5.8 Million PI Coin Released, How Much Is Pi Network Worth to Rupiah Today (April 25)?

Jakarta, Pintu News – As of April 24, 2025, the price of Pi Coin was stuck below $0.70 even though it had edged up 3% in a day. The unlocking of a large number of new tokens has the potential to depress the price further due to weak market demand.

With volatile price movements and a downward trend in recent months, many people are curious about how much Pi Network costs in rupiah today? Check out the full review below.

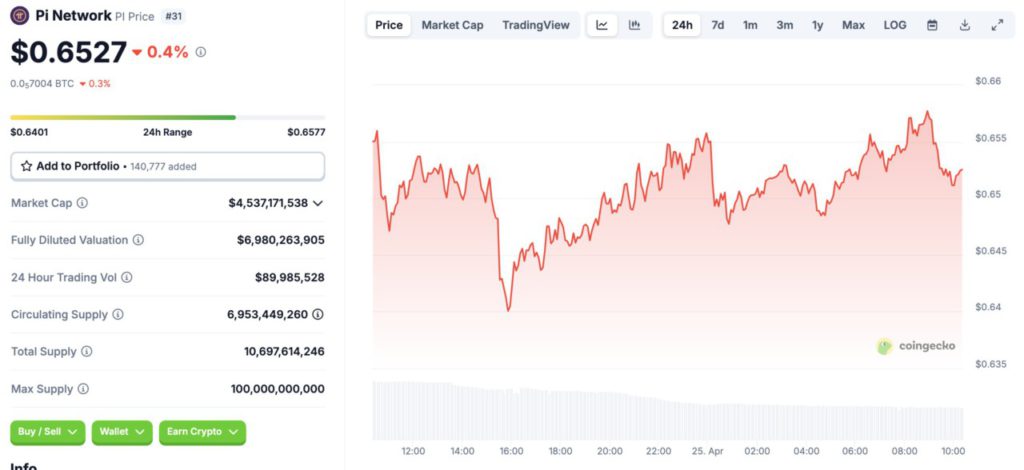

Pi Network Price Drops 0.4% within 24 Hours

On April 25, 2025, the price of Pi Network experienced a 0.4%% correction and is now trading at around $0.6524. If converted to rupiah at the current value, which is $1 = IDR 16,832, the price of Pi Network to rupiah is around IDR 10,941.

Read also: Pi Network Crashes Hard — But Is Its Mysterious Founder Now a Secret Crypto Billionaire?

Although the price movement looks relatively flat, the intraday chart shows quite active volatility, with the price touching a low around $0.6401 and a high at $0.6577 in a 24-hour time span.

In terms of fundamentals, PI’s market capitalization currently stands at $4.53 billion, while its fully diluted valuation stands at nearly $7 billion. The 24-hour trading volume also remains active at around $89.98 million, signaling that there is still considerable investor interest in the token.

5.8 Million PI Tokens Have Been Opened

On Thursday (24/4), around 5.8 million PI tokens came out of lockup, and even more – 223 million tokens will become tradable in the next 30 days. This surge in supply comes amid a lack of market enthusiasm, which could exacerbate selling pressure.

With prices hovering around $0.66 per token, Pi is testing important support levels. Some analysts predict that if the price is able to hold above $0.66, there is a chance for a rebound to the $1.00 mark.

But if this support is broken, the glut of available tokens could intensify the selling pressure and push the price down further.

Since it first hit the exchanges in February, Pi Coin’s price has experienced extreme volatility – spiking to near $3, then plummeting to around $0.40. Many early miners and long holders, especially those active since 2019-2020, have been disappointed by this rapid decline.

Read also: Crypto Expert Exposes Pi Network’s Secret Strategy to Save Pi Coin Price!

Three Main Factors that Are Obstacles for Pi Coin

Here are the three main factors that are considered to be obstacles for Pi Coin:

Selling Pressure After Lockup Period Ends

As with other airdropped tokens, Pi experiences heavy selling pressure whenever the token lockup period ends. Many token holders, especially in the African and Asian regions, choose to sell their assets for cash. This causes the supply in the market to flood.

Massive Supply of Tokens

Currently, Pi has a circulating supply of over 6.9 billion tokens, and its total max supply could reach 100 billion tokens. In comparison, Bitcoin only has a fixed supply of 21 million. Under these circumstances, high price targets such as $10 or $100 seem increasingly unrealistic.

Limited Real Use

Although Pi is positioning itself as the digital currency of the future, real-world adoption has been minimal. Only a handful of merchants accept Pi as payment, so demand based on real-world usage is very limited.

With hundreds of millions of tokens about to be released to the market in the next few weeks, and without any strong triggering factors to attract new buying interest, Pi Coin’s current price position is fairly fragile. Unless there is a change in market sentiment or a spike in adoption rates, downward pressure will continue to lurk.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The News Crypto. Pi Coin Price Prediction Today: Can It Break $1 Before 223M Tokens Unlock? Accessed on April 25, 2025