Why does Bitcoin’s latest cycle feel different than the last?

Jakarta, Pintu News – Bitcoin seems to be transforming into a traditional asset. The regular cycle of Bitcoin supply cuts has been known to trigger large price spikes. However, recent cycles have shown a different dynamic, with more stable market trends and a more mature response to macroeconomic conditions.

Changing Dynamics of the Bitcoin Market

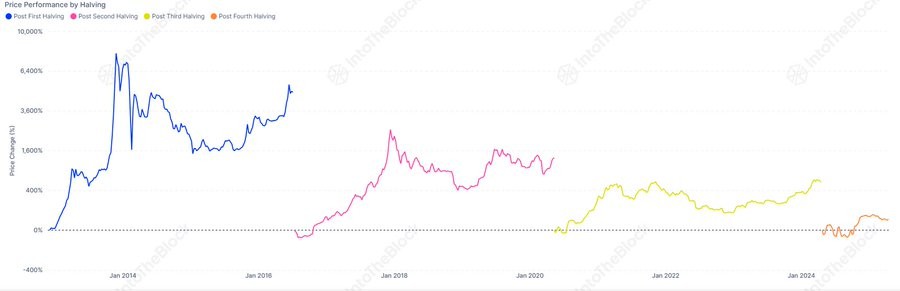

In the past, each cycle of Bitcoin (BTC) supply cuts has been followed by significant price increases. The first cycle recorded an increase of up to 6,400%, and the second cycle saw a decrease to 3,200%. However, in the third cycle, the increase only reached 1,200% and the most recent cycle was even lower, only around 100%.

This shows that the market is no longer reacting euphorically to supply cuts as before. With the entry of institutional players and the influence of macroeconomic factors, Bitcoin (BTC) is now behaving more like a mature financial instrument. Halving still plays a role in reducing supply and tightening supply, but it is no longer the main factor influencing the price.

Also Read: 7 Ways to Save Dollars (USD) for Maximum and Effective Use

Bitcoin and Sensitivity to Macroeconomics

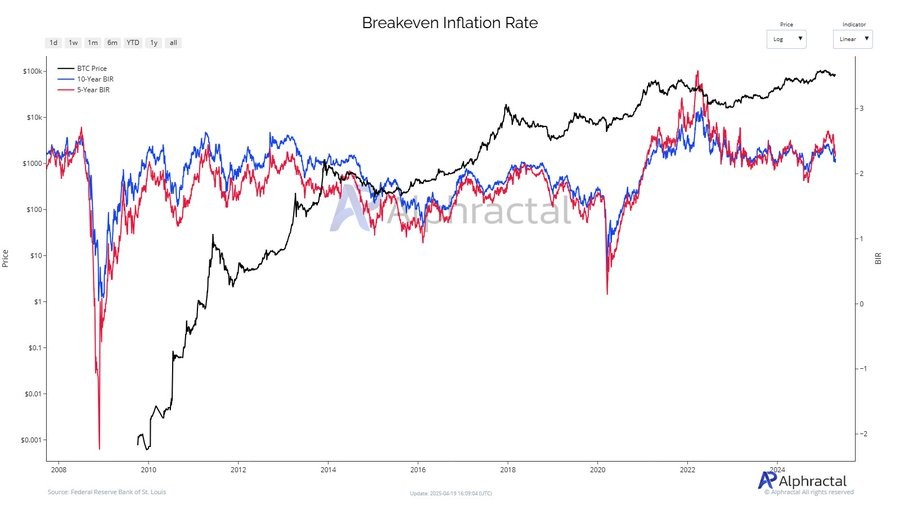

Today, Bitcoin (BTC) price is increasingly tied to liquidity cycles, interest rate expectations, and other macroeconomic signals. This signals that Bitcoin (BTC) is slowly being integrated into the traditional financial system. Its diminishing returns may not indicate weakness, but rather a shift in narrative.

Bitcoin (BTC) is now more sensitive to inflation expectations, especially through the expected inflation rates in the 5-year and 10-year timeframes. As inflation expectations rise, investors tend to look for alternatives to fiat currencies, which increases the appeal of Bitcoin (BTC) as a hedge.

Bitcoin’s Transformation in the Financial System

Bitcoin (BTC) was created as a bulwark against the failure of traditional finance and the threat of runaway inflation. However, in 2025, its behavior indicates a different story. Instead of acting as a pure inflation hedge, Bitcoin (BTC) is becoming increasingly sensitive to the very forces it previously sought to avoid: Federal Reserve policy, liquidity cycles, and real interest rates.

Increased institutional adoption and an influx of macro-conscious capital means Bitcoin’s (BTC) price is now more reflective of changes in policy tone, rather than just mining mechanics or inflation data. This suggests a deeper and more intertwined reflection.

Conclusion: The Future of Bitcoin in Finance

While the core of Bitcoin (BTC) has not changed, the market it is traded in and the way it is valued has. Bitcoin (BTC) may still be considered “digital gold”, but its exchange rate now fluctuates with the same macro levers that drive equities. This is the price to pay for maturity.

Also Read: 7 Ways to Get Passive Income from Crypto 2025, Simple!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Why Bitcoin’s latest cycle feels unlike the rest. Accessed on April 21, 2025

- Featured Image: Generated by AI