60 New Bitcoin Whales Are Amassing Assets: What Secrets Do They Know?

Jakarta, Pintu News – Increased whale interest in Bitcoin suggests the potential for significant price increases in the near future. With institutions getting back into the game and long-time holders staying put, the current market dynamics offer interesting insights into the future of Bitcoin (BTC).

Whale Interest in Bitcoin Increases

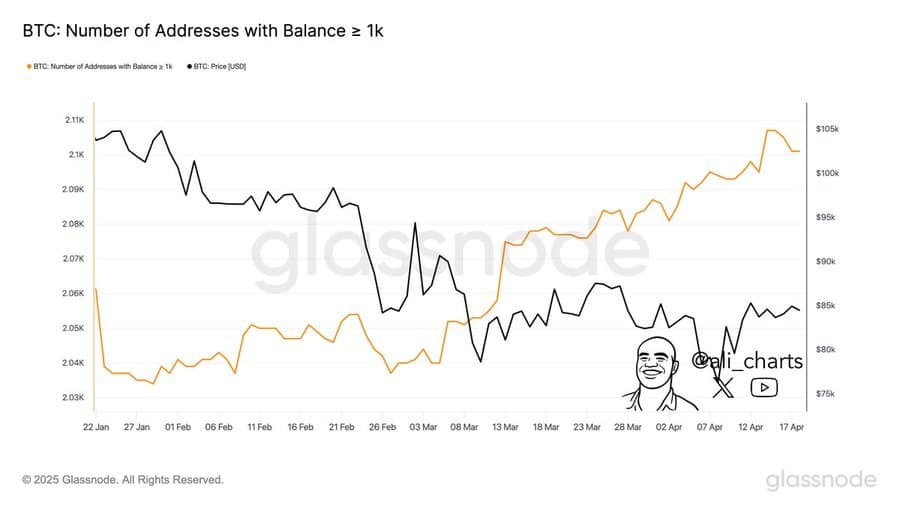

The past few months have seen a significant increase in whale interest in Bitcoin (BTC). Since early March, analysis shows that new whales have entered the market and started accumulating Bitcoin (BTC). To date, there are 60 investors who have bought no less than 1,000 Bitcoin (BTC) each, with a total value of about $85 million.

This increase comes at a time when the price of Bitcoin (BTC) is well below its all-time high, indicating that these large investors see an undervaluation in the asset. This activity is all the more interesting given the overall decline in crypto market liquidity.

Also Read: Bitcoin Continues to Thrive Amid Crypto Market Fears: The Impact of Inflation Fears on Crypto

Institutions and Key Whales in Action

It’s not just whales that are capitalizing on the Bitcoin (BTC) price drop. Analysis from AMBCrypto identified one whale, known as “Abraxas Capital Mgmt”, has been actively accumulating Bitcoin (BTC). Since early April, this whale has increased its Bitcoin (BTC) holdings from $2.8 million to $253 million, confirming a strong investor bias towards the asset.

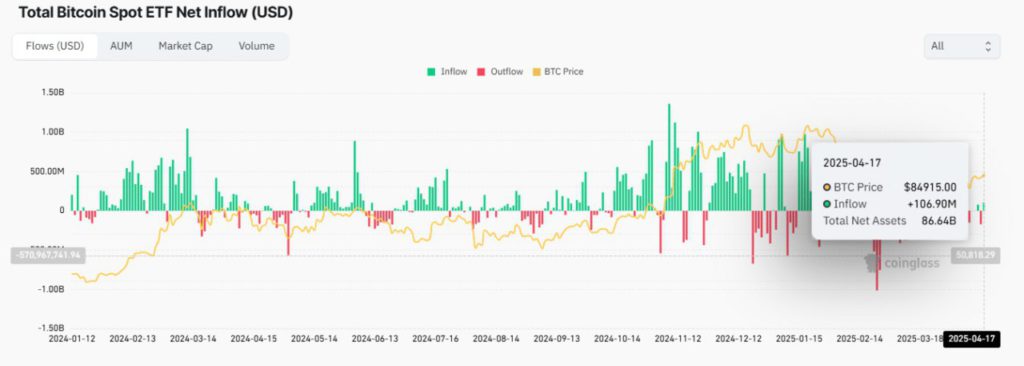

On the other hand, institutional investors have also reduced their selling and ended the week with inflows into the Bitcoin (BTC) ETF. Analysis shows that this group bought $106.90 million worth of Bitcoin (BTC) by the end of the week. If the accumulation by whales and institutions continues, the value of Bitcoin (BTC) could increase, potentially triggering a rally.

Long-Term Traders Buy

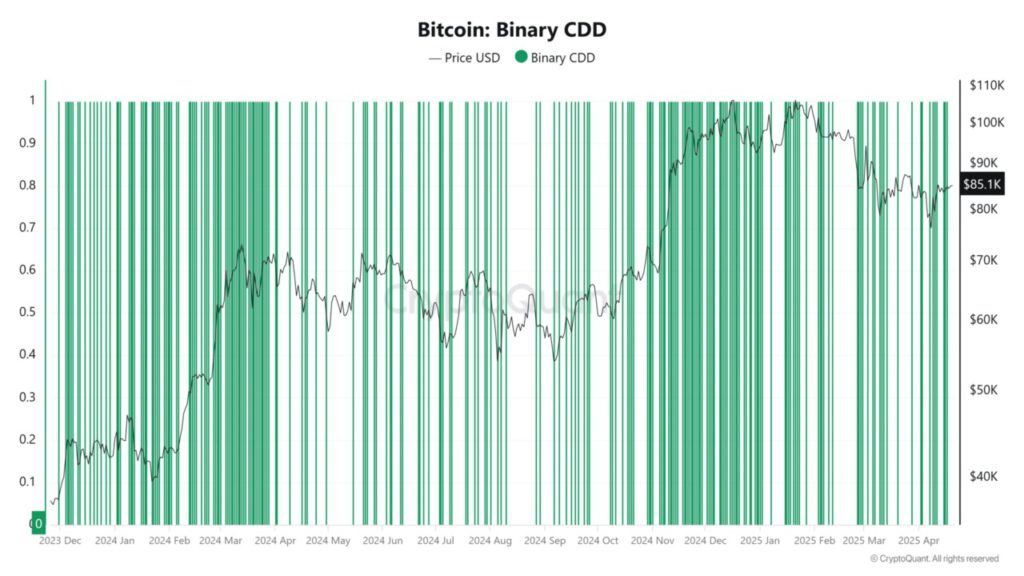

To determine whether this accumulation is temporary or sustainable, AMBCrypto examined the behavior of long-term holders. Using Bitcoin’s (BTC) Coin Days Destroyed (CDD) metric, which indicates whether long-term holders are selling or holding, it found that the CDD trend is close to zero-indicating that long-term holders are not selling.

In fact, they have continued to hold their positions, even through a volatile market. With whales accumulating, institutions re-engaging, and long-term holders staying put, Bitcoin (BTC) has emerged as a major liquidity magnet in a drying market.

Conclusion

With a variety of strong supporting factors, Bitcoin (BTC) may not only be able to withstand this challenging market, but may also be gearing up for its next rally. Significant accumulation activities by whales and institutions, along with the resilience of long-term holders, offer promising prospects for the future of Bitcoin (BTC).

Also Read: Cardano Price Explosion Potential According to Analysts: Repeat 2021 Surge, Target $16?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. 60 new Bitcoin whales are loading up, what secrets do they know?. Accessed on April 21, 2025

- Featured Image: Generated by AI