7 Ways to Earn Passive Income from Crypto 2025, Simple!

Jakarta, Pintu News – Having passive income from crypto assets is becoming increasingly popular, especially amidst the development of blockchain technology and the growing number of opportunities in the Web3 world.

Beyond just buying and storing crypto assets, there are now many ways to earn passive income from crypto, from staking, lending, to yield farming.

Each method has its own potential benefits and risks, so it’s important for investors to understand how they work before jumping in.

In 2025, the opportunities to earn passive income from crypto are increasingly diverse and accessible, even for beginners. Here are some ways that can be an option to get passive income from crypto in a wiser and more measured way, as long as you understand the risks!

1. PoS (Proof of Stake) Staking

Staking is the process of locking crypto assets on a Proof of Stake (PoS) based blockchain network with the aim of helping validate transactions and maintain network security. As a form of appreciation, users who do staking will be rewarded with crypto coins from the blockchain.

This has become one of the most popular methods of earning passive income from crypto assets, while directly contributing to the stability and security of the blockchain ecosystem.

Interestingly, not all PoS networks require users to run their own validator nodes. In the Delegated Proof of Stake (DPoS) system, anyone can participate in staking by simply delegating their crypto assets to a validator of choice.

Later, the validator will be in charge of processing transactions and building blocks, then distributing staking rewards proportionally to delegators. This system makes staking easier, more affordable, and can be participated in by anyone, without the need for special devices or complicated technical knowledge.

2. Airdrop

Airdrops are a way for crypto projects to distribute free tokens to their community as a form of promotion or appreciation. Usually, airdrops are given to users who have already interacted with a particular platform.

One recent example is the airdrop of Sonic SVM (SONIC) in late December 2024. In that program, SONIC tokens were distributed to users who had used Sonic SVM, a gaming-based Layer 2 network in Solana, including those who played SonicX games through TikTok.

To get an airdrop, users generally only need to complete a few simple tasks, such as following social media, trying out certain features, or simply creating a wallet.

If you want to find info about the latest airdrops, you can monitor sites like Airdrops.io or Airdrop Alert by using Pintu Web3 Wallet. Unlike traditional crypto wallets that are limited to buying and selling and storing assets, Pintu Web3 Wallet provides a much more complete and flexible experience.

Users can easily access various crypto assets, interact directly with various DeFi platforms and dApps, and have full control over assets without third-party intervention.

Exploring the world of Web3 is safer and more practical because the Web3 Wallet Door is supported by many blockchain networks, does not require a troublesome seed phrase, and is equipped with advanced security systems such as MPC technology, cloud backup, and Web3 Firewall protection.

You can check how to hunt airdrops through the Web3 Wallet door here.

3. Cloud Mining

Cloud mining is a way of mining crypto assets without the need to have your own hardware. In general, mining activities require special tools with high specifications and a lot of money. Through cloud mining, the process becomes more practical because there is no need to buy or manage mining equipment directly.

The concept of cloud mining is quite simple. Users only need to rent mining services from certain service providers by paying a subscription fee, either on a monthly or annual basis. Later, the service provider will run the mining process using their devices, and the mining results will be shared according to the agreed portion.

Although it seems practical, choosing a cloud mining service provider should not be done carelessly. It is very important to choose a platform that is credible, reputable, and transparent in its operations. This aims to minimize the risk of fraud or losses due to unaccountable services.

In addition, before deciding to join cloud mining, each prospective user also needs to do in-depth research. Understanding how cloud mining works, the potential benefits, and the risks that come with it is an important step.

Because, like investing in other crypto assets, cloud mining also has a number of risks, ranging from asset price fluctuations, regulatory uncertainty, to potential operational failures from service providers.

4. Crypto Lending

Crypto lending has become one of the most popular ways to earn passive income from digital assets. The mechanism is quite simple, namely by depositing crypto assets into certain platforms to lend to other users. In return, the lender or lender will receive interest from the loaned assets.

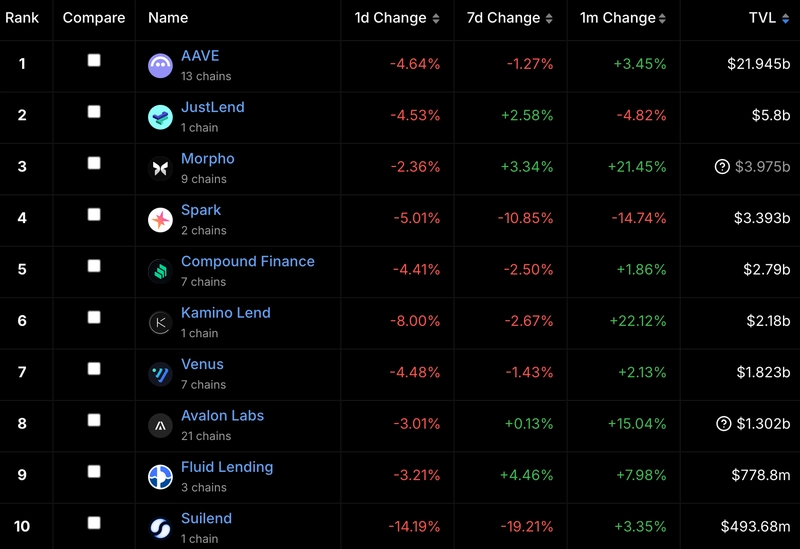

Here are the 10 largest crypto asset lending and borrowing platforms by Total Value Locked (TVL) as of January 27, 2025:

In general, there are two types of crypto lending platforms that can be used, namely Decentralized Lending and Real-World Asset (RWA) Lending.

