Bitcoin Price Climbs to $88,000 Level Today (4/22/25): BTC Whales are Actively Accumulating!

Jakarta, Pintu News – The price of Bitcoin recently recorded a record monthly high by breaking through the $87,000 level (21/4), marking a significant surge for the crypto king.

The rise was driven by favorable macroeconomic conditions as well as increased confidence from major investors.

However, on the back of this growth, profits realized by long-term holders fell to a two-year low. This hints at greater caution among some market participants.

Then, how is the Bitcoin price traveling today?

Bitcoin Price Rises 1.33% in 24 Hours

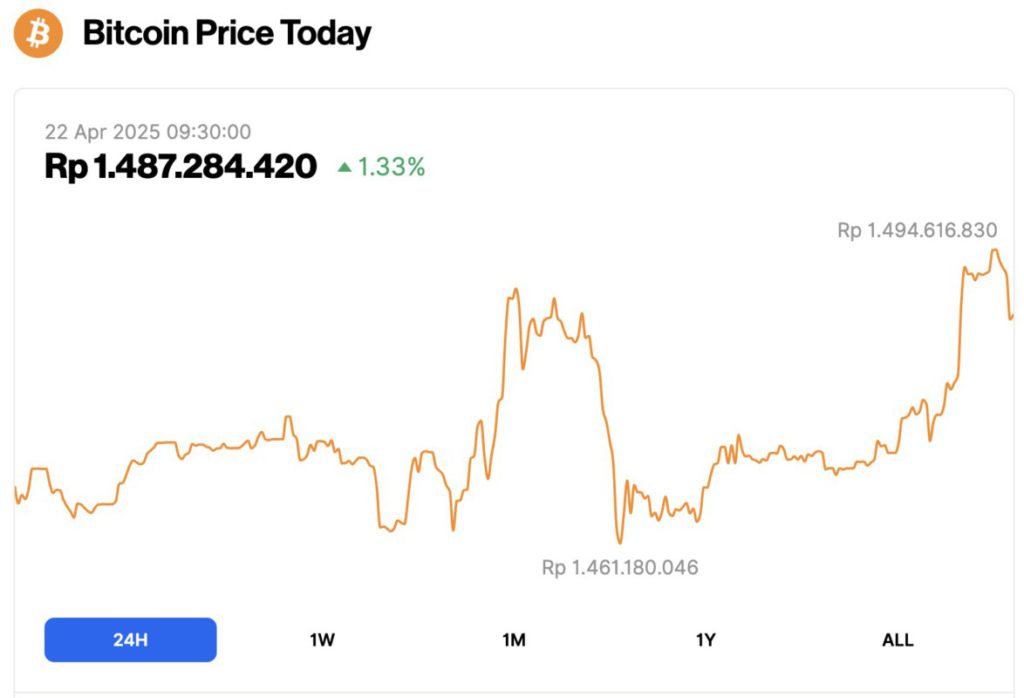

As of April 22, 2025, Bitcoin (BTC) was trading at $88,011, or approximately IDR 1,487,284,420, marking a 1.33% increase over the past 24 hours. During this time, BTC reached a low of IDR 1,461,180,046 and climbed to a high of IDR 1,494,616,830.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $1.74 trillion, with trading volume in the last 24 hours also up 66% to $38.45 billion.

Read also: Gary Gensler: Bitcoin (BTC) will Survive While Other Altcoins will Fade Away!

Bitcoin Whales Remain Optimistic

Whale and shark wallet addresses – which hold between 10 and 10,000 BTC – continue to actively accumulate Bitcoin at lower price levels. Over the past month, these groups have bought around 53,652 BTC, valued at nearly $4.7 billion.

This massive buying activity shows that large investors are capitalizing on Bitcoin’s price drop, with confidence in the asset’s long-term potential.

This accumulation action from large investors is a strong signal that they still believe in Bitcoin’s growth.

While some market participants may be skeptical due to recent price fluctuations, large holders seem to be positioning themselves for future gains.

Bitcoin MVRV Indicator at 2-Year Low

Meanwhile, the MVRV Long/Short Difference indicator – which measures the difference in realized profits between short-term holders (STH) and long-term holders (LTH) – is now at a two-year low.

This shows that the market is currently dominated by short-term holders. The dominance of STHs in realizing profits is often a sign that the market is in a sell-ready phase, which has the potential to push down the price of Bitcoin further.

With the MVRV indicator dropping below the zero line, there is an added risk that Bitcoin’s price could be negatively impacted if short-term holders start selling.

Although the whales continue to add to their holdings, the dominance of short-term holders may trigger higher volatility, especially if market sentiment changes direction.

Read also: Made in the USA: 3 Hot Cryptos Every Trader Is Watching!

Bitcoin Price Aims for $90,000

As of April 21, 2025, Bitcoin was trading at around $87,463, still holding above the important support level of $86,822. Previously, Bitcoin’s failure to maintain this level caused a sharp price drop.

However, if Bitcoin manages to continue to hold above $86,822, there is a high chance of continuing its rise towards the next resistance around $89,800.

Breaking the $90,000 level is the next important target for Bitcoin. If Bitcoin is able to turn the $90,000 level into new support, the uptrend is likely to continue.

This psychological level is crucial to strengthen investor confidence and encourage further price increases.

Conversely, if the selling pressure strengthens and Bitcoin fails to hold the support at $86,822, the price could potentially drop deeper.

The next support is at $85,204; if this level is also broken, Bitcoin could fall to the $82,503 range, erasing most of the gains recently achieved.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Whales Buy $4.7 Billion BTC in A Month; Price Rises To $87,400. Accessed on April 22, 2025

- Cointelegraph. Bitcoin whales, pundits continued to stack throughout April, data shows. Accessed on April 22, 2025