Bitcoin (BTC) Surges on Binance: Is This the Start of a Big Rally?

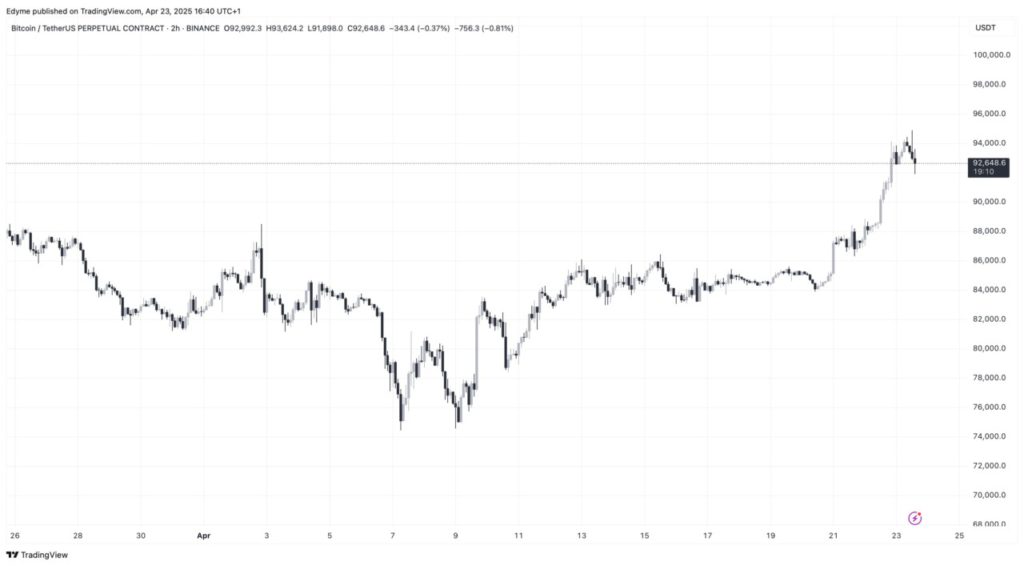

Jakarta, Pintu News – The Bitcoin market seems to have taken a big step by returning to its upward momentum. Currently, the price of Bitcoin (BTC) has broken the psychological level of $90,000, and even briefly touched $94,320 before dropping slightly to its current price of $93,473. This marks a 3.1% increase in the past day, with Binance playing a significant role in this short-term price movement.

Binance’s Role in Buyer Dominance

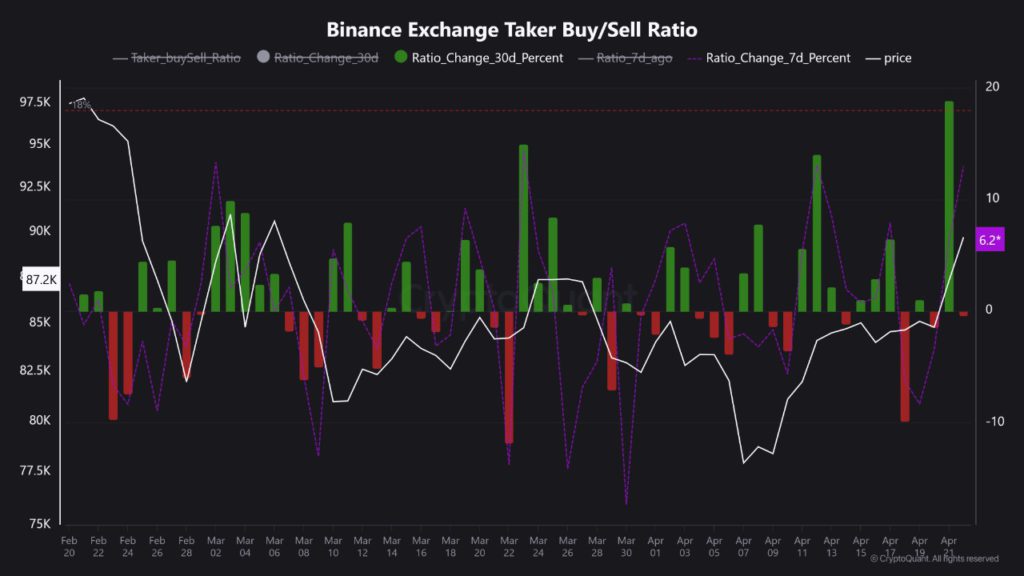

Analysis from CryptoQuant shows that there has been an increase in aggressive buying behavior on Binance, one of the largest crypto exchanges by volume. Market participants no longer seem to be waiting on order books but are opting to buy directly on the market. This activity is often attributed to increased market confidence and could explain the recent surge in Bitcoin (BTC) prices.

