XRP Towards $2.60: Liquidation Zone and Potential Breakout in Late April 2025

Jakarta, Pintu News – Ripple is now in the spotlight in the crypto market with strong indications of reaching $2.60. After a long period of consolidation, Ripple (XRP) is showing a promising bullish pattern. Increased interest from whales and derivatives activity are the catalysts driving this positive sentiment. Recent technical analysis suggests that Ripple (XRP) has great potential to surge higher.

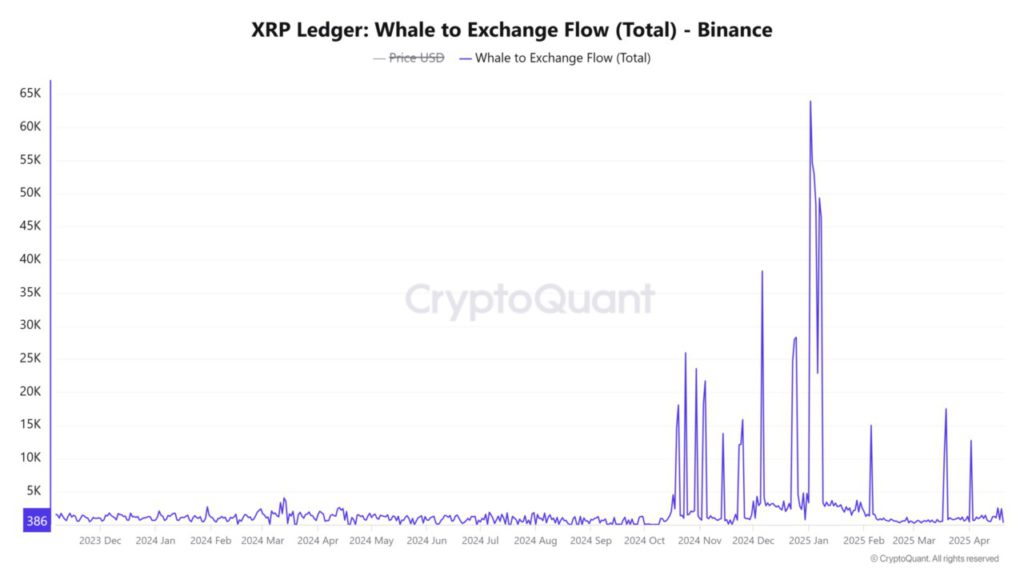

Whale and Flow to the Exchange

Recently, there was an increase in Ripple (XRP) flows to exchanges by 0.51%, totaling 2,880 Ripple (XRP). This increase indicates that whales are starting to reposition their assets in the market. This activity could be in preparation for a larger price movement. These large investors often influence market dynamics through their large transactions.

On the other hand, this increase has also led to speculation among traders about potential price increases. When whales start shifting their Ripple (XRP) to exchanges, this is often interpreted as a bullish signal. However, it is important to remain vigilant and monitor further market movements to confirm this trend.

Also Read: Bitcoin Continues to Thrive Amid Crypto Market Fears: The Impact of Inflation Fears on Crypto

NVT Indicator and Warning Signal

The NVT (Network Value to Transactions) ratio for Ripple (XRP) has surged by 136.83%, reaching a value of 838.17. This spike raises a short-term warning signal that should not be ignored. A high NVT ratio could indicate that the current market value may not be supported by sufficient transaction volume. This could be an indicator that the price is currently overvalued.

However, in the context of the crypto market, these indicators can also indicate the early phases of wider adoption or increased speculation. Therefore, it is important for investors to analyze deeper and not just rely on one indicator. Understanding the context behind changes in the NVT ratio will provide better insight into potential risks and opportunities.

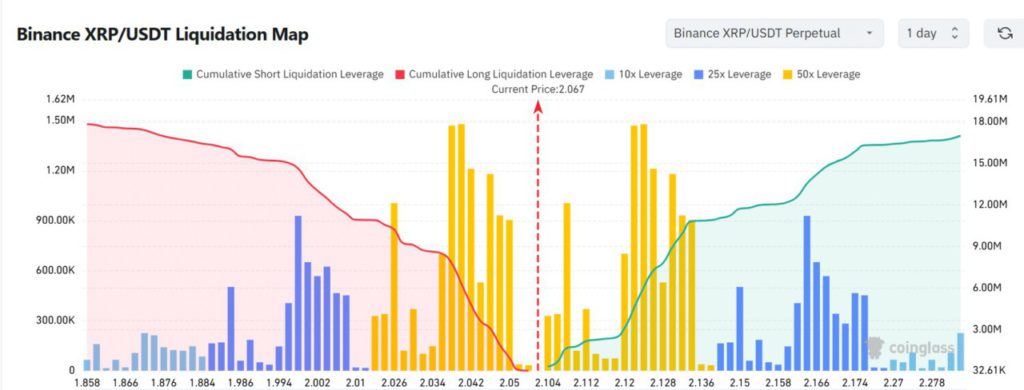

Liquidation Zone and Breakout Potential

Liquidation data from Binance shows a concentration of short liquidation between $2.03 and $2.10. This zone is critical because if Ripple (XRP) can break the upper limit of this zone, there is a huge potential for a further breakout. This breakout could trigger a mass closing of short positions, which in turn could push the price of Ripple (XRP) up significantly.

Observation of these liquidation zones is crucial as it can provide clues as to where selling pressure may begin to ease. Investors and traders should monitor these areas closely to identify opportunities to enter the market or take advantage of increased volatility.

Conclusion

With all factors considered, Ripple (XRP) shows potential driven not only by speculation but also by fundamental changes in the market. Rising interest, whale activity, and technical indicators support a bullish view. However, it is important to stay alert to warning indicators and prepare a strategy that suits the dynamic market conditions.

Also Read: Cardano Price Explosion Potential According to Analysts: Repeat 2021 Surge, Target $16?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. XRP bulls eye $2.60, one move can trigger a major squeeze. Accessed on April 21, 2025

- Featured Image: Track Insight