Bitcoin Dominance (BTC.D) Reaches 64.5%, What Does It Mean for Altcoins?

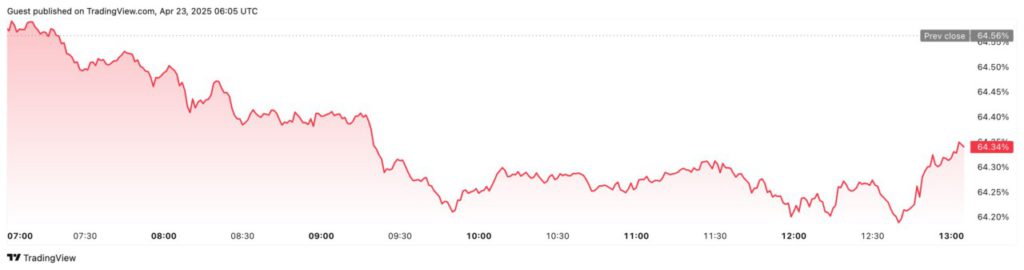

Jakarta, Pintu News – In recent weeks, BTC.D in the crypto market reached its highest level in more than four years, raising questions about the future of the altcoin.

Analysts are divided in their views as to whether this will be an opportunity for altcoins to rise or whether Bitcoin will continue to dominate the market. With BTC.D hitting 64.5%, many are wondering if this trend will continue.

Check out the full analysis below!

Bitcoin Dominance (BTC.D) Analysis

BeInCrypto reported that Bitcoin Dominance (BTC.D) has reached a new peak that has not been seen in the past four years. Mister Crypto, a well-known analyst, said that BTC.D looks set to face rejection at a major trend line.

If this happens, it could be a turning point for altcoins to start rallying. However, not all analysts agree with this view. Instead, Merlijn The Trader, another analyst, argues that BTC.D will soon collapse, triggering the beginning of the altcoin season.

Nonetheless, this prediction remains to be proven, given the current market trends that strongly favor Bitcoin. Investors and analysts should remain vigilant to any changes that may occur.

Also read: Ronin Network Launches Latest Security Migration with Chainlink CCIP!

Scott Melker’s View on the Current Market Cycle

Scott Melker, host of The Wolf Of All Streets podcast, argues that the current market cycle is very different than before. According to Melker, the flow of new money into Bitcoin is coming from a variety of sources, including retail, institutions, and even governments, which is not trickling down to altcoins.

This indicates a fundamental change in the way the crypto market operates. Melker added that the altcoins’ decline against Bitcoin is more due to altcoins selling out of necessity rather than capital shifting to Bitcoin.

This signals a “capitulation” where investors abandon altcoins due to financial pressure, rather than market strategy. This approach suggests that altcoins may need external capital injections to recover.

Also read: Healthy Correction or Bull Trap? Bitcoin (BTC) Aims for Resistance at $90,000!

Bitcoin as an Inflation Hedge

With inflation concerns on the rise, Bitcoin is increasingly seen as a store of value. One analyst stated that this cycle might turn Bitcoin from a risky asset to an inflation hedge. This is supported by Bitcoin’s impressive performance, with the price surging past $87,000 recently.

In addition, the decline in the US Dollar Index (DXY) has also fueled the rise in Bitcoin prices. With economic conditions becoming increasingly uncertain, Bitcoin and gold are emerging as safe havens.

Gold alone reached a new record high of $3,456, indicating that these two assets are the top choice for investors seeking safety in their investments.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Dominance and Altcoin Growth. Accessed on April 23, 2025

- Featured Image: Generated by Ai