Decentralized Lending

Decentralized lending is the most widely used type of crypto asset lending in the DeFi (Decentralized Finance) world. Through this platform, lenders simply deposit crypto assets into a liquidity pool. The funds can then be borrowed by other users, and the lender will benefit in the form of interest.

Some of the largest decentralized lending platforms today include Aave , JustLend , and Morpho (MORPHO). These platforms usually have automated systems to maintain the availability of funds (liquidity), ensure asset security, and manage collateral from borrowers. With this system, lenders can rest assured that their funds are managed transparently and safely.

Real-World Asset (RWA) Lending

Apart from lending crypto assets directly, there is also an RWA Lending option that allows lenders to lend funds to real businesses or companies in the offline world. Companies that wish to borrow from these platforms usually go through a rigorous selection and audit process to ensure their eligibility and credibility.

Just like decentralized lending, lenders on the RWA lending platform will also benefit from interest. The difference is that the funds lent are used to support real-world businesses that have cash flow. Some popular RWA lending platforms include Goldfinch , Maple Finance , and Centrifuge (CFG).

5. Masternodes

Masternodes are one way to earn passive income from crypto assets, but with a higher level of difficulty than other methods. In simple terms, a masternode is a specialized server whose role is to assist in the operation and security of the blockchain network.

Masternodes not only maintain network security, but also have additional functions such as speeding up the transaction process, increasing privacy, and taking part in the voting or decision-making system in the blockchain ecosystem.

To be able to run a masternode, a significant amount of capital is required because you have to stake a certain amount of crypto assets according to network rules. In addition, technical skills are also needed, especially for the installation process, server settings, and keeping the masternode active (online) without interruption.

Although there is no need to monitor the server at all times, masternode operators must still routinely check network conditions and ensure that the server continues to run optimally. By maintaining masternode performance, operators are entitled to rewards from the network as a form of appreciation for their contribution.

6. NFT Royalties

NFT royalties are one way for creators and artists to earn passive income from their digital works. Through this mechanism, creators will receive a percentage of the profits whenever their NFTs are resold on the secondary market. So, the more often the NFT changes hands, the greater the potential income that can be earned.

The potential income from NFT royalties is highly dependent on the popularity and demand for NFTs. The NFT market itself is known to be very volatile and not very liquid, especially since the NFT trend has decreased after the boom in 2021/2022.

Therefore, the opportunity to earn income from NFT royalties can vary greatly, depending on market conditions and how actively the NFT is traded.

For a more practical experience managing NFTs and crypto assets, users can utilize Pintu Web3 Wallet. Through Pintu Web3 Wallet, users can connect directly with various DeFi platforms and dApps, manage NFT collections easily, and have full control over crypto assets without intermediaries.

Interestingly, Pintu Web3 Wallet also allows users to connect to various popular NFT marketplaces, including OpenSea. The method is also very easy:

- Click on the WalletConnect feature available in the Pintu Web3 app.

- Then scan the QR Code that appears on OpenSea

- Within seconds the wallet is connected and ready to use.

7. Yield Farming

Yield farming is one of the most popular ways to earn passive income in the crypto world, especially on DeFi (Decentralized Finance) platforms. In simple terms, yield farming is done by lending or staking crypto assets into certain platforms to provide liquidity. In return, users will benefit in the form of interest or additional tokens from the platform.

The advantage of yield farming lies in its flexibility and high profit potential. Users can easily move their assets to other platforms or liquidity pools that offer higher yields, so the opportunities for profit are also wide open.

However, despite the potential benefits, yield farming also comes with risks that need to be considered. Highly volatile crypto price movements and potential security holes in smart contracts can lead to losses.

In addition, there is also the risk of impermanent loss, which is a condition where the value of assets stored in the liquidity pool may be lower than if they were just stored normally. Therefore, yield farming is more suitable for users who already understand the risks in the DeFi world and are ready to actively monitor their assets.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing.All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Bybit Learn. Top 13 Crypto Passive Income Strategies of 2025. Accessed April 8, 2025

- Blockpit. Passive Income from Crypto: 9 Easiest Ways to Earn in 2025. Accessed April 10, 2025

- The Crypto Basic. Top Strategies To Earn Passive Income From Crypto Assets. Accessed April 8, 2025

- Featured Image: Generated by AI