This increase becomes even more apparent when looking at the buy/sell ratio by takers on Binance, which shows strong buyer dominance. In the last 30 days, this ratio increased by 18.9%, and in the last 7 days, it increased by 6.2%. This shows that traders on Binance are entering the market with great urgency, using market buy orders to instantly fulfill sell offers.

Read More: Crypto Price Surge: What’s Driving Today’s Increase?

Buy/Sell Taker Ratio Analysis

According to CryptoQuant analyst Crazzyblockk, the taker buy/sell ratio not only reflects who is buying or selling, but is also an indicator of market confidence and pressure in real time. Currently, the ratio shows that buyers have control, and Binance is the place where this dominance is most decisive.

For those who follow market structure and look for early signals of momentum, this metric is very important to watch. When taker-driven momentum is concentrated on a single exchange, it can shape the direction of the broader market through the spillover effect. This highlights Binance’s increasing role in short-term price discovery.

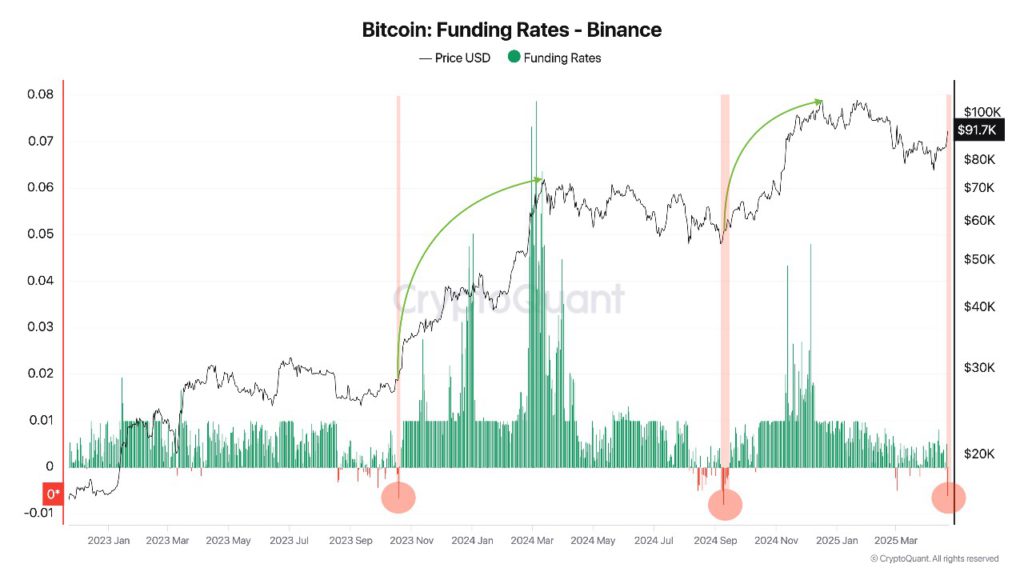

Bitcoin (BTC) Funding Rate and Market Skepticism

Although the order book data shows increased buying activity, Bitcoin (BTC) derivatives metrics tell a different story. Another CryptoQuant analyst, Darkfost, points out that the funding rate on Binance is currently negative, hovering around -0.006.

This metric, which reflects the cost of holding long versus short positions in perpetuity futures contracts, typically becomes negative when short positions are more crowded than long, indicating that many traders are expecting a price drop.

However, Darkfost notes that this mismatch between the rise in spot prices and negative funding rates is similar to past occurrences which were then followed by a sharp price rally. If this historical pattern continues, this level of skepticism in the derivatives market could contribute to further gains.

Conclusion

Given the dynamics at play on Binance and the derivatives market, market participants may need to consider various factors before making an investment decision. Although buyers seem to be in control of the market at the moment, the skepticism that exists in the derivatives market should not be ignored. These observations could be key to understanding the next direction Bitcoin (BTC) price will take.

Read More: Aave Breaks $150 Resistance, What’s Next?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Buyers Take Control on Binance, But Funding Rates Flash a Warning. Accessed on April 24, 2025

- Featured Image: Bitcoin News