LUMIA Price Update: Soaring 34,78%, Lumia & Polygon Launch Tokenized Real Estate Tower Project!

Jakarta, Pintu News – As of April 24, 2025, the price of Lumia has corrected more than 4% in the last 24 hours.

At the time of writing, LUMIA is trading at around IDR 6,245 with its low and high at IDR 6,067 and IDR 7,107.

Then, how has LUMIA crypto moved in the last 1 week?

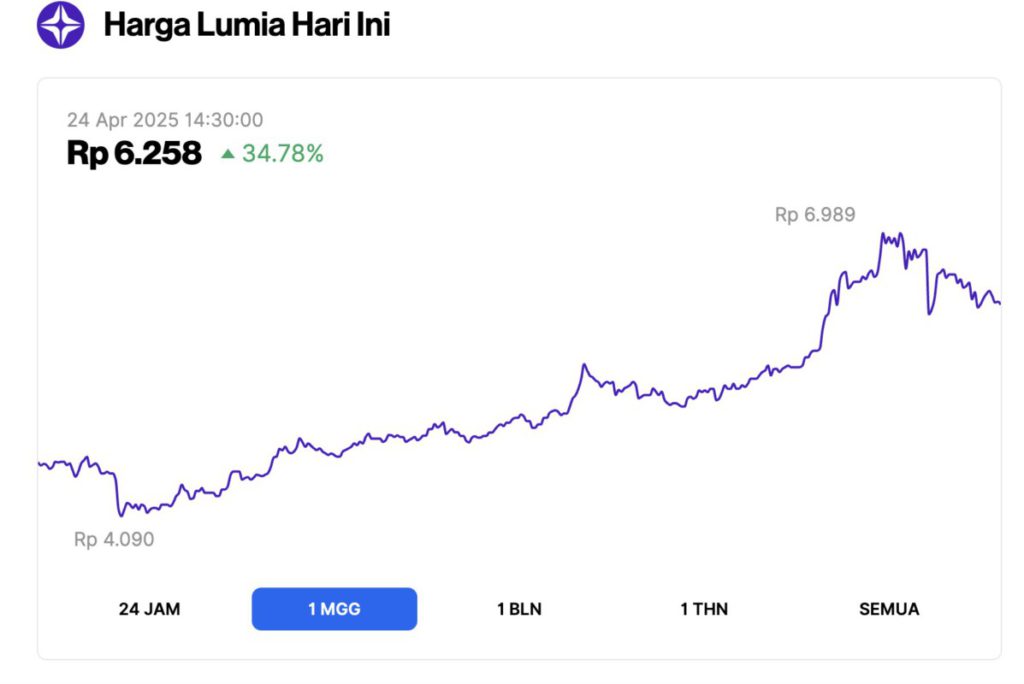

LUMIA Price Update: Up 34,78% within 1 Week

Despite experiencing a daily decline, recorded on the Pintu Market page (24/4/25), the value of LUMIA has increased by 34,78% in the last seven days. In that time span, LUMIA had reached its lowest point at IDR 4,090 and its highest point at IDR 6,989.

As of writing (24/4), LUMIA’s market cap now stands at around $43.16 million, with trading volume up 82% to $16.67 million in the last 24 hours.

Read also: Top 3 USA Crypto Ready to Boom – The Next Big Winners?

In the latest development, Lumia and Polygon Labs, are set to revolutionize the property industry through tokenization technology.

Lumia CEO Kal Ali revealed that they have teamed up with Polygon to build the world’s first crypto-based real estate project, Lumia Towers.

Lumia and Polygon Launch Localized Real Estate Tower Project

The Lumia Tower, which is estimated to be worth around US$220 million, is planned to be completed and fully tokenized by the second quarter of 2026.

This massive project is two skyscrapers covering more than 50,000 square meters and located in Istanbul, Turkey’s largest city. The towers will house around 300 residential and commercial units, and are expected to become a global crypto center.

According to Ali, Lumia Tower is a new breakthrough in property ownership. By adopting a tokenization system, Lumia aims to make the property market more open, accessible and efficient, especially for retail investors.

Based on data from Landshares, the value of real-world assets that have been tokenized currently stands at around 187 billion US dollars.

In the pessimistic scenario, the value is expected to rise to 3.5 trillion dollars, and in the optimistic scenario it could reach 10 trillion dollars by 2030, indicating a potential growth of up to 50 times.

This rapid growth is largely driven by projects that seek to fragment the ownership of high-value assets through blockchain technology. This allows investors to own both residential and commercial properties simply by purchasing tokens.

However, despite the promise of democratizing property investment, challenges such as regulatory complexity and market liquidity issues remain. This could pose future risks to Lumia’s project.

For example, investors may find it difficult to buy or sell property ownership tokens if trading volumes are insufficient, limiting the promised liquidity benefits.

Previously, several tokenization projects have been carried out on existing buildings. In the United States, Tokeninvest purchased a $740,000 building in Longmont, Colorado, and then tokenized it. This allowed third-party investors to provide 97% of the purchase funds directly.

Boris Spremo, Head of Financial and Corporate Services at Polygon Labs, admits that barriers to entry into the property market are still very high. Even so, property prices in Turkey continue to rise, including at the Lumia Towers construction site.

Lumia Towers Ownership Distribution

Ali explained that ownership rights to the two tokenized skyscrapers, Lumia Towers, will be granted through Special Purpose Vehicles (SPVs). Users will acquire shares of the SPVs that are minted directly on the blockchain as ERC-20 tokens.

The token grants its owner governance rights, including voting rights in decisions regarding the use of the property, such as whether the property will be leased or sold. Ali also added that the Lumia Tower token will be launched on Lumia Chain, which is designed to make it easier for retail investors to access.

Polygon will be instrumental in allowing developers like Lumia to customize their blockchain according to the specific needs of this project. Boris Spremo explained that Polygon will help reduce the cost of tokenizing the ownership of this $220 million property without compromising on security.

Ali also revealed plans to expand Lumia Tower models to other regions such as the Middle East and North Africa (MENA), the United States, and Europe.

The announcement of the Lumia Towers project comes amidst a rapidly rising trend of property tokenization. As previously discussed, Tether is working with Reelly Tech to integrate USDT into the United Arab Emirates’ booming property market.

Previously, the New York Real Estate Fund (NYREF) had tokenized an $18 million property located in the heart of New York City.

In a previous article we covered, Ripple’s CEO, Brad Garlinghouse, also revealed that the demand for XRP as a payment solution in the real estate sector is on the rise.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News Flash. Real Estate Meets Crypto- Lumia CEO and Polygon Exec Talk Tokenized $220M Towers. Accessed on April 24, 2025