Ferocious Fight in the HYPE Market: Who Will Win?

Jakarta, Pintu News – The cryptocurrency market is always full of interesting dynamics, and this time, the battle between retail traders and big players or “whales” in Hyperliquid cryptocurrency is in the spotlight. With unpredictable price movements, the two camps are trading strategies to win their bets.

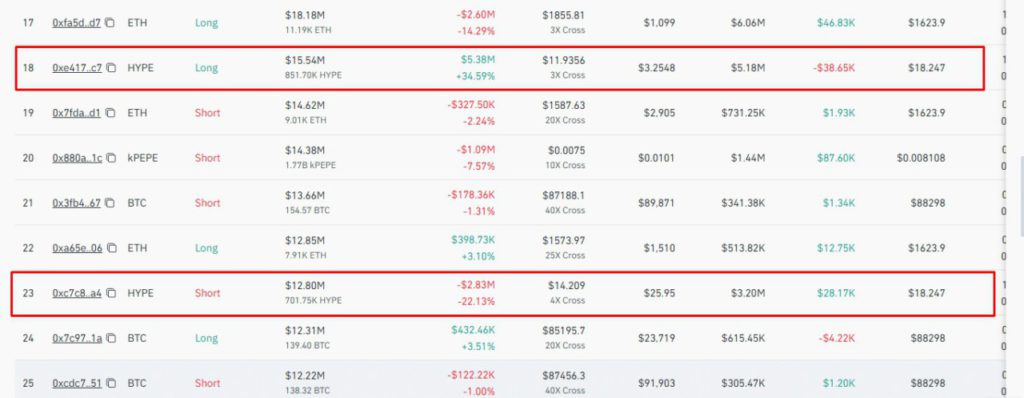

Whale Opposite in HYPE Betting

Coinglass’ Hyperliquid Whale Tracker shows that two whales have taken opposing positions on Hyperliquid cryptocurrency (HYPE). One of them is placing a bet for a price increase, while the other is predicting a price decrease. This creates an interesting market dynamic, where the actions of one whale can directly influence the strategy of the other.

These two positions show how polarized expectations are in the market. Whales who are optimistic about HYPE’s price rise seem to be relying on deep technical and fundamental analysis, while pessimists may have different information or analysis that led them to take big risks.

Also Read: Gold or Bitcoin: Which is a Safe Investment Amid US-China Tensions?

Retail Defies Bearish Predictions

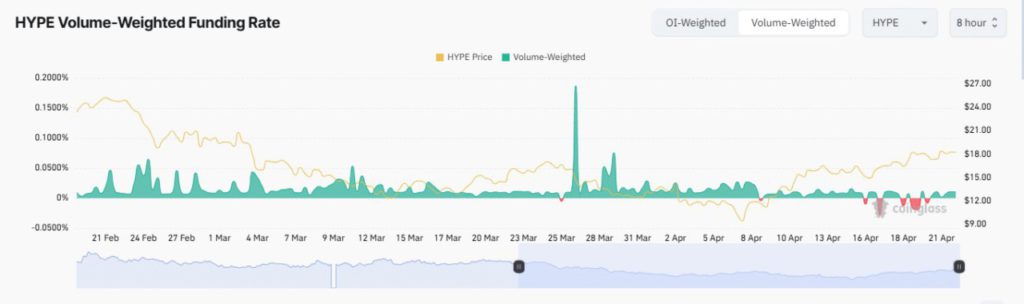

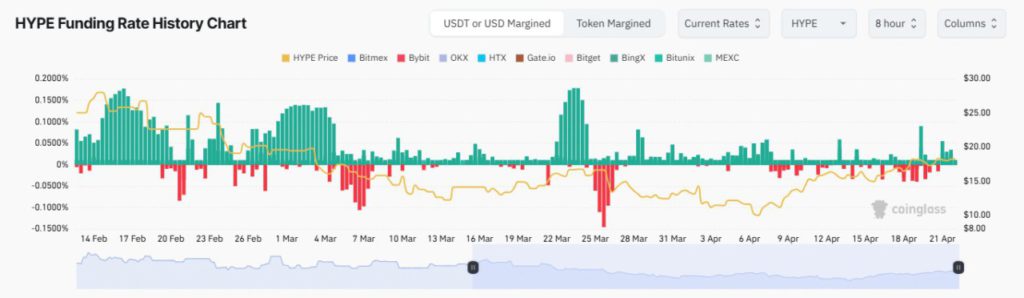

On the other hand, retail traders participating in the derivatives market seem to be more inclined towards bullish sentiment. They are actively opening long positions, which means they are betting on HYPE’s price increase. This sentiment is supported by recent market trends that show increased interest in HYPE.

This activity shows that despite the great uncertainty, many retail traders still have a strong belief in HYPE’s upside potential. These traders are hoping that the pressure they create will be enough to overcome the short position taken by one of the whales, which could eventually trigger a sharper price increase.

Losses of Bearish Players

In the past 24 hours, derivatives traders who bet against HYPE’s price increase have incurred losses of $47,790. This is an indication that the current market momentum is in favor of the optimists. If this pressure continues, it’s possible that whales betting on price drops will face the risk of liquidation.

These losses also add to the evidence that the current market sentiment is very bullish. Those traders who chose to take bearish positions may need to re-evaluate their strategies, given that the market is currently not supporting their predictions.

Conclusion: Complex Market Dynamics

The battle between whales and retail traders in the Hyperliquid (HYPE) market reflects the complexity and volatility that often occurs in the cryptocurrency world. Both sides have different strategies and predictions, which keeps this market interesting to follow. Either way, the outcome of this battle will provide important lessons on how sentiment and big actions can affect prices in the crypto market.

Also Read: Polkadot (DOT) Preparing to Surpass Resistance, Is it Time to Buy?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. HyperLiquid: Retail traders tip the scale as whales clash over HYPE’s next move. Accessed on April 23, 2025

- Featured Image: 99 Bitcoins