Bitcoin Hits $90K Again Today (April 23) — Is This the Start of a Massive Bull Run?

Jakarta, Pintu News – Bitcoin broke through the $90,000 level for the first time since March 5, driven by technical signals that increasingly point to an uptrend.

This latest rise was supported by a sharp spike in the ADX indicator, the formation of a bullish pattern on the Ichimoku Cloud, as well as the alignment of the EMAs indicating further upside potential.

Stronger buying pressure than selling pressure, plus fund inflows into ETFs reaching the highest level in three months, suggest that market sentiment is currently leaning towards optimism.

If the resistance level is successfully crossed, BTC has the opportunity to head towards $100,000, strengthening its role as a hedge asset amid global market uncertainty.

Bitcoin Price Up 5.53% in 24 Hours

On April 23, 2025, Bitcoin (BTC) surged to $92,892, equivalent to approximately IDR 1,569,864,447, marking a 5.53% gain over the past 24 hours. Throughout the day, BTC fluctuated between a low of IDR 1,485,330,080 and a peak of IDR 1,581,950,980, reflecting renewed bullish momentum in the market.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $1.84 trillion, with trading volume in the last 24 hours also up 48% to $56.96 billion.

Read also: Bitcoin Open Interest Explodes by $3.1 Billion — Is a Massive Rebound Next?

Bullish Dominance Returns, ADX Shows Strong Trend in Bitcoin

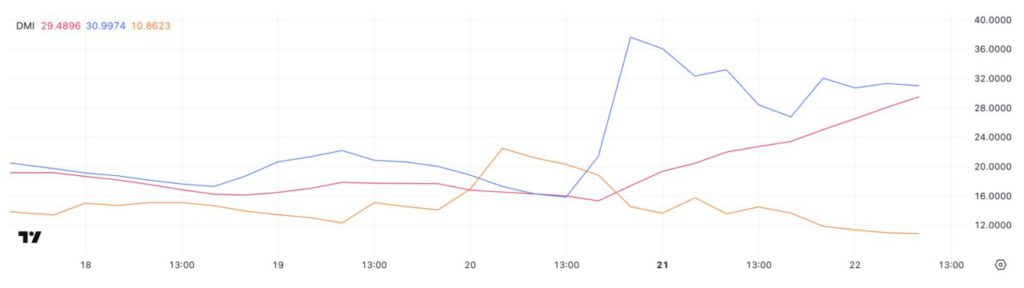

Bitcoin’s Directional Movement Index (DMI) indicator signaled a significant shift in momentum, with the ADX value jumping sharply to 29.48 – up from just 15.3 two days ago.

The ADX(Average Directional Index) itself measures the strength of a trend regardless of its direction. Values below 20 reflect a weak or sideways-moving market, while numbers above 25 indicate that a strong trend is forming.

With the ADX now approaching 30, the price action is now showing strength, confirming that the direction of the trend is becoming clearer.

Digging deeper into the DMI component, the positive directional indicator (+DI) currently stands at 30.99 – almost double from 15.82 two days ago, although slightly down from yesterday’s peak of 37.61.

This shows that buying pressure had surged sharply, but has eased slightly in the past 24 hours. On the other hand, the negative directional indicator (-DI) dropped dramatically to 10.86 from 22.48 previously, signaling that selling pressure weakened significantly.

The combination of a strong ADX and a high +DI, along with a falling -DI, indicates that the market is currently dominated by bulls. If this trend holds, it is likely that Bitcoin will continue its rise in the short term.

Read also: Michael Saylor Strikes Again: Snaps Up 6,556 Bitcoin Worth $555 Million — MSTR Stock Soars!

Bitcoin Trend Strengthens, Bullish Signals Become Clearer

The Ichimoku Cloud chart for Bitcoin shows a strong bullish signal. The current price movement is well above the Kumo area , which signals solid upside momentum.

The Ichimoku cloud itself has changed color from red to green, reflecting a shift in sentiment from bearish to bullish.

The Tenkan-sen line (blue line) remains above the Kijun-sen (red line), reinforcing the bullish bias in the short term. The widening distance between the two lines is also an indicator that the strengthening momentum continues.

Moreover, the upward-pointing shape of the future clouds (Senkou Span A and B) hints that this uptrend is likely to persist as long as the current conditions do not change.

The Chikou Span line (trailing green line) is also above the price candles and clouds, confirming the trend alignment from a trailing indicator perspective.

All of these elements point to a healthy uptrend, with no signs of reversal in the near future-unless there is a sharp drop below Tenkan-sen or Kumo.

Bitcoin Poised to Break New Levels Amid Strengthening Bullish Momentum

Bitcoin’s EMA (Exponential Moving Average) line shows a bullish configuration, with the short-term average being above the long-term average-signaling strong upward momentum.

Read also: Sell These 4 Crypto Fast If Japan Turns Its Back on U.S. Demands!

Currently, Bitcoin price is approaching an important resistance area at $92,920. If it is able to break through this zone, the opportunity for further gains is wide open.

With buying pressure on the rise and fund inflows into Bitcoin ETFs recording a three-month high, the next upside target is expected to be around $96,484.

The current market structure suggests that the bulls are still in control, as long as support levels are maintained and the upward momentum continues.

According to Tracy Jin, COO of crypto exchange MEXC, Bitcoin’s recent performance has revived its nickname as “digital gold”:

“Bitcoin’s recent strength amid broad market turmoil has reawakened its status as the long-dormant ‘digital gold’. With US stocks slipping back to tariff-era lows, and the US dollar slumping to its three-year nadir, Bitcoin’s ability to post gains is changing investors’ outlook,” Jin said.

However, if the trend loses steam and a reversal occurs, Bitcoin could potentially experience a short-term correction to the support level at $88,800.

If the price drops below this level, the technical structure will weaken and the risk of a deeper correction will increase. The next important areas to watch are $86,532 and $83,133.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Breaks Above $90,000 After 7 Weeks – What’s Next? Accessed on April 23, 2025