with open interest continuing to rise.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Why is Crypto Market Up Today Ahead of FOMC Meeting? Accessed on January 28, 2026