Bitcoin Open Interest Explodes by $3.1 Billion — Is a Massive Rebound Next?

Jakarta, Pintu News – As of April 21, 2025, Bitcoin has experienced a significant price spike in the last few hours, breaking through the $87,600 level after previously staying around $84,500 throughout the day.

The rise to $87,600 is the highest price recorded since April 2 and indicates a return of upward momentum in the market.

Furthermore, this rise coincided with a huge surge in open interest and activity in the derivatives market.

Sharp Spike in Bitcoin Open Interest

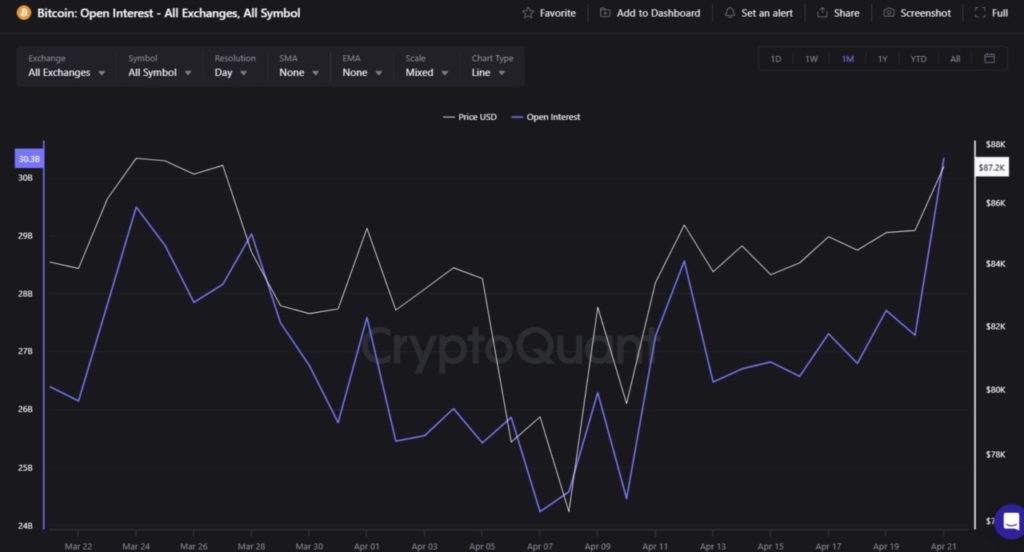

Based on data from CryptoQuant, Bitcoin’s recent price rally was significantly supported by an increase in open interest, which jumped by $3.1 billion in the last 24 hours (4/21/25).

Read also: Michael Saylor Strikes Again: Snaps Up 6,556 Bitcoin Worth $555 Million — MSTR Stock Soars!

This sharp spike indicates that traders are starting to leverage their positions, anticipating a potential continuation of the price rise.

Previously, Bitcoin’s open interest had decreased from around $29.2 billion to $24 billion between March 22 and April 10. However, after April 10, the open interest figure gradually increased again, until it reached $30.4 billion on April 21 – the highest figure since early February.

This increase in open interest is in line with Bitcoin’s price movements, showing a strong positive correlation between the two. Open interest itself reflects the total value of contracts still open in the market, and its spike indicates that new capital is flowing into the market amid increased trading activity.

However, an increase in open interest does not necessarily mean stronger market sentiment.

If open interest rises while Bitcoin’s price falls, this could be a bearish signal. But in the current situation, where open interest is surging along with the price, this trend is generally considered bullish, as it shows that more and more market participants believe in Bitcoin’s recovery and are taking positions in anticipation of further upside potential.

Growth Explodes in the Bitcoin Options Market

The Bitcoin options market also recorded a huge surge in trading activity, with options trading volume increasing by 346.73%, reaching $3.57 billion.

This increase in volume indicates that traders are hedging their positions or speculating on higher price volatility.

In addition, open interest in the options market also grew by 3.84%, now reaching $32.35 billion. This increase shows that more traders are maintaining positions in Bitcoin options, reflecting the generally more bullish view of the market towards the asset.

The long/short ratio in the last 24-hour period (21/4) stood at 1.0644, which means there were slightly more accounts that went long than short.

Long-term Bitcoin Accumulation

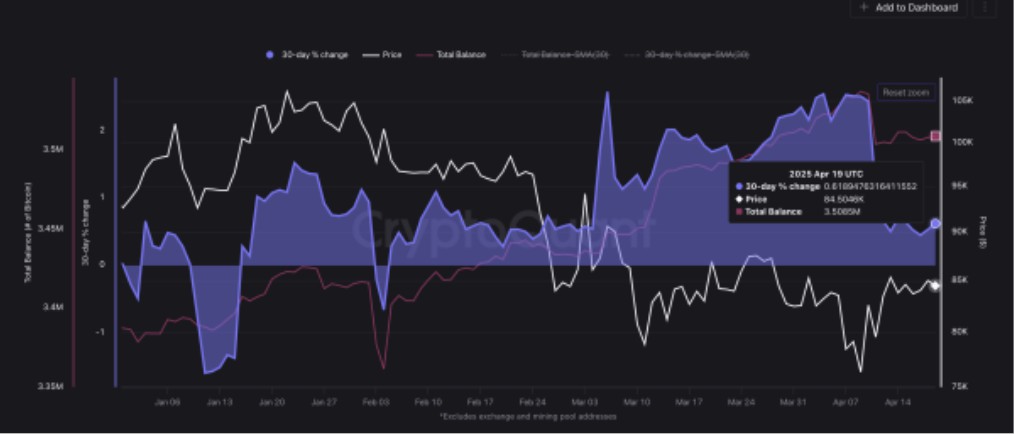

Amidst market fluctuations, Bitcoin holdings by whales have shown steady growth.

Read also: Robert Kiyosaki: Bitcoin Price Could Reach $180,000 to $200,000 by 2025!

Data from CryptoQuant revealed that whale holdings increased from 3.3865 million BTC on January 1 to 3.5085 million BTC on April 19, reflecting a continued upward trend.

Although the 30-day peak had reached 3.53 million BTC, the percentage increase in whale ownership in the last 30 days was recorded at 0.62%.

This consistent accumulation supports the view that there is potential for a long-term bullish trend for Bitcoin.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinGape. Bitcoin Open Interest Climbs to $58B, What It Means for BTC Price. Accessed on April 22, 2025

- The Crypto Basic. Bitcoin Open Interest Jumps by $3.1B to $30B, Here’s What This Means for the Ongoing Rebound. Accessed on April 22, 2025